A Target Redemption Note (TARN) is a structured financial derivative product used primarily in foreign exchange and interest rate markets. It offers investors a capped potential return over multiple periods, where payments continue until a predefined cumulative payout target is reached. The underlying asset performance determines periodic coupon payments, and once the aggregate coupon hits the target, the note matures early, limiting further gains. In a typical foreign exchange TARN, an investor might receive a fixed coupon whenever the exchange rate meets certain conditions, such as staying above a strike price. The cumulative sum of these coupons grows until it hits the redemption target amount set at issuance. Investors use TARNs to gain exposure to directional moves with controlled payout risk, making them popular for hedging or speculative strategies in volatile markets.

Table of Comparison

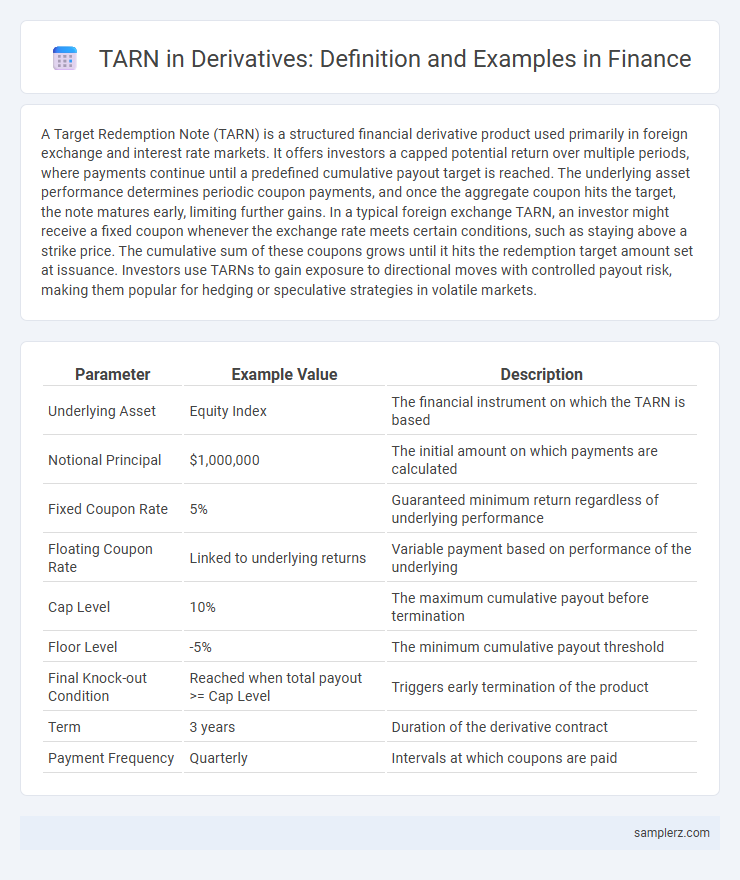

| Parameter | Example Value | Description |

|---|---|---|

| Underlying Asset | Equity Index | The financial instrument on which the TARN is based |

| Notional Principal | $1,000,000 | The initial amount on which payments are calculated |

| Fixed Coupon Rate | 5% | Guaranteed minimum return regardless of underlying performance |

| Floating Coupon Rate | Linked to underlying returns | Variable payment based on performance of the underlying |

| Cap Level | 10% | The maximum cumulative payout before termination |

| Floor Level | -5% | The minimum cumulative payout threshold |

| Final Knock-out Condition | Reached when total payout >= Cap Level | Triggers early termination of the product |

| Term | 3 years | Duration of the derivative contract |

| Payment Frequency | Quarterly | Intervals at which coupons are paid |

Introduction to TARNs in Derivatives

Target Accrual Redemption Notes (TARNs) are structured derivative products designed to provide investors with enhanced yield by setting a fixed accrual target and a cap on redemption. These instruments are linked to the performance of underlying assets such as equities, interest rates, or foreign exchange, offering payouts until the target accrual is met or exceeded. TARNs enable risk management and tailored investment strategies by combining features of options and bonds, making them integral in customized financial solutions.

Key Features of TARN Structures

Target Accrual Redemption Notes (TARNs) feature a predefined target accrual level, which triggers early redemption once achieved, limiting investor gains to a capped amount. These structured derivatives involve periodic coupon payments linked to an underlying asset's performance, with payoff profiles designed to balance yield enhancement and principal protection. Embedded stop-loss or knock-out mechanisms manage downside risk by terminating the note if losses surpass specified thresholds, making TARNs attractive for tailored risk-return strategies in fixed-income portfolios.

How TARNs Function in Financial Markets

Target Accrual Redemption Notes (TARNs) function as structured derivatives that enable investors to accumulate fixed coupon payments until a predetermined target amount is reached, at which point the product is automatically redeemed. These instruments combine features of bonds and options, offering customized exposure to underlying assets while managing payout risk through early termination upon hitting the target accrual. TARNs facilitate risk management and yield enhancement in financial markets by providing predictable income streams and limiting investor losses when market conditions fluctuate.

Real-World Examples of TARN Applications

A Target Accrual Redemption Note (TARN) was utilized by a major Japanese bank to hedge against interest rate volatility, where the derivative structure enabled capped coupon payments tied to LIBOR rates until a predefined target accrual level was reached. European energy companies employed TARNs linked to commodity prices, effectively managing cash flow risks associated with oil price fluctuations by terminating the note once profit targets were met. In currency markets, multinational corporations used TARN structures pegged to FX rates like USD/EUR to optimize exposure while limiting downside risks during periods of high market uncertainty.

TARN Payoff Calculation Explained

Total Return Swap (TARN) payoff calculation involves determining the net payment based on the underlying asset's cumulative return relative to a predefined target. The payoff equals the total return up to the target level, capping the exposure, with the calculation resetting once the target is reached to limit losses or gains. This mechanism enables precise risk management by defining maximum payoff and loss through the TARN structure in derivative contracts.

Risk Management with TARN Derivatives

Total Return Average Notes (TARNs) present unique risk management challenges due to their path-dependent payoff structures, which complicate hedging strategies and exposure assessments. Effective risk management with TARN derivatives requires dynamic monitoring of underlying asset volatility, correlation shifts, and early termination triggers to mitigate potential losses. Implementing advanced quantitative models and real-time risk analytics enables traders and risk managers to optimize hedging effectiveness and control counterparty risk.

Pros and Cons of Using TARNs

Target Accrual Redemption Notes (TARNs) offer investors leveraged exposure to underlying assets with predefined payoff caps, enabling effective risk management and potential for high returns during favorable market movements. However, TARNs carry the risk of early termination once the target accrual is reached, limiting upside if markets continue to move favorably, and they often involve complex pricing structures and higher counterparty risk compared to standard derivatives. Investors must weigh the benefits of structured payout profiles and mitigation of drawdown against the potential constraints on profit and increased market and credit risks inherent in TARNs.

Sector-Specific TARN Use Cases

Target Accrual Redemption Notes (TARNs) are extensively used in the energy sector to hedge against commodity price volatility, enabling companies to cap costs while participating in favorable price movements. Financial institutions in metals trading utilize TARNs to manage exposure to fluctuating prices of base and precious metals, optimizing cash flow stability. In the interest rate market, corporations employ TARNs to lock in borrowing costs within specific thresholds, reducing the risk of adverse rate spikes during capital raising activities.

Comparing TARNs to Other Structured Products

TARNs (Target Redemption Notes) differ from other structured products by offering capped payout profiles combined with a target return feature, which limits both upside gains and downside risk. Unlike traditional options or credit-linked notes, TARNs provide investors with a predetermined redemption threshold, ensuring a fixed income once the target is reached, even if market conditions improve further. This unique payoff structure balances risk and reward, making TARNs particularly suitable for investors seeking predictable returns in volatile markets.

Regulatory Considerations for TARN Derivatives

Regulatory considerations for Target Accrual Redemption Notes (TARNs) include compliance with Dodd-Frank Act requirements imposing stricter reporting, margin, and clearing obligations on over-the-counter derivatives. Capital adequacy standards under Basel III necessitate banks holding TARN derivatives to maintain higher risk-weighted assets, reflecting exposure to market volatility. Furthermore, MiFID II in the EU mandates enhanced transparency and investor protection measures, requiring detailed disclosure and fair valuation practices for TARN instruments.

example of TARN in derivative Infographic

samplerz.com

samplerz.com