A clawback in finance refers to the process where investors or funds recover previously distributed profits or fees under specific conditions. In private equity funds, a common clawback occurs when general partners receive carried interest payments exceeding their entitled share, prompting a refund to limited partners. This mechanism ensures fair profit allocation and prevents overpayment based on estimated returns. Clawbacks also appear in hedge funds as provisions that adjust incentive fees if future losses offset prior gains. Data from fund performance reports typically trigger clawbacks when net asset values decline after profit distributions. The clawback clause protects investors by realigning compensation structures with actual fund outcomes.

Table of Comparison

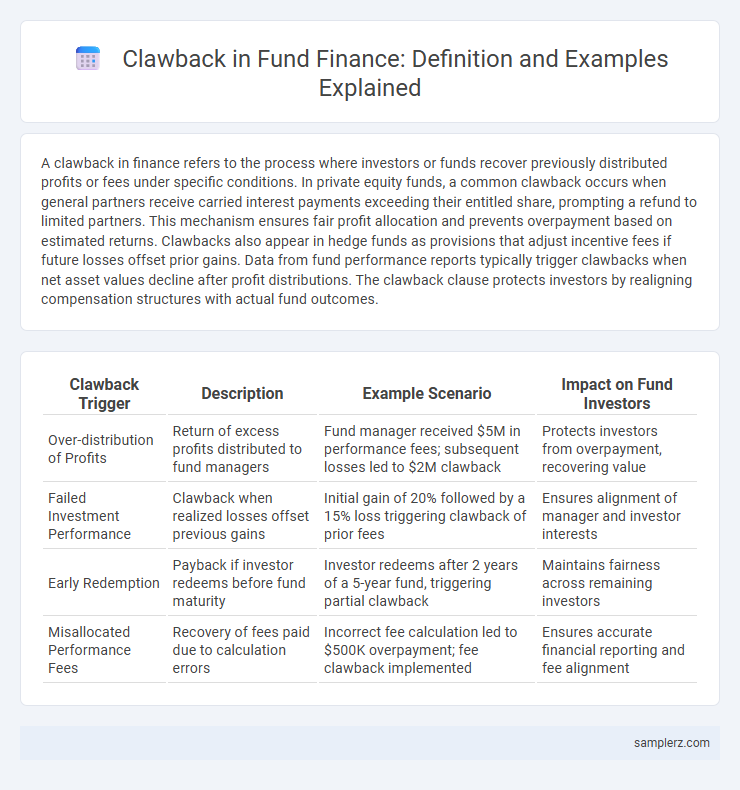

| Clawback Trigger | Description | Example Scenario | Impact on Fund Investors |

|---|---|---|---|

| Over-distribution of Profits | Return of excess profits distributed to fund managers | Fund manager received $5M in performance fees; subsequent losses led to $2M clawback | Protects investors from overpayment, recovering value |

| Failed Investment Performance | Clawback when realized losses offset previous gains | Initial gain of 20% followed by a 15% loss triggering clawback of prior fees | Ensures alignment of manager and investor interests |

| Early Redemption | Payback if investor redeems before fund maturity | Investor redeems after 2 years of a 5-year fund, triggering partial clawback | Maintains fairness across remaining investors |

| Misallocated Performance Fees | Recovery of fees paid due to calculation errors | Incorrect fee calculation led to $500K overpayment; fee clawback implemented | Ensures accurate financial reporting and fee alignment |

Overview of Clawback Provisions in Investment Funds

Clawback provisions in investment funds ensure that fund managers return a portion of previously received carried interest if the fund's overall performance declines below a specified threshold. These provisions protect limited partners by realigning fund managers' incentives with long-term investment success and preventing overpayment based on short-term gains. Commonly found in private equity and hedge funds, clawbacks activate during fund liquidation or specific distribution events to recoup excess profits beyond agreed fund return hurdles.

Key Triggers for Clawback in Fund Agreements

Key triggers for clawback in fund agreements typically include the failure to achieve hurdle rates, distributions exceeding carried interest allocations, and breaches of representations or warranties by fund managers. These provisions ensure that limited partners can recover excess payments if fund performance metrics are not met or if managerial misconduct occurs. Clawback clauses align interests by safeguarding investor capital and maintaining equitable profit-sharing structures.

Real-World Clawback Example: Private Equity Fund

A real-world clawback example in a private equity fund occurs when general partners must return previously distributed carried interest if the fund underperforms or final returns do not meet the agreed hurdle rate. This mechanism protects limited partners by ensuring that general partners only receive performance fees after meeting specific profit thresholds. Clawback clauses are critical for alignment of interests and risk mitigation in private equity fund agreements.

How Clawback Works in Venture Capital Structures

In venture capital structures, a clawback provision ensures limited partners (LPs) recover any excess distributions if the general partners (GPs) receive more than their agreed-upon share of profits during early exits. This mechanism typically comes into effect at the fund's liquidation, where LPs calculate the total proceeds and demand GPs return overpaid carried interest. Clawbacks maintain fairness by aligning the interests of both LPs and GPs, protecting investors from disproportionate profit allocations.

Clawback Scenario: Overpayment of Fund Managers

In finance, a common clawback scenario occurs when fund managers receive incentive fees based on preliminary profits that later diminish due to portfolio losses. For example, if a hedge fund initially reports strong returns and pays performance fees to managers, subsequent losses require the fund to reclaim part of those fees to align compensation with actual net profits. This clawback mechanism ensures fund managers' earnings accurately reflect the fund's overall performance and protect investors from overpayment.

Case Study: Clawback Application after Fund Liquidation

A notable example of clawback in fund finance occurred in the XYZ Private Equity Fund, where investors triggered a clawback provision after the fund's liquidation revealed a shortfall in the anticipated carried interest allocation. Following the exit of portfolio companies, the fund's final distributions to limited partners included a recalculation of performance fees, requiring the general partner to return excess carried interest received earlier during interim distributions. This case study highlights the critical role of clawback clauses in ensuring equitable profit-sharing and protecting limited partners' interests post-liquidation.

Clawback Example Due to Underperformance

A fund manager may face a clawback provision if the investment returns fall short of the hurdle rate, requiring them to return previously received performance fees. For instance, if a private equity fund distributes carried interest based on initial gains but later experiences significant losses, the excess fees must be refunded to investors. This clawback mechanism ensures alignment of interests by protecting limited partners from overpaid incentives during periods of underperformance.

Clawback Enforcement: Legal Precedents in Fund Management

Clawback enforcement in fund management is exemplified by the case of Invesco Ltd. v. Sandford, where the court upheld the fund's right to recover overpaid carried interest from a former partner based on breach of fiduciary duty. Legal precedents in this area often emphasize the fund manager's obligation to return excess profits when initial performance hurdles are not met or when distributions exceed actual gains. These rulings reinforce the contractual and equitable bases for clawbacks, ensuring fairness and protection for limited partners in private equity and hedge funds.

Impact of Clawback on LP-GP Relationships

Clawback provisions in funds safeguard Limited Partners (LPs) by ensuring General Partners (GPs) return excess carried interest if early distributions exceed the fund's overall profit, reinforcing financial fairness. This mechanism fosters trust between LPs and GPs, aligning incentives for long-term fund performance rather than short-term gains. However, stringent clawback terms may create tension, affecting collaboration and negotiation dynamics within investment partnerships.

Best Practices for Structuring Effective Clawback Clauses

Effective clawback clauses in fund management typically include clear definitions of trigger events such as underperformance or misallocation of capital, ensuring precise conditions for reclaiming distributed profits. Structuring these clauses with predefined repayment schedules and caps helps maintain fairness and transparency between fund managers and investors. Incorporating audit rights and dispute resolution mechanisms enhances enforcement and reduces conflicts while aligning incentives across stakeholders.

example of clawback in fund Infographic

samplerz.com

samplerz.com