A white knight in a takeover scenario refers to a friendly investor or company that acquires a target firm to prevent a hostile takeover by an unfriendly bidder. One notable example is when KKR acted as a white knight in the 2008 takeover battle for TXU Corporation, helping the company avoid a hostile bid by a rival consortium. White knights are valued for preserving the target company's existing management and strategic vision. The presence of a white knight can significantly alter the dynamics of a takeover attempt by increasing the purchase price and improving terms for shareholders. In the case of TXU, KKR's intervention not only prevented a hostile acquisition but also facilitated a leveraged buyout that benefited stakeholders. Entities involved in such transactions often undergo detailed financial, legal, and strategic evaluations to assess the best outcome for the target company.

Table of Comparison

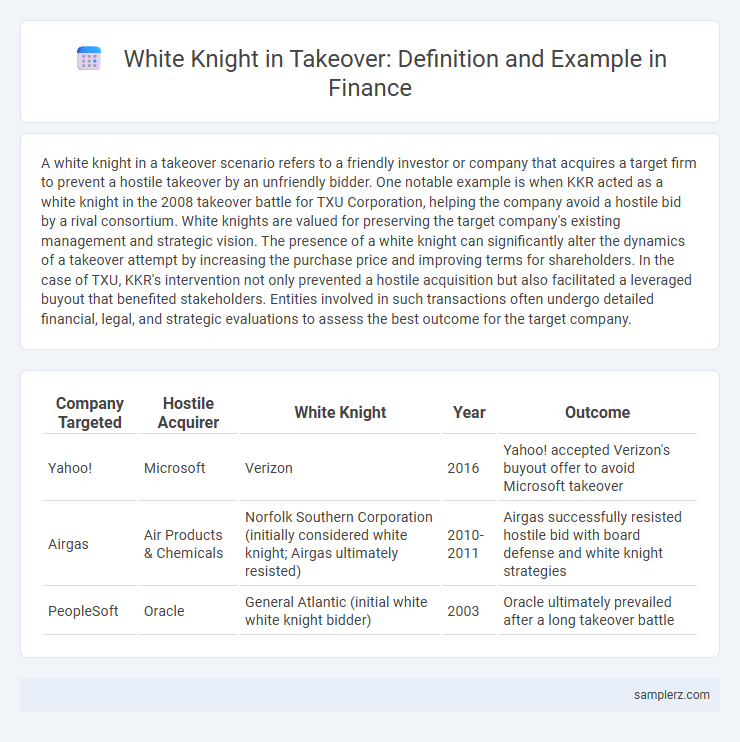

| Company Targeted | Hostile Acquirer | White Knight | Year | Outcome |

|---|---|---|---|---|

| Yahoo! | Microsoft | Verizon | 2016 | Yahoo! accepted Verizon's buyout offer to avoid Microsoft takeover |

| Airgas | Air Products & Chemicals | Norfolk Southern Corporation (initially considered white knight; Airgas ultimately resisted) | 2010-2011 | Airgas successfully resisted hostile bid with board defense and white knight strategies |

| PeopleSoft | Oracle | General Atlantic (initial white white knight bidder) | 2003 | Oracle ultimately prevailed after a long takeover battle |

Understanding the White Knight Concept in Finance

A white knight in finance refers to a friendly investor or company that acquires a target firm facing a hostile takeover, preserving its value and management structure. This strategic intervention often prevents hostile acquirers from implementing unfavorable changes and protects shareholder interests. Prominent examples include Warren Buffett's intervention in preventing hostile bids or companies like Kraft acting as white knights in mergers and acquisitions.

Key Characteristics of a White Knight in Takeovers

A white knight in takeovers is a friendly investor or company that rescues a target firm from a hostile bidder by offering a more favorable acquisition deal. Key characteristics include preserving management control, providing better valuation terms, and maintaining the target company's strategic vision and operational independence. This approach safeguards shareholder value while enabling a smoother transition compared to a hostile takeover.

Famous White Knight Examples in Corporate History

In 2008, Warren Buffett acted as a white knight by investing $5 billion in Goldman Sachs during the financial crisis, stabilizing the company amid hostile takeover pressures. Another notable example is Tata Sons rescuing Jaguar Land Rover from Ford in 2008, preserving the brand's autonomy and fostering long-term growth. These cases highlight how strategic white knight interventions can protect target companies from unfavorable acquisitions and secure shareholder value.

White Knight vs. Other Takeover Defenses

A white knight takeover involves a friendly investor acquiring a struggling company to prevent a hostile takeover, offering a more favorable alternative to the target's management and shareholders. Unlike other takeover defenses such as poison pills, which dilute shares to fend off the acquirer, or staggered boards that delay takeover attempts, white knights provide immediate financial stability and strategic alignment. This method preserves shareholder value by avoiding protracted battles and hostile conditions, making it a preferred defense in complex mergers and acquisitions.

Case Study: IBM as a White Knight in the Lotus Takeover

IBM acted as a white knight in the Lotus takeover by acquiring Lotus Development Corporation to prevent a hostile bid from competitors. This strategic move preserved Lotus's business autonomy while enabling IBM to expand its software portfolio, particularly in groupware technology. The acquisition exemplified how a white knight can stabilize a takeover battle and create synergistic growth opportunities in the technology and finance sectors.

The Role of White Knights in Hostile Bids

During hostile bids, a white knight serves as a friendly investor who acquires the target company to prevent a hostile takeover by an adversarial bidder. This strategy helps preserve the target's management and strategic vision while often offering better terms and ensuring shareholder value protection. Prominent examples include KKR acting as a white knight for RJR Nabisco during its takeover battle in the late 1980s.

Impact of White Knight Interventions on Shareholder Value

White knight interventions often protect shareholder value by preventing hostile takeovers that could undervalue the company's stock. For example, when Microsoft acted as a white knight in resisting Yahoo's hostile bid, it preserved Yahoo's strategic direction and stabilized stock prices. Such interventions typically result in improved market confidence and enhanced long-term shareholder returns.

Legal and Regulatory Aspects of White Knight Strategies

White knight strategies in corporate takeovers often involve complex legal and regulatory considerations, such as compliance with antitrust laws and securities regulations. For instance, during the 2007 hostile bid for Ingersoll-Rand, the white knight defense used by Gardner Denver required SEC approvals and adherence to state takeover statutes to ensure legitimacy. Properly navigating these legal frameworks helps white knights avoid litigation and regulatory penalties while facilitating successful acquisition bids.

White Knight Outcomes: Successes and Failures

White knights often save target companies from hostile takeovers by offering more favorable terms, as seen in the 2008 Heinz acquisition where Berkshire Hathaway acted as a white knight, preserving the firm's strategic goals. Successes include maintaining management autonomy and protecting shareholder value, while failures occur when white knights overpay or fail to integrate effectively, leading to long-term financial strain. The contrasting outcomes highlight the importance of due diligence and alignment of objectives between the white knight and the target company.

Lessons Learned from White Knight Takeover Scenarios

White knight takeovers demonstrate the strategic use of friendly investors to prevent hostile acquisitions, highlighting the importance of company valuation and shareholder interests. Key lessons include carefully vetting potential white knights to ensure alignment with long-term business goals and maintaining transparent communication with stakeholders to preserve trust. These scenarios underscore the value of proactive defense mechanisms and the need for robust corporate governance in takeover battles.

example of white knight in takeover Infographic

samplerz.com

samplerz.com