Accretion in a discount bond refers to the gradual increase in the bond's value as it approaches maturity. For example, if an investor purchases a discount bond with a face value of $1,000 for $900, the $100 difference represents the accretion amount. Over time, this accreted value is recognized as interest income, steadily raising the bond's book value until it reaches the face value at maturity. This process is critical in finance because it affects the bondholder's taxable income and investment returns. The accretion is recorded using the effective interest method, which allocates the bond's discount over its life based on the bond's yield. Tracking accretion ensures accurate financial reporting and helps investors evaluate the true earnings from discount bonds.

Table of Comparison

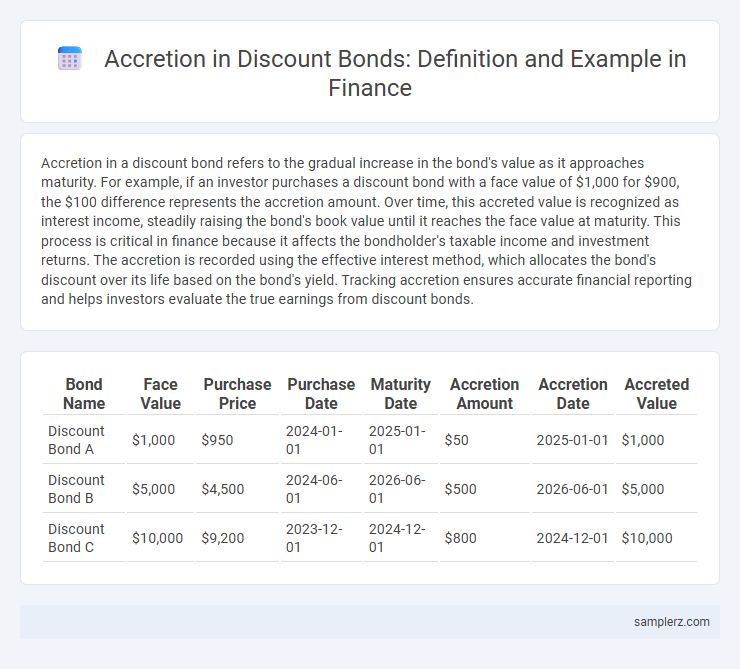

| Bond Name | Face Value | Purchase Price | Purchase Date | Maturity Date | Accretion Amount | Accretion Date | Accreted Value |

|---|---|---|---|---|---|---|---|

| Discount Bond A | $1,000 | $950 | 2024-01-01 | 2025-01-01 | $50 | 2025-01-01 | $1,000 |

| Discount Bond B | $5,000 | $4,500 | 2024-06-01 | 2026-06-01 | $500 | 2026-06-01 | $5,000 |

| Discount Bond C | $10,000 | $9,200 | 2023-12-01 | 2024-12-01 | $800 | 2024-12-01 | $10,000 |

Introduction to Discount Bonds and Accretion

Discount bonds are debt securities issued below their face value, allowing investors to earn a return through accretion as the bond approaches maturity. Accretion represents the gradual increase in the bond's book value, reflecting the earned interest that causes its price to converge to the par value at maturity. For example, a $1,000 bond purchased at $950 will accrete $50 over its term, recognizing interest income without periodic coupon payments.

Understanding the Concept of Bond Accretion

Bond accretion is the gradual increase in the value of a discount bond as it approaches maturity, reflecting the amortization of the bond's discount to its par value. For example, a $1,000 bond purchased at $950 will accrete $50 over its life, adjusting the bond's book value upward each period. This process impacts yields and financial reporting by recognizing interest income beyond coupon payments.

How Discount Bonds Generate Accretion

Discount bonds generate accretion by gradually increasing in value as they approach maturity, reflecting the difference between their purchase price and face value. The accretion represents the bondholder's earned interest, realized when the bond is redeemed at par. This process enhances the bond's yield, making discount bonds attractive for investors seeking capital appreciation alongside fixed income.

Step-by-Step Example of Accretion in Discount Bonds

Accretion in discount bonds involves gradually increasing the bond's book value as it approaches maturity, reflecting the bond's purchase below par and its eventual redemption at face value. For instance, a $1,000 bond purchased for $900 with a maturity of 2 years accretes $50 each year, recognized as interest income, until it reaches $1,000 at maturity. This step-by-step accretion improves the effective yield, aligning the bond's carrying amount with its redemption price over time.

Calculating Accretion Using the Straight-Line Method

Calculating accretion on a discount bond using the straight-line method involves evenly allocating the bond's discount over its life until maturity. For instance, if a bond with a face value of $1,000 is purchased for $950 and matures in five years, the annual accretion would be ($1,000 - $950) / 5 = $10. This approach simplifies the calculation by assigning equal increments of accreted interest each year.

Effective Interest Method for Bond Accretion

The Effective Interest Method applies to discount bonds by systematically increasing the bond's carrying amount over time to its face value at maturity. This method calculates interest revenue by multiplying the bond's carrying amount by the market interest rate at issuance, resulting in accretion of the discount. As periods progress, the interest income recognized grows, reflecting the bond accreting toward par value through amortization of the discount.

Accretion Impact on Financial Statements

Accretion of a discount bond increases the bond's carrying value on the balance sheet over time, reflecting the gradual recognition of interest income. This process results in higher interest expense reported on the income statement, impacting net income and earnings per share. By adjusting the bond's book value to face value at maturity, accretion ensures accurate matching of interest cost with financial reporting periods.

Tax Implications of Accreted Discount

Accretion of discount on a discount bond increases the bond's adjusted basis annually for tax purposes, resulting in taxable income even if no cash interest is received. The accreted amount is treated as ordinary income and must be reported each year, influencing the investor's tax liability. Failure to account for accretion can lead to underpayment of taxes and potential penalties from the IRS.

Real-World Case Studies: Discount Bond Accretion

Discount bond accretion occurs when the bond's price increases gradually as it approaches maturity, reflecting the bond's value rising from its discounted purchase price to its face value. For example, a U.S. Treasury bond purchased at 95 will accrete 5 points over its term, realizing an effective yield as the price moves toward 100 by maturity. Real-world cases include corporate bonds purchased below par, where accretion impacts yield calculations and portfolio valuation strategies in fixed income investment management.

Key Takeaways on Accretion in Discount Bonds

Accretion in discount bonds refers to the gradual increase in the bond's value as it approaches maturity, reflecting the accumulation of interest income. The bond's purchase price is below par value, and the difference is systematically recognized as interest revenue over time, impacting income statement reporting. Key takeaways include understanding accretion's effect on yield calculation, accurate amortization schedules, and its role in enhancing portfolio valuation through non-cash earnings recognition.

example of accretion in discount bond Infographic

samplerz.com

samplerz.com