The waterfall model in cash flow management is a structured method used to prioritize the distribution of cash among various stakeholders. Typically, cash inflows are allocated first to operating expenses and debt servicing, ensuring critical obligations are met. Once these primary obligations are fulfilled, remaining cash flows are distributed to equity holders or reinvested in the business. In finance, this model clearly defines the order of payments, reducing conflicts among investors and creditors. For example, a real estate investment trust (REIT) may use a waterfall model to allocate rental income, paying property maintenance costs and mortgage interest before distributing profits to shareholders. This approach ensures transparency and predictability in cash flow allocation across different tiers of claims.

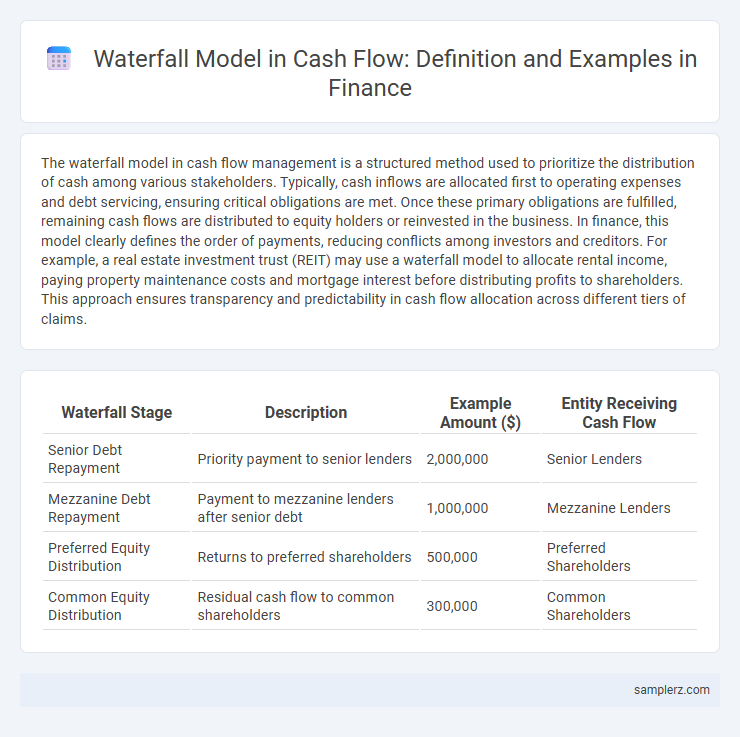

Table of Comparison

| Waterfall Stage | Description | Example Amount ($) | Entity Receiving Cash Flow |

|---|---|---|---|

| Senior Debt Repayment | Priority payment to senior lenders | 2,000,000 | Senior Lenders |

| Mezzanine Debt Repayment | Payment to mezzanine lenders after senior debt | 1,000,000 | Mezzanine Lenders |

| Preferred Equity Distribution | Returns to preferred shareholders | 500,000 | Preferred Shareholders |

| Common Equity Distribution | Residual cash flow to common shareholders | 300,000 | Common Shareholders |

Introduction to the Waterfall Model in Cash Flow

The waterfall model in cash flow structures the priority of payments, ensuring investors, creditors, and stakeholders receive distributions according to predefined tiers. Cash inflows are sequentially allocated, starting with operating expenses and senior debt servicing, followed by subordinate debt, preferred equity, and finally common equity returns. This hierarchical cash flow distribution optimizes risk management and clarifies payout order during project financing or investment returns.

Key Components of a Cash Flow Waterfall

A cash flow waterfall is structured to prioritize payments by allocating incoming cash through a hierarchy of key components: operating expenses, debt service, reserves, and equity distributions. Operating expenses are covered first to ensure business continuity, followed by scheduled debt repayments such as interest and principal installments. Excess cash flows then move to reserve accounts before finally being distributed to equity investors, maintaining a disciplined and transparent financial flow management.

How the Waterfall Model Operates in Finance

The waterfall model in finance allocates cash flow sequentially among stakeholders according to a predefined priority order, often starting with senior debt holders, then mezzanine lenders, and equity investors last. Each tier receives payment only after the preceding class's obligations are fully satisfied, ensuring risk and return are systematically managed. This structured distribution method optimizes capital recovery, aligns incentives, and clarifies stakeholder expectations in complex financial arrangements.

Step-by-Step Example of a Waterfall Cash Flow

The waterfall cash flow model allocates incoming cash sequentially, starting with senior debt repayment, followed by operating expenses and maintenance reserves. Next, subordinate debts and preferred equity receive payments, with remaining cash flows distributed to common equity holders as residual income. This step-by-step prioritization ensures orderly financial obligations settlement and risk mitigation across stakeholders.

Priority of Payments in a Waterfall Structure

In a waterfall structure for cash flow prioritization, senior secured debt receives the first allocation of available funds, ensuring these creditors are paid before others. Subordinated debt holders are next in line, receiving payments only after senior obligations are fully satisfied. Equity investors are last, obtaining residual cash flow only after all higher-priority claims have been settled, reflecting the hierarchical risk-return framework fundamental to structured finance.

Waterfall Model in Real Estate Investment

The waterfall model in real estate investment delineates the priority of cash flow distributions among stakeholders, ensuring investors receive their preferred returns before sponsors partake in profit sharing. Typically, cash flows are allocated first to repay capital contributions, then to achieve hurdle rates for limited partners, and finally to distribute residual profits according to agreed-upon equity splits. This structured hierarchy optimizes risk management and aligns incentives, enhancing transparency in investment returns within real estate projects.

Waterfall Cash Flow in Private Equity Deals

Waterfall cash flow in private equity deals structures the distribution of returns by prioritizing the return of capital to limited partners before general partners receive carried interest. This tiered payout typically follows a sequence: return of invested capital, preferred return hurdle (often around 8%), and then catch-up provisions leading to carried interest allocations. This model ensures alignment of interests and incentivizes performance by linking fund managers' compensation to the achievement of specific return thresholds.

Advantages of Using a Waterfall Structure

A waterfall model in cash flow allocation ensures prioritized distribution of funds, enhancing clarity and discipline by systematically channeling cash to senior debt, mezzanine financing, and equity holders in sequence. This structure mitigates risk by aligning payment streams with investor seniority, which optimizes capital efficiency and improves predictability for stakeholders. Clear delineation of cash flow rights reduces disputes, streamlines financial planning, and facilitates better resource management for complex finance projects.

Common Challenges in Waterfall Implementation

Cash flow waterfall models often face challenges such as inaccurate cash flow forecasting, which can disrupt the prioritization of payments to investors and stakeholders. Complex contractual provisions and multiple stakeholder classes create difficulties in automating distributions, leading to potential delays and disputes. Limited transparency and inconsistent data integration further complicate waterfall execution, making it critical for firms to invest in robust financial technology and comprehensive scenario analysis.

Conclusion: Best Practices for Waterfall Cash Flow Management

Effective waterfall cash flow management requires clear prioritization of payment tiers, starting with senior debt servicing, followed by subordinated obligations and equity distributions to optimize liquidity and risk allocation. Implementing automated tracking systems enhances accuracy and transparency in fund allocation, reducing disputes among stakeholders. Regular analysis of waterfall structures aligned with business performance ensures adaptive cash flow strategies that maintain financial stability and investor confidence.

example of waterfall model in cash flow Infographic

samplerz.com

samplerz.com