A shelf registration is a regulatory tool that allows companies to register a new issue of securities without having to sell the entire issue at once. This approach provides flexibility for issuers to access capital markets quickly and efficiently over a period, often up to three years. The securities remain "on the shelf," ready to be offered to investors when market conditions are favorable. In finance, shelf registrations typically involve entities such as corporations, banks, or investment funds that intend to raise funds through equity or debt offerings. Data related to these registrations include the total amount of securities registered, the duration of the shelf period, and the specific types of securities involved, such as common stock, preferred stock, or bonds. This method streamlines the capital-raising process and reduces the need for repeated regulatory filings.

Table of Comparison

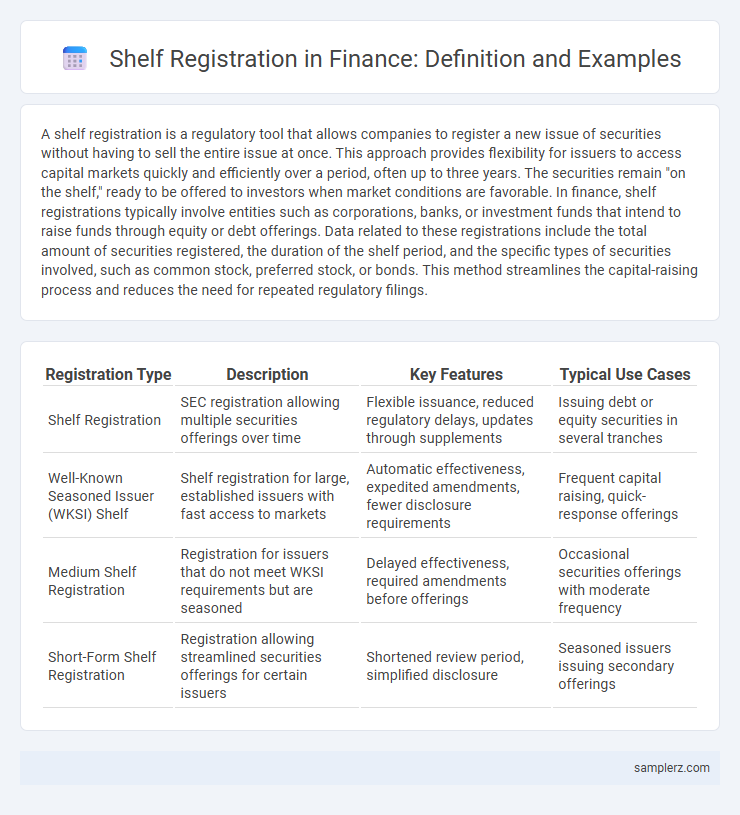

| Registration Type | Description | Key Features | Typical Use Cases |

|---|---|---|---|

| Shelf Registration | SEC registration allowing multiple securities offerings over time | Flexible issuance, reduced regulatory delays, updates through supplements | Issuing debt or equity securities in several tranches |

| Well-Known Seasoned Issuer (WKSI) Shelf | Shelf registration for large, established issuers with fast access to markets | Automatic effectiveness, expedited amendments, fewer disclosure requirements | Frequent capital raising, quick-response offerings |

| Medium Shelf Registration | Registration for issuers that do not meet WKSI requirements but are seasoned | Delayed effectiveness, required amendments before offerings | Occasional securities offerings with moderate frequency |

| Short-Form Shelf Registration | Registration allowing streamlined securities offerings for certain issuers | Shortened review period, simplified disclosure | Seasoned issuers issuing secondary offerings |

Understanding Shelf Registration: A Financial Overview

Shelf registration allows companies to register a new issue of securities without selling the entire issue immediately, enabling flexible capital raising over a period, typically up to three years. This method streamlines the regulatory process by pre-approving the securities with the SEC, reducing time and costs associated with multiple offerings. Major corporations and financial institutions leverage shelf registration to respond swiftly to market conditions and optimize financing strategies.

Key Features of Shelf Registration Statements

Shelf registration statements allow companies to register a new issue of securities without immediately selling them, providing flexibility in capital raising. Key features include the ability to offer multiple securities over a specified period, typically up to three years, and the streamlined amendment process that keeps filings current without repeated SEC reviews. This mechanism benefits issuers by reducing regulatory delays and enabling timely access to market opportunities.

Real-World Examples of Shelf Registration

Real-world examples of shelf registration include Disney's $5 billion shelf offering in 2020, allowing the company to access capital markets efficiently over two years. Amazon filed a $10 billion shelf registration in 2021, enabling flexible issuance of equity or debt securities to fund acquisitions and growth initiatives. These examples demonstrate how large corporations utilize shelf registration to maintain strategic financial agility and minimize market disruption.

Shelf Registration Process: Step-by-Step

Shelf registration in finance enables companies to register a new issue of securities without selling the entire issue at once, streamlining capital raising over time. The step-by-step process begins with filing a comprehensive registration statement with the SEC, including detailed financial disclosures and risk factors, followed by a review period where the SEC may request amendments. Once declared effective, the company can offer and sell portions of the registered securities over a specified timeframe, typically up to three years, without needing to file again.

Advantages of Using Shelf Registration for Issuers

Shelf registration allows issuers to access capital markets quickly by pre-registering securities for future sale, reducing the time and costs associated with multiple individual filings. This flexibility enables companies to time their offerings strategically based on favorable market conditions, optimizing fundraising potential. Moreover, it simplifies regulatory compliance, allowing issuers to update information through streamlined prospectus supplements rather than preparing entirely new registration statements.

Regulatory Requirements for Shelf Registration

Shelf registration requires issuers to comply with SEC Regulation S-K and Securities Act Rule 415, enabling the offering of multiple securities over a set period without separate registrations. Issuers must file a comprehensive Form S-3 or Form F-3, ensuring timely disclosure of financial statements and material changes. Ongoing compliance includes maintaining eligibility criteria such as timely filings and market capitalization thresholds to avoid suspension or withdrawal of the shelf registration.

Case Study: Major Shelf Registration Filings

Major shelf registration filings illustrate how companies efficiently access capital markets by registering a large amount of securities in advance, allowing for flexible issuance over time. For example, Apple Inc.'s $10 billion shelf registration enabled phased bond offerings to fund product development without repeated regulatory delays. Similarly, General Electric's $15 billion shelf registration provided a streamlined path to raise capital opportunistically while maintaining investor confidence.

Common Industries Utilizing Shelf Registration

Common industries utilizing shelf registration include technology, healthcare, and energy sectors, where companies seek flexible access to capital markets. In the technology industry, firms often use shelf registration to quickly fund innovation and expansion. Healthcare and energy companies rely on shelf offerings to support research, development, and large-scale projects while maintaining compliance with SEC regulations.

Shelf Registration vs. Traditional Public Offerings

Shelf registration allows companies to offer securities to the public over time without re-filing for each issuance, providing greater flexibility compared to traditional public offerings, which require separate registration for each sale. This method is especially advantageous for issuers seeking to capitalize on favorable market conditions quickly, reducing regulatory delays and underwriting costs. Companies using shelf registration can raise capital incrementally, optimizing timing and investor demand, whereas traditional offerings are typically executed as single, large transactions.

Risks and Considerations in Shelf Registration

Shelf registration involves listing multiple securities with the SEC for future sale, presenting risks such as market volatility that can impact pricing and investor demand. Companies face regulatory compliance challenges, including timely disclosure requirements and potential liability for any misleading information. Investors should consider the uncertainty in timing and size of offerings, which can dilute share value and affect market perception.

example of shelf in registration Infographic

samplerz.com

samplerz.com