Laddering in an IPO refers to the practice where underwriters allocate shares to investors with the expectation that these investors will buy additional shares at higher prices after the stock starts trading. This technique artificially inflates demand, pushing the stock price upward in the secondary market. Data shows that laddering often leads to a temporary surge in the stock price, benefiting initial investors and underwriters while potentially harming long-term investors. Entities involved in laddering typically include investment banks, institutional investors, and retail investors. Underwriters use laddering to create momentum and positive sentiment around the IPO, influencing market perception and trading volumes. Regulatory bodies closely monitor laddering activities due to the risk of market manipulation and unfair trading advantages.

Table of Comparison

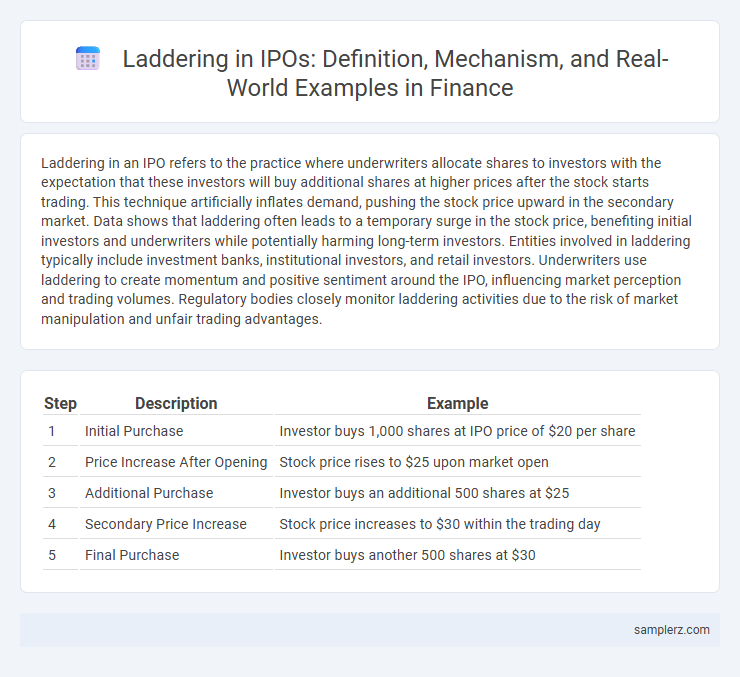

| Step | Description | Example |

|---|---|---|

| 1 | Initial Purchase | Investor buys 1,000 shares at IPO price of $20 per share |

| 2 | Price Increase After Opening | Stock price rises to $25 upon market open |

| 3 | Additional Purchase | Investor buys an additional 500 shares at $25 |

| 4 | Secondary Price Increase | Stock price increases to $30 within the trading day |

| 5 | Final Purchase | Investor buys another 500 shares at $30 |

Understanding Laddering in IPOs

Laddering in IPOs involves underwriters encouraging investors to purchase additional shares at higher prices to create artificial demand and drive up the stock price. This practice can lead to inflated initial returns but poses regulatory risks due to its potential to manipulate market prices. Understanding laddering helps investors and regulators identify signs of price manipulation during IPO allocations.

Common Laddering Tactics Used in IPOs

Common laddering tactics in IPOs involve investors placing bids for shares at multiple price levels to create artificial demand, often driving up initial prices. Underwriters may encourage this behavior by allocating shares preferentially to those who agree to ladder bids, thereby stabilizing the aftermarket price and enhancing perceived market interest. Such strategies can lead to short-term price inflation, impacting investor returns and market efficiency.

Case Study: Historical Examples of Laddering

Laddering in IPOs involves investors placing orders for shares at multiple price levels to create artificial demand and drive up prices. A notable case study is the 1999 Hotmail IPO, where underwriters allegedly encouraged laddering by allocating shares to favored clients who agreed to buy shares at increasing prices, boosting the initial aftermarket performance. This practice led to regulatory scrutiny and highlighted the risks of market manipulation in IPOs.

Real-World IPOs Impacted by Laddering

In the 1990s, notable IPOs such as Netscape and Yahoo experienced laddering, where investors placed multiple bids at escalating prices to drive up demand and share prices artificially. This practice impacted market perception and led to regulatory scrutiny by the SEC, highlighting the need for transparency in IPO allocations. Laddering contributed to inflated initial returns, distorting true market value and investor trust in high-profile public offerings.

How Laddering Influences IPO Pricing

Laddering in IPO pricing occurs when underwriters allocate shares to investors who agree to purchase additional shares at higher prices post-IPO, artificially inflating demand and driving up the initial stock price. This practice can lead to price manipulation, creating a misleading market perception of value and causing volatility once the artificial purchasing pressure subsides. Regulatory scrutiny often targets laddering due to its impact on fair price discovery and investor confidence during IPO launches.

Regulatory Actions Against Laddering in IPOs

Regulatory actions against laddering in IPOs have intensified to prevent artificial inflation of stock prices and market manipulation. The U.S. Securities and Exchange Commission (SEC) enforces strict penalties on underwriters and investors involved in laddering, including fines and bans from participating in future offerings. These measures aim to enhance transparency and protect retail investors from unfair pricing practices.

Investor Behavior in IPO Laddering Schemes

Investor behavior in IPO laddering schemes often involves placing conditional orders to buy additional shares at higher prices, creating artificial demand and price inflation during the initial offering. This tactic manipulates the market by encouraging investors to hold shares and avoid selling, thereby stabilizing or driving up the stock price post-IPO. Regulators scrutinize laddering because it can distort true market value and disadvantage retail investors unaware of such coordinated buying strategies.

Notable Lawsuits Involving IPO Laddering

Notable lawsuits involving IPO laddering include the 2003 case against Credit Suisse First Boston, where the firm was accused of allocating shares in initial public offerings to favored clients in exchange for their agreement to buy additional shares at higher prices. The SEC alleged this practice distorted the IPO pricing mechanism and harmed ordinary investors. These legal actions emphasized the importance of transparent allocation processes to maintain fair market conditions during IPO launches.

Preventing Laddering: Best Practices for Issuers

Issuers can prevent laddering in IPOs by implementing strict allocation policies that limit share distribution among investors to avoid intentional resale manipulation. Monitoring aftermarket trading closely and establishing clear lock-up agreements help maintain market stability and deter artificial price inflation. Transparent communication with underwriters about allocation strategies ensures compliance and reinforces investor confidence during the IPO process.

Lessons Learned from IPO Laddering Scandals

IPO laddering scandals revealed critical risks of market manipulation where underwriters incentivized investors to place oversized orders at inflated prices, distorting true demand and pricing. Regulatory bodies enhanced transparency and strict enforcement measures, emphasizing the importance of fair allocation practices and robust monitoring to protect retail investors and maintain market integrity. These lessons stress that combating laddering requires coordinated efforts between regulators, underwriters, and investors to uphold ethical standards in IPO pricing.

example of laddering in IPO Infographic

samplerz.com

samplerz.com