A zero-coupon bond is a debt security that does not pay periodic interest. Instead, it is issued at a significant discount to its face value and redeems at full par value upon maturity. Investors profit from the difference between the purchase price and the amount received at maturity, making it a popular instrument for long-term investment strategies. For example, a zero-coupon bond with a face value of $1,000 might be sold for $700 and mature in 10 years. The bondholder does not receive interest payments over the term but will collect the $1,000 at the end. This structure allows issuers to defer interest payments and helps investors lock in a guaranteed return over the bond's life.

Table of Comparison

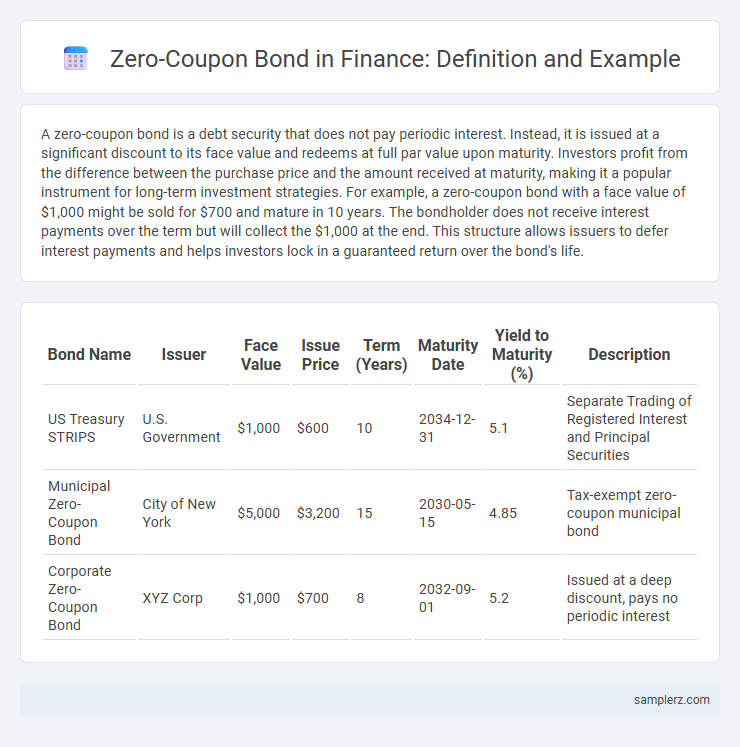

| Bond Name | Issuer | Face Value | Issue Price | Term (Years) | Maturity Date | Yield to Maturity (%) | Description |

|---|---|---|---|---|---|---|---|

| US Treasury STRIPS | U.S. Government | $1,000 | $600 | 10 | 2034-12-31 | 5.1 | Separate Trading of Registered Interest and Principal Securities |

| Municipal Zero-Coupon Bond | City of New York | $5,000 | $3,200 | 15 | 2030-05-15 | 4.85 | Tax-exempt zero-coupon municipal bond |

| Corporate Zero-Coupon Bond | XYZ Corp | $1,000 | $700 | 8 | 2032-09-01 | 5.2 | Issued at a deep discount, pays no periodic interest |

Introduction to Zero-Coupon Bonds

Zero-coupon bonds are debt securities issued at a significant discount to their face value and do not pay periodic interest. Investors receive a single payment at maturity, which includes the principal and the interest accrued, making these bonds an attractive option for long-term investment strategies. The absence of interim coupon payments allows issuers to raise capital efficiently while investors benefit from predictable, lump-sum returns.

Key Features of Zero-Coupon Bonds

Zero-coupon bonds are issued at a significant discount to their face value and pay no periodic interest, with the investor receiving the full face value at maturity. These bonds have fixed maturities, often ranging from one to thirty years, and their yield is determined by the difference between the purchase price and the par value. Zero-coupon bonds are highly sensitive to interest rate changes and are commonly used for long-term financial goals like education funding or retirement planning.

How Zero-Coupon Bonds Work

Zero-coupon bonds are debt securities that do not pay periodic interest, instead they are issued at a significant discount to their face value and mature at par, allowing investors to receive the full face value at maturity. The return on investment comes from the difference between the purchase price and the amount paid at maturity, effectively yielding interest that accrues over the bond's life. These bonds are commonly used for long-term goals such as funding education or retirement due to their predictable payout structure and tax advantages in certain jurisdictions.

Notable Examples of Zero-Coupon Bonds

Notable examples of zero-coupon bonds include U.S. Treasury STRIPS, which are government-issued securities stripped of their coupons and sold at a deep discount to face value, maturing at par without periodic interest payments. Corporate zero-coupon bonds from firms like Tesla and IBM often attract investors seeking long-term capital appreciation without interim income. Municipal zero-coupon bonds, issued by local governments for infrastructure projects, provide tax advantages and are popular for investors in high tax brackets aiming for deferred tax liability.

Zero-Coupon Treasury Bonds Explained

Zero-coupon Treasury bonds are government securities sold at a substantial discount to their face value and do not pay periodic interest. Investors receive the full face value at maturity, with the difference between purchase price and maturity value representing the interest earned. These bonds are popular for long-term savings and planning due to their predictable return and tax advantages on accrued interest.

Corporate Zero-Coupon Bonds: Real-Life Cases

Corporate zero-coupon bonds, such as those issued by companies like Ford and Dell, are sold at a significant discount to face value and mature at par without periodic interest payments, offering investors capital appreciation instead of regular income. These bonds are particularly attractive for investors seeking long-term growth and willing to accept higher credit risk compared to government securities. Real-life cases demonstrate how corporations utilize zero-coupon bonds to raise funds efficiently while investors benefit from the tax deferral on accrued interest until maturity.

Municipal Zero-Coupon Bonds: Illustrative Examples

Municipal zero-coupon bonds are issued at a deep discount and mature at face value, providing interest income exempt from federal and often state taxes. For example, a $10,000 municipal zero-coupon bond purchased for $6,000 will mature in 10 years at its full par value, yielding tax-free capital appreciation. These bonds are especially attractive for investors seeking long-term, tax-advantaged growth without periodic interest payments.

Benefits of Investing in Zero-Coupon Bonds

Zero-coupon bonds offer investors the advantage of buying at a significant discount to face value, allowing for predictable returns at maturity without periodic interest payments. These bonds provide tax efficiency since the interest income is accrued and taxed only upon maturity, making them suitable for long-term financial planning. Investors benefit from reduced reinvestment risk and the ability to lock in a fixed yield, especially in a low-interest-rate environment.

Risks Associated with Zero-Coupon Bonds

Zero-coupon bonds expose investors to heightened interest rate risk due to their lack of periodic coupon payments, causing price volatility when market rates fluctuate. They also carry reinvestment risk, as the investor receives no interim interest to reinvest at potentially higher rates during the bond's life. Furthermore, zero-coupon bonds are subject to inflation risk, which can erode the real return since the investor only receives a lump sum at maturity without interim cash flows.

Comparing Zero-Coupon Bonds to Coupon Bonds

Zero-coupon bonds are issued at a significant discount to their face value and pay no periodic interest, maturing at par value, which contrasts with coupon bonds that provide regular interest payments throughout the bond's life. Investors in zero-coupon bonds benefit from compounded interest and predictable lump-sum returns at maturity, whereas coupon bondholders receive steady income and potential reinvestment opportunities. The tax treatment also differs since zero-coupon bonds accrue imputed interest annually, while coupon bonds report actual interest income as received.

example of zero-coupon in bond Infographic

samplerz.com

samplerz.com