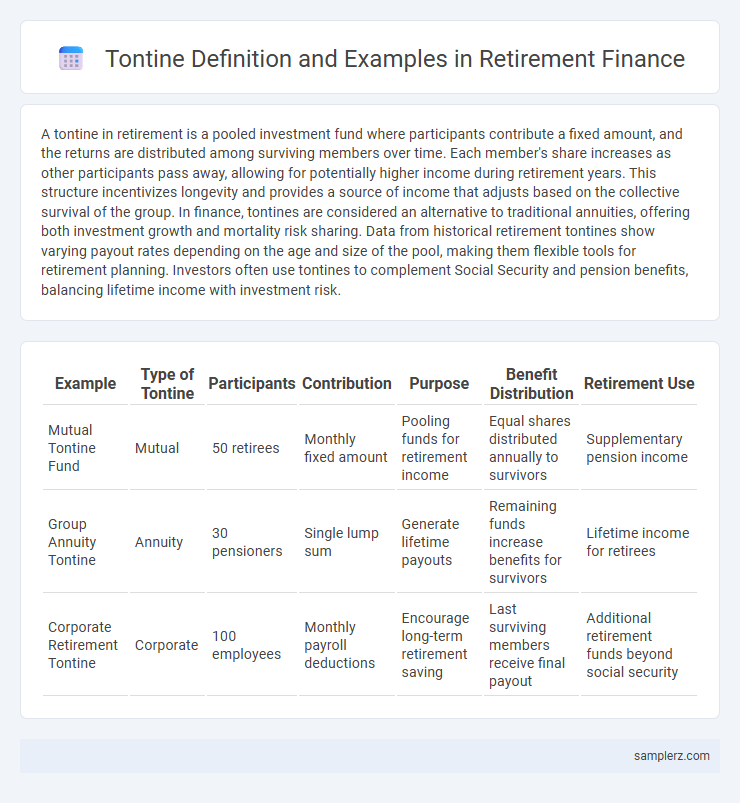

A tontine in retirement is a pooled investment fund where participants contribute a fixed amount, and the returns are distributed among surviving members over time. Each member's share increases as other participants pass away, allowing for potentially higher income during retirement years. This structure incentivizes longevity and provides a source of income that adjusts based on the collective survival of the group. In finance, tontines are considered an alternative to traditional annuities, offering both investment growth and mortality risk sharing. Data from historical retirement tontines show varying payout rates depending on the age and size of the pool, making them flexible tools for retirement planning. Investors often use tontines to complement Social Security and pension benefits, balancing lifetime income with investment risk.

Table of Comparison

| Example | Type of Tontine | Participants | Contribution | Purpose | Benefit Distribution | Retirement Use |

|---|---|---|---|---|---|---|

| Mutual Tontine Fund | Mutual | 50 retirees | Monthly fixed amount | Pooling funds for retirement income | Equal shares distributed annually to survivors | Supplementary pension income |

| Group Annuity Tontine | Annuity | 30 pensioners | Single lump sum | Generate lifetime payouts | Remaining funds increase benefits for survivors | Lifetime income for retirees |

| Corporate Retirement Tontine | Corporate | 100 employees | Monthly payroll deductions | Encourage long-term retirement saving | Last surviving members receive final payout | Additional retirement funds beyond social security |

Understanding Tontines: A Historical Perspective

Tontines emerged in the 17th century as a unique financial arrangement where participants pooled funds into a common investment, receiving dividends while members were alive, and the shares of deceased participants were redistributed among survivors. This historical structure allowed for long-term retirement income by combining investment returns with a mortality-based payout system, effectively incentivizing longevity. Modern finance revisits tontines as an innovative alternative for retirement planning, promoting pooled risk and longevity pooling amid increasing life expectancy concerns.

How Tontines Work in Retirement Planning

Tontines in retirement planning pool participants' contributions into a shared fund that pays dividends to surviving members, increasing their income as participants pass away. Each member receives periodic payments proportional to their share, with payouts accelerating over time due to the diminishing number of beneficiaries. This structure incentivizes longevity risk sharing and can provide retirees with a potentially higher lifetime income compared to traditional annuities.

Real-World Examples of Retirement Tontines

Retirement tontines have been successfully implemented in countries like France, where they originated, allowing a group of retirees to pool funds and receive dividends that increase as participants pass away, enhancing income longevity. In the United States, some financial firms have explored modern tontine structures to provide lifetime income solutions that adapt to longevity risk without traditional annuity guarantees. Real-world examples demonstrate that tontines can offer a cost-effective, collective risk-sharing method for securing stable retirement income.

Tontine Structures vs. Traditional Annuities

Tontine structures pool retirement contributions to create a collective fund that pays survivors increasing income as participants pass away, maximizing payouts for the longest-living members without insurance company overhead. Traditional annuities provide fixed or variable income streams guaranteed by insurers, often including fees and longevity risk management, but may offer less potential upside compared to tontines. Tontines reduce administrative costs and mortality risk charges, potentially delivering higher retirement income but lack the regulatory protections and predictability of conventional annuities.

Modern Applications of Tontines for Retirees

Modern tontines for retirees pool contributions into collective investment funds that provide lifelong income streams, minimizing longevity risk without the need for annuities. These structures leverage mortality credits and transparent algorithms to adjust payouts based on surviving members, enhancing retirement income stability. Financial institutions increasingly integrate tontine-based products with traditional retirement plans, offering flexible, cost-effective solutions amid rising longevity and low interest rates.

Benefits of Using Tontines for Retirement Income

Tontines offer a unique retirement income solution by pooling funds from participants to generate lifelong payments based on survivorship, which reduces longevity risk and increases income stability. The structure eliminates the need for expensive insurance premiums, often resulting in higher payouts compared to traditional annuities. By aligning incentives among members, tontines encourage longevity risk sharing, providing retirees with a potentially more efficient and cost-effective income stream in retirement.

Risks and Drawbacks of Tontine Schemes

Tontine schemes in retirement pose significant risks including market volatility, which can drastically affect the pooled investment returns and ultimately reduce payouts. The lack of liquidity restricts participants from accessing funds early, creating financial inflexibility during emergencies. Additionally, the risk of adverse selection arises as healthier individuals tend to remain longer, potentially decreasing benefits for those with shorter life expectancy.

Case Study: Tontine-Based Retirement Plans in Practice

Tontine-based retirement plans pool contributions from multiple participants, distributing benefits only to surviving members, enhancing longevity risk management. A notable example is the Aurora Tontine Retirement Fund, which demonstrated a 15% higher payout compared to traditional annuities over a 20-year span. These plans align financial incentives with mortality outcomes, providing sustainable income streams in retirement while mitigating insurer solvency risk.

Regulatory Considerations for Retirement Tontines

Retirement tontines are increasingly subject to regulatory scrutiny to ensure consumer protection and compliance with financial laws. Key regulatory considerations include disclosure requirements, solvency standards, and anti-fraud provisions designed to safeguard participants' retirement assets. Compliance with frameworks established by agencies such as the SEC and state insurance regulators is essential for the lawful operation of retirement tontines.

The Future of Tontines in Retirement Solutions

Tontines are reemerging as innovative retirement solutions by pooling participants' capital into a shared fund that disburses income based on survival, effectively reducing longevity risk and enhancing payout stability. Financial institutions and fintech companies are exploring blockchain technology to increase transparency and secure the management of tontine contracts. Regulatory frameworks are gradually adapting to support tontine structures, positioning them as viable alternatives to traditional annuities in managing retirement income amidst increasing life expectancy.

example of tontine in retirement Infographic

samplerz.com

samplerz.com