Fungibility in finance refers to an asset's ability to be interchangeable with other individual units of the same asset. A prime example is cash, where any $10 bill holds the same value and can be exchanged directly for another $10 bill without loss of value. This characteristic enables efficient trade and liquidity in financial markets, supporting seamless transactions. Cryptocurrencies like Bitcoin also exhibit fungibility, with each Bitcoin holding the same value regardless of its transaction history. Stocks are another instance where shares of the same class are fungible, allowing investors to trade them without distinction. The concept of fungibility ensures that assets remain standardized and easily tradable, which is crucial for maintaining market stability and investor confidence.

Table of Comparison

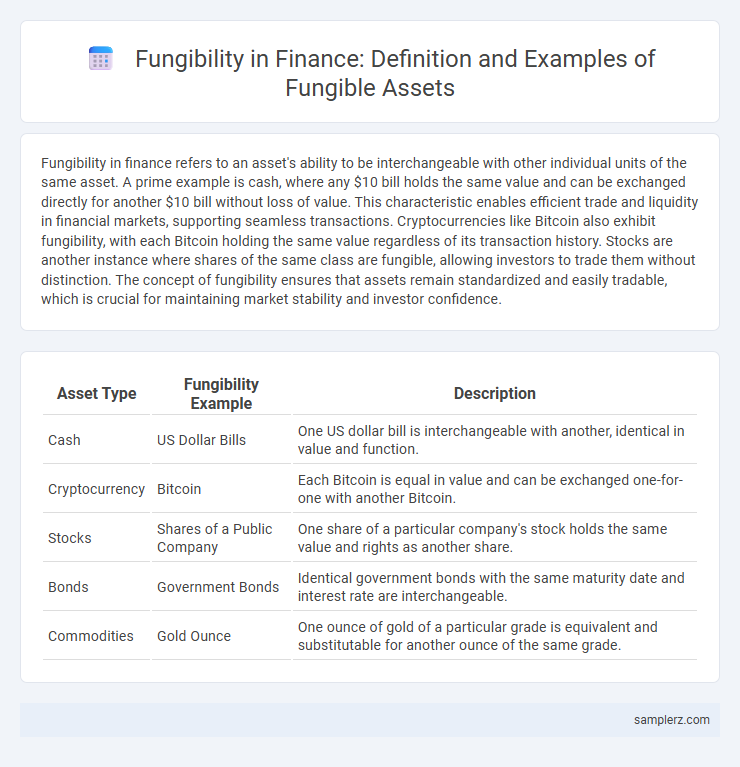

| Asset Type | Fungibility Example | Description |

|---|---|---|

| Cash | US Dollar Bills | One US dollar bill is interchangeable with another, identical in value and function. |

| Cryptocurrency | Bitcoin | Each Bitcoin is equal in value and can be exchanged one-for-one with another Bitcoin. |

| Stocks | Shares of a Public Company | One share of a particular company's stock holds the same value and rights as another share. |

| Bonds | Government Bonds | Identical government bonds with the same maturity date and interest rate are interchangeable. |

| Commodities | Gold Ounce | One ounce of gold of a particular grade is equivalent and substitutable for another ounce of the same grade. |

Understanding Fungibility in Financial Assets

Fungibility in financial assets means each unit is interchangeable and holds equal value, exemplified by currencies like the US dollar and commodities such as gold bars standardized by weight and purity. Stocks of the same class issued by a company are also fungible, where one share equals another in rights and value on the same trading platform. Understanding this characteristic allows investors to trade assets seamlessly, ensuring liquidity and market efficiency.

Key Characteristics of Fungible Assets

Fungible assets, such as stocks, bonds, and currency, possess the key characteristic of interchangeability, allowing individual units to be exchanged or replaced without loss of value. Their uniformity ensures that each unit holds identical market value and function, facilitating liquidity and ease of trade. This indistinguishability underpins efficient markets, enabling seamless transactions and valuation consistency for investors.

Cryptocurrencies: A Modern Example of Fungibility

Cryptocurrencies exemplify fungibility by allowing each unit of a digital currency, such as Bitcoin or Ethereum, to be identical and interchangeable with another of the same type and value. This property facilitates seamless transactions on blockchain networks, where individual tokens cannot be distinguished from one another, ensuring liquidity and ease of exchange. Fungibility in cryptocurrencies supports decentralized finance applications by maintaining consistent value across transactions without differentiation.

Fungibility in Stocks and Shares

Fungibility in stocks and shares allows investors to trade shares of the same company interchangeably without affecting their value or ownership rights. Each share represents an equal portion of ownership, ensuring liquidity and ease of transfer on stock exchanges. This characteristic supports efficient market operations and portfolio diversification.

Government Bonds as Fungible Assets

Government bonds exemplify fungible assets because each bond of the same issue and maturity date holds equal value, allowing investors to trade them interchangeably. These bonds, issued by sovereign entities, maintain standardized terms and fixed interest payments, ensuring uniformity across the market. Their fungibility facilitates liquidity in secondary markets, enhancing portfolio management and efficient capital allocation.

Commodities: Gold, Oil, and Fungibility

Gold and oil serve as prime examples of fungible commodities, where each unit is interchangeable and holds equal value regardless of its origin. This inherent fungibility allows investors and traders to buy, sell, or exchange these assets seamlessly in global markets without concern for individual asset differentiation. The standardized quality and divisibility of gold and oil underpin their liquidity and essential role in financial portfolios and commodity exchanges.

Currency Exchange and Global Fungibility

Currency exchange exemplifies fungibility as each unit of a currency, such as one US dollar or one euro, holds equal value and is interchangeable with any other unit of the same denomination, facilitating seamless global transactions. Global fungibility in currency enables investors and businesses to convert and transfer assets across borders without loss of value or differentiation, enhancing liquidity and market efficiency. This universal acceptability of currencies underpins international trade, foreign investment, and the integration of financial markets worldwide.

Non-Fungible vs Fungible Assets: Key Differences

Fungible assets like stocks and currencies are interchangeable, enabling seamless trading due to their uniform value and standardized units. Non-fungible assets, such as real estate and NFTs (non-fungible tokens), possess unique characteristics and cannot be exchanged on a one-to-one basis. This distinction impacts liquidity and valuation strategies, with fungible assets offering higher liquidity while non-fungible assets require individualized appraisal.

Real-World Transactions Demonstrating Fungibility

Cash is a prime example of fungibility in finance, where one $20 bill is universally interchangeable with another $20 bill during real-world transactions. Commodities such as gold exhibit fungibility, allowing investors to trade ounces regardless of the specific source or batch. Cryptocurrencies like Bitcoin also demonstrate fungibility, as each token holds equal value and is accepted identically across digital wallets and exchanges.

Importance of Fungibility in Financial Markets

Fungibility in financial markets ensures that assets like stocks, bonds, or cryptocurrencies can be exchanged or replaced with identical units without loss of value, enhancing liquidity and market efficiency. This characteristic allows investors to trade seamlessly, maintaining consistent pricing and reducing transaction costs across large-scale portfolios. The importance of fungibility lies in its role in facilitating transparent, reliable markets where assets can be easily bought, sold, or used as collateral.

example of fungibility in asset Infographic

samplerz.com

samplerz.com