A dead cat bounce in the financial market refers to a temporary recovery in the price of a declining stock or index, followed by a continuation of the downtrend. For example, during the 2008 financial crisis, several major stocks, such as Citigroup, experienced brief price upticks after significant drops, misleading some investors into thinking a recovery was underway. These short-lived rebounds were largely driven by short-covering or speculative buying, not a fundamental improvement in the companies' financial health. Another instance of a dead cat bounce occurred in the cryptocurrency market in 2018 when Bitcoin's price briefly surged after a prolonged downturn from its peak near $20,000. The bounce gave a false signal of recovery before prices resumed their downward trajectory, dropping to around $3,200 later that year. Traders who interpreted the bounce as a trend reversal faced significant losses, highlighting the risk of relying on transient price increases in volatile markets.

Table of Comparison

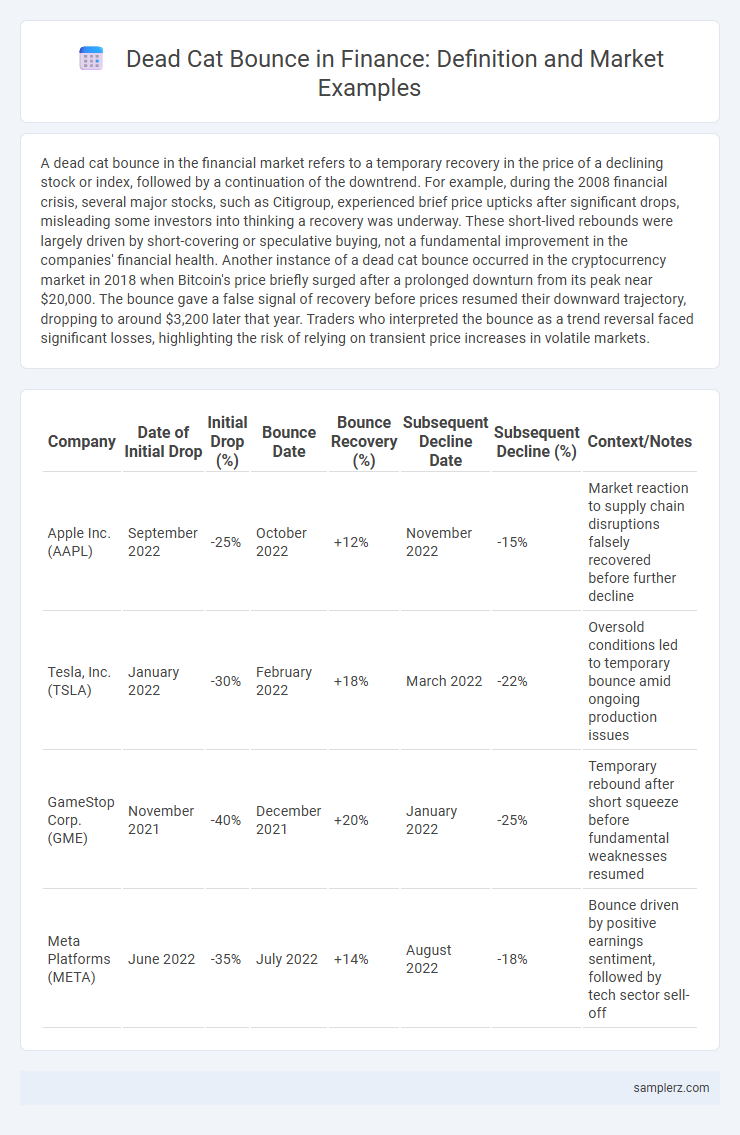

| Company | Date of Initial Drop | Initial Drop (%) | Bounce Date | Bounce Recovery (%) | Subsequent Decline Date | Subsequent Decline (%) | Context/Notes |

|---|---|---|---|---|---|---|---|

| Apple Inc. (AAPL) | September 2022 | -25% | October 2022 | +12% | November 2022 | -15% | Market reaction to supply chain disruptions falsely recovered before further decline |

| Tesla, Inc. (TSLA) | January 2022 | -30% | February 2022 | +18% | March 2022 | -22% | Oversold conditions led to temporary bounce amid ongoing production issues |

| GameStop Corp. (GME) | November 2021 | -40% | December 2021 | +20% | January 2022 | -25% | Temporary rebound after short squeeze before fundamental weaknesses resumed |

| Meta Platforms (META) | June 2022 | -35% | July 2022 | +14% | August 2022 | -18% | Bounce driven by positive earnings sentiment, followed by tech sector sell-off |

Understanding the Dead Cat Bounce Phenomenon in Finance

The dead cat bounce is a temporary recovery in stock prices after a significant decline, often misleading investors into believing the market is rebounding. A notable example occurred during the 2008 financial crisis when major indices like the S&P 500 briefly recovered before continuing their downward trend. Recognizing this phenomenon helps investors avoid false optimism and better manage risk during volatile market conditions.

Key Characteristics of a Dead Cat Bounce in the Market

A dead cat bounce in the market is characterized by a brief, temporary recovery in asset prices following a significant decline, often misleading investors into believing a sustained rebound is underway. Key indicators include a sharp price drop followed by a short-lived rally with lower trading volume and inadequate fundamentals to support continued growth. This phenomenon typically signals investor pessimism and precedes further downward movement in stock prices or market indices.

Historical Examples of Dead Cat Bounces

The 2008 financial crisis exhibited a classic dead cat bounce when global markets briefly rallied after the Lehman Brothers collapse before plunging further into a prolonged recession. Another notable example is the dot-com bubble burst in 2000, where technology stocks experienced a temporary recovery before continuing their steep decline. The COVID-19 pandemic-induced market crash in early 2020 also saw a short-lived bounce before volatility persisted amid ongoing economic uncertainty.

Notable Dead Cat Bounce Events: Case Studies

The 2008 financial crisis presented a notable dead cat bounce when stock prices briefly rebounded in March before continuing their sharp decline. Another significant example occurred during the dot-com bubble burst in 2000, where technology stocks experienced short-lived recoveries amid a prolonged downturn. These case studies highlight how dead cat bounces can mislead investors during major market downturns.

Dead Cat Bounce in Stock Markets: Real-Life Scenarios

The 2020 stock market crash amid the COVID-19 pandemic saw a notable dead cat bounce when the S&P 500 briefly rebounded after an initial sharp decline, only to fall again as uncertainty persisted. Another prominent example occurred during the 2008 financial crisis when the Dow Jones Industrial Average experienced temporary recoveries before further plunges due to weakening financial institution stability. These scenarios underscore the dead cat bounce phenomenon as short-lived recoveries within longer-term downward market trends.

Major Indices and Dead Cat Bounce Instances

The Dow Jones Industrial Average experienced a classic dead cat bounce in March 2020, briefly recovering after a sharp pandemic-driven decline before resuming its downward trend. Similarly, the S&P 500 exhibited a short-lived rebound in February 2022 following a significant sell-off triggered by inflation fears and interest rate hikes. These instances highlight the transient nature of dead cat bounces in major indices, where temporary recoveries can mislead investors during broader market corrections.

Dead Cat Bounce vs. True Market Recovery: Examples

A dead cat bounce occurs when an asset's price temporarily rebounds after a significant decline but fails to sustain upward momentum, such as during the 2020 coronavirus-induced stock market crash when major indices like the S&P 500 briefly recovered before further declines. In contrast, a true market recovery involves consistent bullish trends supported by strong economic indicators and corporate earnings growth, as seen in the post-2009 financial crisis rebound. Differentiating these phenomena requires analyzing volume patterns, macroeconomic data, and investor sentiment to confirm whether the recovery is transient or sustainable.

Investor Reactions to Dead Cat Bounces

Investors often misinterpret a dead cat bounce as a market recovery, prompting premature buying that leads to temporary price spikes. This reaction can result in increased volatility and short-lived gains before prices resume their downward trajectory. Understanding behavioral finance helps investors avoid falling into the trap of dead cat bounce traps and mitigate losses.

Lessons Learned from Famous Dead Cat Bounces

The 2020 stock market crash saw a notable dead cat bounce when markets briefly recovered after steep declines, only to plunge further during the COVID-19 pandemic's early stages. Investors learned the importance of recognizing temporary recoveries as potential traps rather than true recoveries, emphasizing disciplined risk management and avoiding premature bullish bets. Historical examples like the 2008 financial crisis reinforced the value of analyzing underlying economic conditions and not solely relying on short-term price rebounds for investment decisions.

Identifying Potential Dead Cat Bounce Patterns in Real Markets

A dead cat bounce often occurs when a stock or market index experiences a brief, sharp recovery after a significant decline, only to resume its downward trend shortly after. For instance, during the 2020 COVID-19 pandemic market crash, many equities showed short-lived rebounds before continuing their declines, signaling potential dead cat bounce patterns. Traders identify these patterns by monitoring volume spikes, weak follow-through buying, and failure to break key resistance levels.

example of dead cat bounce in market Infographic

samplerz.com

samplerz.com