In finance, a negative basis in a swap occurs when the swap rate is lower than the corresponding spot interest rate or benchmark rate. For example, if the LIBOR rate is 2.5% and the fixed swap rate is 2.3%, the basis is negative by 0.2%. This situation often arises due to market conditions such as liquidity constraints or credit risk spreads influencing the swap spread. Negative basis can impact trading and risk management strategies in interest rate swaps by signaling potential inefficiencies or arbitrage opportunities. Entities engaged in swap contracts monitor the basis to manage exposure and hedge interest rate risks effectively. A consistent negative basis may indicate underlying economic factors such as changes in supply and demand for swap contracts relative to cash instruments.

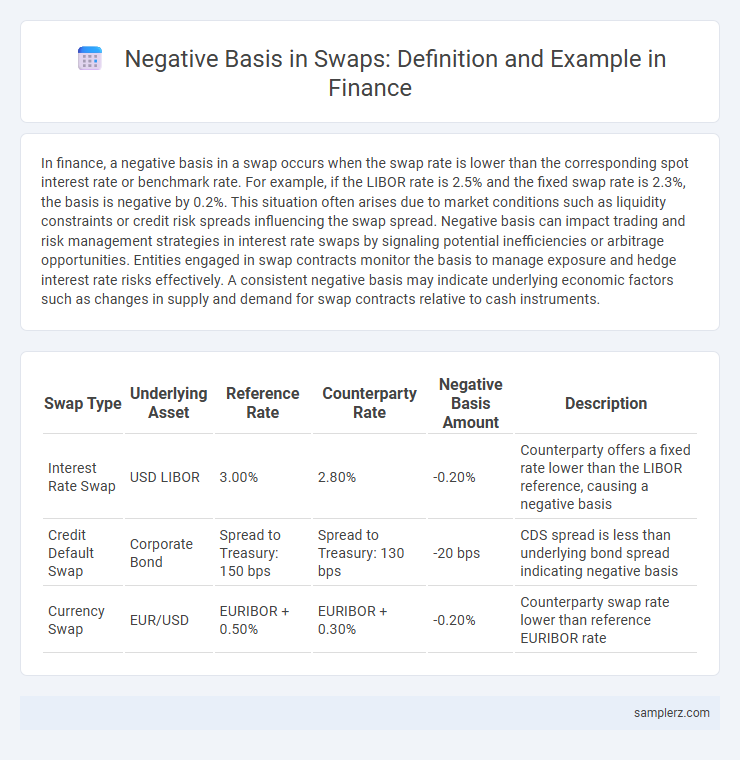

Table of Comparison

| Swap Type | Underlying Asset | Reference Rate | Counterparty Rate | Negative Basis Amount | Description |

|---|---|---|---|---|---|

| Interest Rate Swap | USD LIBOR | 3.00% | 2.80% | -0.20% | Counterparty offers a fixed rate lower than the LIBOR reference, causing a negative basis |

| Credit Default Swap | Corporate Bond | Spread to Treasury: 150 bps | Spread to Treasury: 130 bps | -20 bps | CDS spread is less than underlying bond spread indicating negative basis |

| Currency Swap | EUR/USD | EURIBOR + 0.50% | EURIBOR + 0.30% | -0.20% | Counterparty swap rate lower than reference EURIBOR rate |

Understanding Negative Basis in Swap Contracts

Negative basis in swap contracts occurs when the credit spread of a corporate bond exceeds the swap spread, causing the bond to trade at a higher yield than the corresponding interest rate swap. This divergence can signal increased credit risk or liquidity concerns in the underlying bond market compared to the swap market. Traders use this information to exploit arbitrage opportunities by entering swap positions that benefit from the convergence of bond yields and swap rates.

Key Factors Leading to Negative Swap Basis

Negative swap basis occurs when the yield on a Treasury bond exceeds the swap rate, driven by factors such as heightened demand for Treasury securities as safe-haven assets and limited liquidity in the repo market. Counterparty credit risk and regulatory capital constraints on banks reduce the willingness to enter into swap contracts, exacerbating the negative basis. Market stress and increased funding costs also contribute to the divergence, impacting the pricing dynamics of interest rate swaps.

Real-World Example: Negative Basis in Corporate Bond Swaps

A real-world example of negative basis in corporate bond swaps occurred during the 2008 financial crisis when certain investment-grade corporate bonds traded at higher spreads than their corresponding credit default swaps (CDS). This negative basis indicated that the cost to buy protection via CDS was lower than the yield spread earned from holding the bonds, leading to arbitrage opportunities for hedge funds and asset managers. The phenomenon reflected market stress and liquidity mismatches, influencing pricing models and risk management strategies in fixed income portfolios.

Negative Basis Trade: Mechanics and Execution

Negative basis trade occurs when the swap spread, the difference between the interest rate swap yield and the corresponding government bond yield, is negative. Traders exploit this by entering into a payer swap while simultaneously shorting the underlying government bond, aiming to profit from the mispricing. Successful execution relies on identifying the negative basis through market data, managing counterparty risk, and efficiently arbitraging the spread before it converges.

Case Study: Sovereign Bond Swaps with Negative Basis

Sovereign bond swaps exhibiting a negative basis occur when the swap spread is lower than the yield difference between on-the-run and off-the-run sovereign bonds, creating an arbitrage opportunity for investors. In a notable case study, investors exploited this negative basis by entering into receive-fixed swaps while holding off-the-run bonds, capturing the spread tightening as liquidity premiums diminished. This strategy highlights the importance of monitoring liquidity risk and market segmentation in sovereign debt markets to optimize swap pricing and risk-adjusted returns.

Implications of Negative Basis for Arbitrage Opportunities

Negative basis in swap markets occurs when the swap rate is lower than the corresponding treasury yield, creating a disparity between credit risk and liquidity premiums. This mispricing signals potential arbitrage opportunities where traders can exploit the difference by simultaneously entering long positions in government bonds and short positions in interest rate swaps. However, these arbitrage strategies may be constrained by transaction costs, funding limitations, and counterparty risk, which influence the practical realization of profits in negative basis scenarios.

Risk Considerations in Negative Basis Trades

Negative basis in swaps occurs when the swap spread is less than zero, signaling potential market stress or liquidity issues. Risk considerations in negative basis trades include increased counterparty risk, as pricing discrepancies may reflect hidden credit or funding pressures. Traders must closely monitor market volatility and collateral requirements to mitigate potential losses from these distortions.

Historical Instances of Negative Basis in Credit Markets

Historical instances of negative basis in credit markets reveal significant discrepancies between cash bond spreads and synthetic CDS spreads, often driven by liquidity constraints or regulatory capital demands. During the 2008 financial crisis, negative basis widened sharply as banks faced funding pressures, and hedge funds capitalized on dislocations between the bond and CDS markets. Similar patterns emerged in the European sovereign debt crisis, where sovereign bonds traded wider than corresponding CDS spreads, highlighting systemic stress and market segmentation.

Strategies for Profiting from Negative Basis Swaps

Negative basis swaps occur when the swap spread turns negative, creating opportunities for arbitrage strategies. Traders exploit negative basis by entering into swap contracts while simultaneously holding underlying bonds, profiting from the divergence between swap rates and bond yields. Implementing relative value trades and hedging interest rate exposure enables market participants to capitalize on inefficiencies in the fixed income and derivatives markets.

Impact of Market Liquidity on Swap Basis Premiums

Negative basis in swaps occurs when the swap rate is lower than the corresponding Treasury yield, often signaling imbalances in market liquidity. Limited market liquidity reduces demand for certain swap maturities, causing swap basis premiums to widen negatively and increase funding costs for traders. This dynamic can exacerbate pricing inefficiencies and risk assessment challenges in fixed-income derivatives markets.

example of negative basis in swap Infographic

samplerz.com

samplerz.com