A custodian in a fund is a specialized financial institution responsible for safeguarding a fund's assets, including securities and cash. These custodians ensure the security, proper settlement of transactions, and accurate record-keeping of assets held within mutual funds, hedge funds, or pension funds. Key entities offering custodial services include banks like BNY Mellon, State Street, and Northern Trust. Custodians play a crucial role in risk management by protecting the fund's portfolio from theft, loss, or misuse. They provide essential services such as settlement of trades, collection of dividends, and corporate actions processing. Data maintained by custodians includes transaction records, asset valuations, and compliance reports, which are vital for fund managers and auditors.

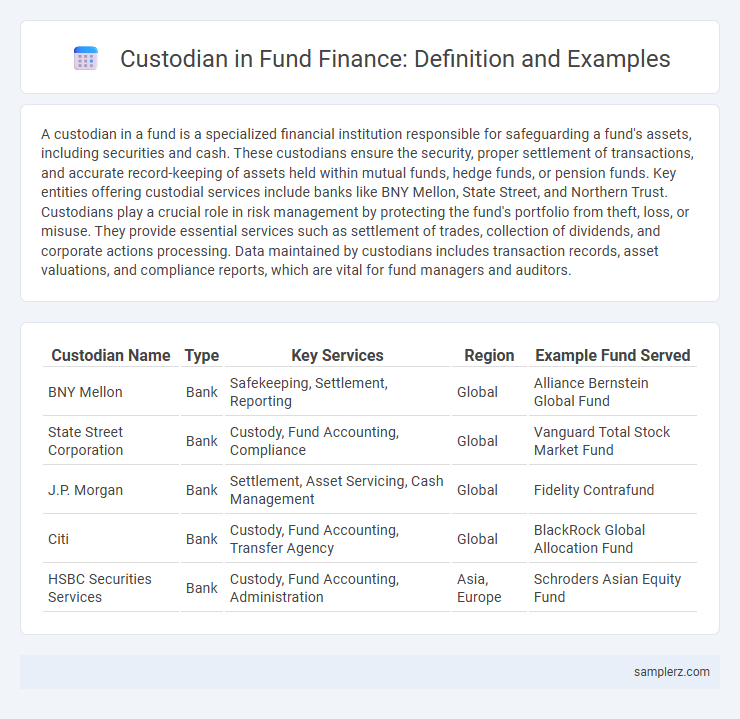

Table of Comparison

| Custodian Name | Type | Key Services | Region | Example Fund Served |

|---|---|---|---|---|

| BNY Mellon | Bank | Safekeeping, Settlement, Reporting | Global | Alliance Bernstein Global Fund |

| State Street Corporation | Bank | Custody, Fund Accounting, Compliance | Global | Vanguard Total Stock Market Fund |

| J.P. Morgan | Bank | Settlement, Asset Servicing, Cash Management | Global | Fidelity Contrafund |

| Citi | Bank | Custody, Fund Accounting, Transfer Agency | Global | BlackRock Global Allocation Fund |

| HSBC Securities Services | Bank | Custody, Fund Accounting, Administration | Asia, Europe | Schroders Asian Equity Fund |

Understanding the Role of Custodians in Investment Funds

Custodians in investment funds safeguard assets by holding securities and cash, ensuring accurate record-keeping and facilitating settlement of trades. Major custodians like Bank of New York Mellon, State Street, and JPMorgan Chase provide critical services such as asset safekeeping, regulatory compliance, and risk management. Their role is essential for maintaining investor confidence and operational efficiency in fund administration.

Real-World Examples of Fund Custodians

State Street and BNY Mellon serve as leading examples of fund custodians, managing trillions in assets across global markets. Their roles include safeguarding securities, processing transactions, and ensuring regulatory compliance for mutual funds, hedge funds, and pension funds. BlackRock's Aladdin platform also integrates custodian services with asset management technology to enhance operational efficiency for institutional investors.

Leading Global Custodian Banks for Mutual Funds

Leading global custodian banks for mutual funds include BNY Mellon, State Street, and JP Morgan Chase, which provide comprehensive asset safekeeping, settlement, and reporting services. These institutions manage trillions of dollars in assets under custody, ensuring regulatory compliance and operational efficiency for fund managers. Their advanced technology platforms support real-time transaction processing, risk management, and investor transparency, solidifying their roles as trusted partners in the finance industry.

Key Responsibilities of a Fund Custodian

A fund custodian safeguards a mutual fund's assets, ensuring accurate settlement and record-keeping of all transactions. Responsibilities include holding securities in safe custody, administering income collections, and performing reconciliation of fund assets to maintain integrity and compliance. They also provide critical reporting to fund managers and regulatory bodies, ensuring transparency and adherence to financial regulations.

Top Custodian Service Providers in the Finance Industry

State Street Corporation, BNY Mellon, and JPMorgan Chase serve as leading custodian service providers in the finance industry, safeguarding assets for mutual funds, pension funds, and ETFs. These top custodians offer comprehensive services including asset servicing, settlement, and regulatory compliance, ensuring security and operational efficiency. Their global networks and advanced technology platforms facilitate accurate reporting and risk management for institutional investors worldwide.

Case Studies: Custodians in Hedge Fund Operations

State Street and BNY Mellon serve as leading custodians in hedge fund operations, offering comprehensive asset safeguarding, performance reporting, and compliance monitoring. One notable case study involves Blackstone, which leverages State Street's custody services to enhance transparency and operational efficiency while mitigating counterparty risk. These custodians facilitate streamlined trade settlements and regulatory adherence, ensuring robust protection of investor assets in dynamic hedge fund environments.

Regulatory Framework Governing Fund Custodians

Fund custodians, such as State Street and BNY Mellon, operate under stringent regulatory frameworks including the Investment Company Act of 1940 in the United States, which mandates fiduciary responsibilities and asset segregation. The European Union's Alternative Investment Fund Managers Directive (AIFMD) imposes comprehensive requirements on fund custodians to ensure transparency, safekeeping, and compliance. Regulatory oversight enforces due diligence, risk management, and reporting standards to protect investors' assets and maintain market integrity.

Selection Criteria for Choosing a Fund Custodian

Selecting a fund custodian involves evaluating criteria such as regulatory compliance, asset security protocols, and technology infrastructure to ensure robust protection and efficient management of fund assets. The custodian's reputation, experience with similar fund types, and ability to provide comprehensive reporting and transparent transaction records are critical for informed decision-making. Cost-effectiveness, global custody capabilities, and strong risk management practices further optimize fund operations and investor confidence.

How Custodians Safeguard Fund Assets

Custodians in fund management, such as BNY Mellon and State Street, safeguard fund assets by securely holding and monitoring securities, cash, and other financial instruments to prevent theft or loss. They perform daily reconciliation of assets, ensuring accurate record-keeping and compliance with regulatory requirements, which minimizes operational risk for fund managers. Through stringent controls like segregation of assets and independent verification, custodians maintain the integrity and safety of fund holdings, fostering investor confidence and protecting against fraud.

The Future of Custody Services in Asset Management

State Street Corporation exemplifies a leading custodian in asset management, providing comprehensive custody services that safeguard assets and facilitate seamless fund operations. Innovations in blockchain and artificial intelligence are driving the future of custody services, enhancing transparency, security, and efficiency for institutional investors. Embracing digital asset custody solutions, custodians are increasingly integrating advanced technology to meet evolving regulatory demands and investor expectations.

example of custodian in fund Infographic

samplerz.com

samplerz.com