Fungibility in futures contracts refers to the ability to interchange one contract with another of the same type without loss of value or function. For example, crude oil futures traded on the New York Mercantile Exchange (NYMEX) are fungible, meaning that a contract for 1,000 barrels of West Texas Intermediate (WTI) crude oil expiring in June can be exchanged for another contract of the same specifications and expiry. This standardization ensures liquidity and facilitates efficient trading. Data reflecting fungibility in futures includes contract size, expiration date, and underlying asset quality. Futures contracts for agricultural commodities like corn or wheat are fungible because each contract represents a specified quantity and grade as defined by the exchange. Such uniformity allows traders to buy and sell contracts without concern for variations in underlying asset characteristics, enhancing market efficiency and price discovery.

Table of Comparison

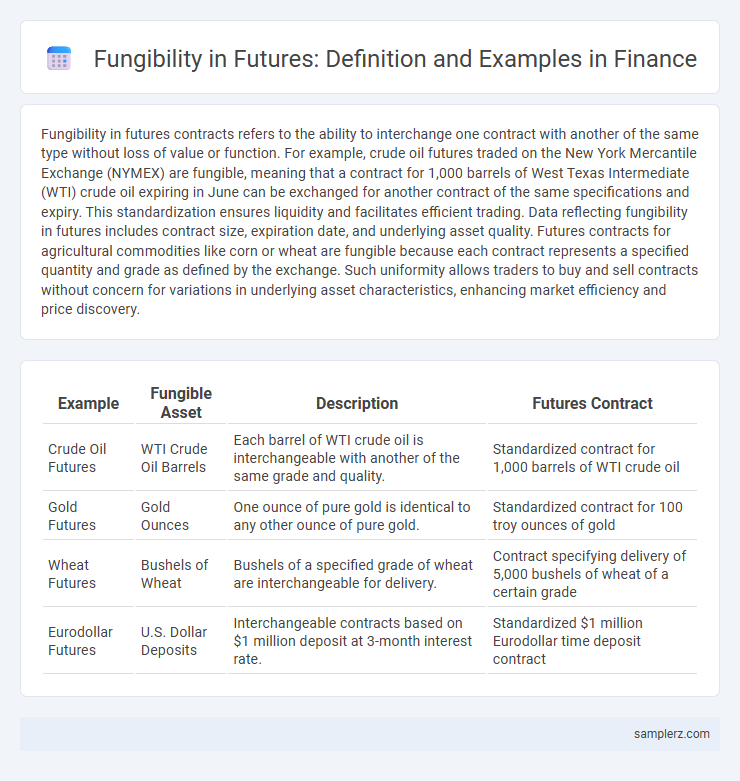

| Example | Fungible Asset | Description | Futures Contract |

|---|---|---|---|

| Crude Oil Futures | WTI Crude Oil Barrels | Each barrel of WTI crude oil is interchangeable with another of the same grade and quality. | Standardized contract for 1,000 barrels of WTI crude oil |

| Gold Futures | Gold Ounces | One ounce of pure gold is identical to any other ounce of pure gold. | Standardized contract for 100 troy ounces of gold |

| Wheat Futures | Bushels of Wheat | Bushels of a specified grade of wheat are interchangeable for delivery. | Contract specifying delivery of 5,000 bushels of wheat of a certain grade |

| Eurodollar Futures | U.S. Dollar Deposits | Interchangeable contracts based on $1 million deposit at 3-month interest rate. | Standardized $1 million Eurodollar time deposit contract |

Understanding Fungibility in Futures Contracts

Fungibility in futures contracts allows traders to interchange contracts of the same commodity, delivery month, and quality without affecting their value, ensuring seamless trading and liquidity. For instance, a December crude oil futures contract on the CME can be swapped between traders without any alteration in rights or obligations. This interchangeability is crucial for efficient price discovery and risk management in the futures market.

Key Characteristics of Fungible Futures Assets

Fungible futures contracts possess key characteristics such as standardized contract size, expiration dates, and underlying asset specifications that allow them to be easily exchanged or offset without loss of value. These features ensure that each contract is identical in terms, facilitating liquidity and seamless trading on futures exchanges. The uniformity in contract specifications enables market participants to substitute one contract for another, maintaining consistent pricing and efficient risk management.

Commodities as Fungible Instruments in Futures Trading

Commodities such as crude oil, gold, and wheat exemplify fungible instruments in futures trading due to their standardized contracts and interchangeable units. Each futures contract for these commodities represents a specified quantity and quality, allowing traders to easily buy or sell without concern for individual item differences. This fungibility enhances liquidity and price transparency in commodity futures markets, facilitating efficient hedging and speculation.

Financial Futures: Perfect Example of Fungibility

Financial futures contracts are a perfect example of fungibility, as each contract for a specific underlying asset, expiration date, and contract size is interchangeable with another identical contract. This uniformity allows traders to easily buy or sell contracts without concern for differences in quality or terms, ensuring seamless liquidity in the futures market. The fungible nature of these contracts supports efficient price discovery and risk management in global financial markets.

Fungible Futures Exchanges and Standardization

Fungible futures contracts enable seamless trading across multiple futures exchanges by maintaining consistent contract specifications such as size, expiration dates, and underlying assets. This standardization ensures that contracts traded on one exchange are interchangeable with those on another, enhancing liquidity and market efficiency. Major fungible futures exchanges like the CME Group and ICE facilitate this uniformity, allowing traders to easily offset or roll positions without concern for contract discrepancies.

Case Study: Fungibility in Crude Oil Futures

Crude oil futures on the New York Mercantile Exchange (NYMEX) exemplify fungibility, as contracts for West Texas Intermediate (WTI) crude are standardized and interchangeable regardless of the specific delivery month. Traders can sell a February contract and purchase a March contract without loss of value, ensuring liquidity and seamless market operations. This fungibility supports efficient price discovery and risk hedging in global oil markets.

Role of Fungibility in Hedging and Speculation

Fungibility in futures contracts enables traders to seamlessly substitute one contract for another, ensuring standardized terms and liquidity essential for effective hedging and speculation. This interchangeability allows market participants to manage risk efficiently by offsetting positions without concerns over contract uniqueness. As a result, fungibility enhances market confidence and facilitates smooth price discovery in financial markets.

Clearing Houses and the Assurance of Fungibility

Clearing Houses play a crucial role in ensuring fungibility in futures markets by standardizing contracts and guaranteeing performance through margin requirements and daily settlements. This assurance enables participants to buy and sell identical futures contracts without concern for counterparty risk, thereby maintaining liquidity and market efficiency. The centralized clearing mechanism facilitates seamless contract substitution and transfer, reinforcing the uniformity and interchangeability of futures contracts.

Challenges to Fungibility in Futures Markets

Fungibility in futures markets faces challenges such as contract specifications varying between exchanges, which limits seamless substitution among contracts. Differences in delivery terms, underlying asset quality, and expiration dates create discrepancies that reduce liquidity and increase basis risk. Regulatory changes and varying margin requirements further complicate the uniformity essential for maintaining fungibility in futures trading.

The Impact of Fungibility on Futures Liquidity

Fungibility in futures contracts allows traders to exchange one contract for another of the same specification without loss of value, significantly boosting market liquidity. This interchangeability reduces transaction costs and narrows bid-ask spreads, enabling seamless entry and exit positions for participants. Enhanced liquidity driven by fungibility improves price discovery and market efficiency in futures trading.

example of fungibility in futures Infographic

samplerz.com

samplerz.com