Rebalancing in an index fund involves adjusting the portfolio to align with the target index weights. For example, if an S&P 500 index fund experiences an overweight in technology stocks due to market gains, the fund manager will sell some technology shares and buy underrepresented sectors like healthcare or utilities. This process ensures the fund maintains its objective of mirroring the index's performance and risk profile. Data-driven rebalancing reflects changes in the underlying index composition or market capitalization shifts. Suppose the index adds new companies or removes others, the fund updates its holdings to maintain accurate tracking. This systematic rebalancing optimizes tracking accuracy and reduces deviation from the benchmark index over time.

Table of Comparison

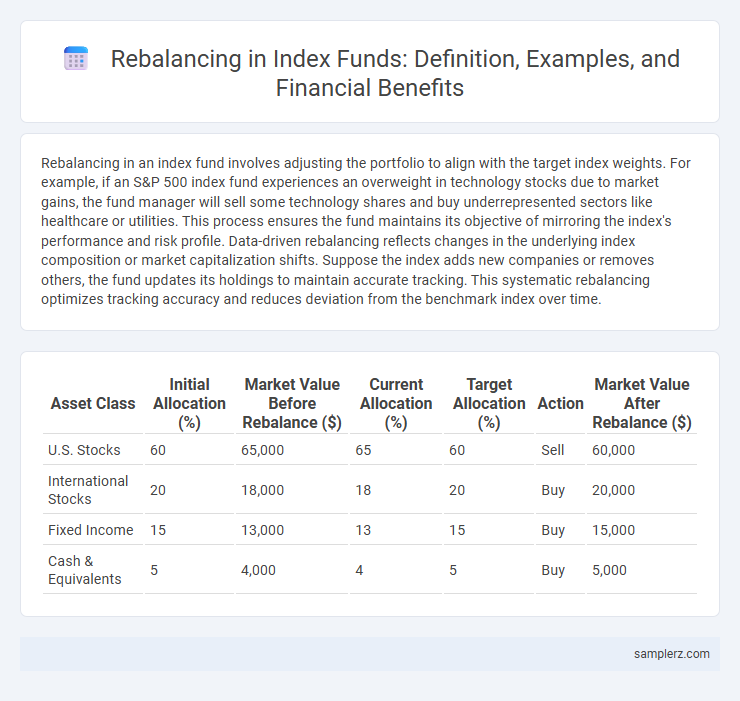

| Asset Class | Initial Allocation (%) | Market Value Before Rebalance ($) | Current Allocation (%) | Target Allocation (%) | Action | Market Value After Rebalance ($) |

|---|---|---|---|---|---|---|

| U.S. Stocks | 60 | 65,000 | 65 | 60 | Sell | 60,000 |

| International Stocks | 20 | 18,000 | 18 | 20 | Buy | 20,000 |

| Fixed Income | 15 | 13,000 | 13 | 15 | Buy | 15,000 |

| Cash & Equivalents | 5 | 4,000 | 4 | 5 | Buy | 5,000 |

Understanding the Basics of Index Fund Rebalancing

Index fund rebalancing involves adjusting the portfolio to maintain its target asset allocation, often by selling overperforming assets and buying underperforming ones. For example, if an index fund tracking the S&P 500 becomes overweight in technology stocks due to market appreciation, the fund manager will sell some tech shares and purchase more stocks from other sectors like healthcare or energy to restore balance. This process ensures the fund continues to mirror the underlying index accurately and controls risk by preventing sector concentration.

Why Rebalancing Matters in Portfolio Management

Rebalancing in an index fund involves periodically adjusting the asset allocation to maintain the target risk level and investment strategy, which helps prevent drift caused by market fluctuations. This process ensures alignment with the original investment objectives, enhances risk management, and can improve long-term returns by systematically buying undervalued assets and selling overvalued ones. Maintaining a balanced portfolio through rebalancing reduces exposure to individual asset volatility and promotes consistent performance aligned with market benchmarks.

Common Triggers for Rebalancing an Index Fund

Common triggers for rebalancing an index fund include significant deviations from the target asset allocation, such as when a stock or bond allocation drifts by 5% or more due to market fluctuations. Additionally, changes in the underlying index components, like additions or deletions of stocks in the benchmark index, prompt rebalancing to maintain accurate tracking. Periodic scheduled reviews, typically quarterly or annually, also serve as routine triggers to realign the portfolio with the index composition and target weights.

Step-by-Step Example of Manual Rebalancing

Manual rebalancing of an index fund involves selling overweight assets and buying underweight assets to restore target allocations, such as adjusting a 60% equity and 40% bond portfolio back to its original proportions after market fluctuations. For instance, if equities rise to 70% and bonds fall to 30%, an investor sells part of the equity holdings and uses the proceeds to buy bonds, rebalancing the portfolio to the desired 60/40 split. This systematic process helps maintain risk levels and alignment with investment objectives over time.

Automatic Rebalancing: How Index Funds Stay on Track

Automatic rebalancing in index funds involves systematically adjusting the portfolio to mirror the target index weights, ensuring consistent alignment with benchmark allocations. For example, if a tech stock's weight in the index rises from 20% to 25% due to price appreciation, the fund automatically sells a portion to restore the allocation to the original 20%. This disciplined process maintains diversification and risk exposure without manual intervention, optimizing long-term performance and tracking accuracy.

Rebalancing Frequency: Quarterly vs. Annual Adjustments

Rebalancing an index fund quarterly helps maintain target asset allocations more precisely by counteracting market fluctuations, which can reduce risk and enhance returns over time. Annual adjustments, while less frequent, lower transaction costs and tax implications but may allow portfolio drift that impacts performance. Investors must weigh the trade-off between tighter control with quarterly rebalancing and cost efficiency from annual rebalancing to align with their investment goals.

Real-Life Case Study: S&P 500 Index Fund Rebalancing Example

The S&P 500 Index Fund regularly rebalances its portfolio to maintain alignment with the index's market-cap weights by selling shares of overperforming companies and buying underperforming ones, ensuring accurate index tracking. For instance, during the 2020 market volatility, the fund reallocated assets by reducing tech stocks like Apple and Microsoft while increasing positions in sectors such as energy and financials to reflect shifting index composition. This disciplined rebalancing process helps in risk management and capturing market returns synonymous with the S&P 500 benchmark.

Tax Implications of Rebalancing in Index Funds

Rebalancing an index fund often triggers capital gains taxes when appreciated assets are sold to maintain target allocations, impacting after-tax returns. Investors should consider tax-efficient strategies such as tax-loss harvesting or using tax-advantaged accounts to minimize these liabilities. Monitoring the fund's turnover rate also helps control taxable events, preserving long-term investment growth.

Rebalancing During Market Volatility: Practical Scenarios

During market volatility, rebalancing an index fund might involve reducing overweight sectors that have surged unexpectedly, such as technology stocks during a rapid rally, and reallocating to underperforming sectors like energy or financials to maintain the target asset allocation. This practical approach ensures the index fund remains aligned with its risk profile and investment objectives despite sharp market fluctuations. By systematically adjusting holdings, investors mitigate concentration risk and capture potential value from undervalued assets in turbulent markets.

Key Takeaways for Investors Considering Rebalancing

Index fund rebalancing involves periodically adjusting the portfolio to maintain the original asset allocation, such as shifting proportions between stocks and bonds to match the benchmark index. This strategy helps manage risk by preventing overexposure to a particular asset class that has outperformed and ensures alignment with long-term investment goals. Investors should consider transaction costs, tax implications, and the fund's rebalancing frequency to optimize returns while maintaining portfolio diversification.

example of rebalancing in index fund Infographic

samplerz.com

samplerz.com