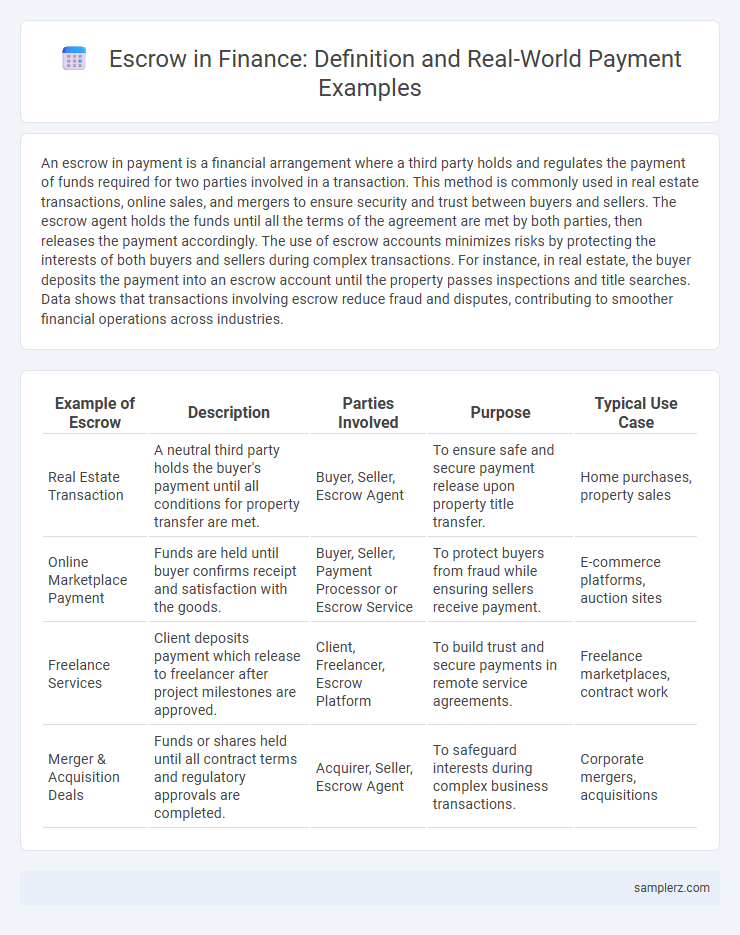

An escrow in payment is a financial arrangement where a third party holds and regulates the payment of funds required for two parties involved in a transaction. This method is commonly used in real estate transactions, online sales, and mergers to ensure security and trust between buyers and sellers. The escrow agent holds the funds until all the terms of the agreement are met by both parties, then releases the payment accordingly. The use of escrow accounts minimizes risks by protecting the interests of both buyers and sellers during complex transactions. For instance, in real estate, the buyer deposits the payment into an escrow account until the property passes inspections and title searches. Data shows that transactions involving escrow reduce fraud and disputes, contributing to smoother financial operations across industries.

Table of Comparison

| Example of Escrow | Description | Parties Involved | Purpose | Typical Use Case |

|---|---|---|---|---|

| Real Estate Transaction | A neutral third party holds the buyer's payment until all conditions for property transfer are met. | Buyer, Seller, Escrow Agent | To ensure safe and secure payment release upon property title transfer. | Home purchases, property sales |

| Online Marketplace Payment | Funds are held until buyer confirms receipt and satisfaction with the goods. | Buyer, Seller, Payment Processor or Escrow Service | To protect buyers from fraud while ensuring sellers receive payment. | E-commerce platforms, auction sites |

| Freelance Services | Client deposits payment which release to freelancer after project milestones are approved. | Client, Freelancer, Escrow Platform | To build trust and secure payments in remote service agreements. | Freelance marketplaces, contract work |

| Merger & Acquisition Deals | Funds or shares held until all contract terms and regulatory approvals are completed. | Acquirer, Seller, Escrow Agent | To safeguard interests during complex business transactions. | Corporate mergers, acquisitions |

Understanding Escrow in Financial Transactions

Escrow in financial transactions involves a neutral third party holding funds until all terms of a payment agreement are met, ensuring security for both buyers and sellers. Real estate purchases often use escrow accounts to protect the buyer's deposit until property inspections and paperwork are finalized. This mechanism minimizes risk by guaranteeing that funds are only released when contractual obligations are satisfied, enhancing trust and reducing fraud in financial dealings.

Common Escrow Payment Scenarios

Common escrow payment scenarios include real estate transactions where funds are held until property title transfers, online marketplace sales ensuring buyer and seller protection, and freelance projects where payments are released upon milestone completion. These transactions use escrow services to minimize risk by securely holding funds until contract terms are fulfilled. Escrow payments provide trust and transparency across various financial agreements, reducing fraud and ensuring compliance with agreed conditions.

Real Estate Escrow: A Step-by-Step Illustration

In real estate escrow, a neutral third party holds the buyer's funds and documents until all conditions of the sale are met, ensuring secure transactions. The process begins with the buyer depositing earnest money into the escrow account, followed by verification of property title and contract contingencies. Once inspections, appraisals, and financing approvals are completed, the escrow agent disburses funds to the seller and transfers the property title to the buyer, finalizing the sale.

Escrow Services in Online Marketplaces

Escrow services in online marketplaces secure transactions by holding funds until both buyer and seller fulfill agreed conditions, reducing fraud risks. Platforms like eBay and Amazon integrate escrow to protect high-value payments, ensuring sellers receive funds only after verified delivery. This system fosters trust by mitigating payment disputes and enhancing transaction transparency in digital commerce.

Freelance Payments Secured by Escrow

Escrow services in freelance payments ensure funds are securely held by a trusted third party until project milestones are met, mitigating risks for both clients and freelancers. Platforms like Upwork and Freelancer use escrow to protect payments, fostering trust and guaranteeing that freelancers are compensated only after verified delivery. This secure payment model reduces disputes and enhances transparency in global freelance transactions.

Mortgage Payments and Escrow Accounts

Mortgage payments often include escrow accounts where funds for property taxes and insurance are held securely until due. This system ensures timely payment of these obligations, protecting both lenders and homeowners from potential defaults or liens. Escrow accounts in mortgage payments provide a transparent and organized approach to managing recurring expenses tied to homeownership, thereby reducing financial risk.

Business-to-Business (B2B) Escrow Agreements

B2B escrow agreements secure transactions by holding funds or assets with a neutral third party until contractual obligations between companies are fulfilled. This method reduces payment risks in mergers, acquisitions, or large procurement deals, ensuring compliance with agreed terms before release of funds. Utilizing escrow accounts enhances trust and financial transparency, protecting both buyers and sellers in complex commercial transactions.

International Trade: Role of Escrow in Cross-border Payments

Escrow services in international trade act as a secure intermediary to hold payments until contractual obligations between buyers and sellers in different countries are fulfilled, mitigating risks associated with cross-border transactions. By ensuring funds are released only after verification of goods shipment or service delivery, escrow reduces fraud while enhancing trust and compliance with trade regulations. This mechanism is particularly crucial for high-value shipments and unfamiliar trading partners, facilitating smoother global commerce with financial security.

Milestone Payments with Escrow in Project Management

Milestone payments with escrow in project management ensure funds are securely held until predefined project phases are successfully completed, mitigating risk for both clients and service providers. By using an escrow account, payments are released only when agreed-upon deliverables are verified, enhancing trust and accountability throughout the project lifecycle. This payment structure is particularly effective in complex projects, where progress-based funding supports financial transparency and protects all parties involved.

Choosing the Right Escrow Service Provider

Selecting the right escrow service provider ensures secure and reliable payment processing, safeguarding transactions between buyers and sellers. Factors such as regulatory compliance, reputation, and transparent fee structures are critical to minimizing financial risks in escrow agreements. A reputable provider facilitates smooth fund transfers, enhances trust in high-value deals, and protects all parties from fraud or payment disputes.

example of escrow in payment Infographic

samplerz.com

samplerz.com