A lockup period in an IPO refers to a predetermined timeframe during which insiders, such as company executives and early investors, are restricted from selling their shares after the company goes public. This lockup typically lasts between 90 to 180 days, aiming to stabilize the stock price by preventing a sudden influx of shares in the market. The lockup helps maintain investor confidence by ensuring that insiders have a vested interest in the company's long-term success. For instance, during the Facebook IPO in 2012, a 180-day lockup restricted major shareholders and employees from selling their shares immediately post-IPO. This prevented a flood of shares that could have driven the stock price down following the initial public offering. Lockup agreements are standard practice in IPOs to balance supply and demand in the early trading period.

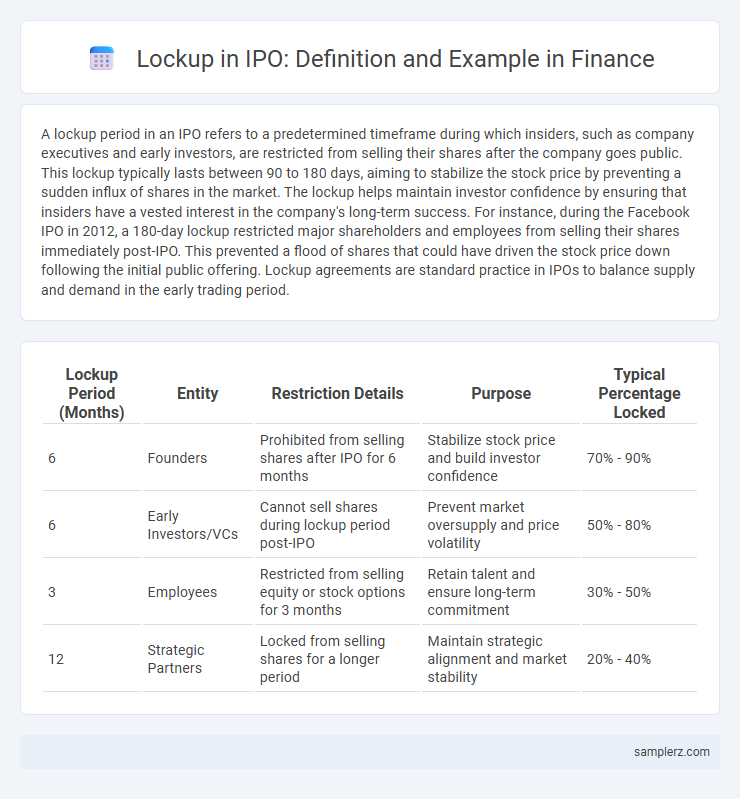

Table of Comparison

| Lockup Period (Months) | Entity | Restriction Details | Purpose | Typical Percentage Locked |

|---|---|---|---|---|

| 6 | Founders | Prohibited from selling shares after IPO for 6 months | Stabilize stock price and build investor confidence | 70% - 90% |

| 6 | Early Investors/VCs | Cannot sell shares during lockup period post-IPO | Prevent market oversupply and price volatility | 50% - 80% |

| 3 | Employees | Restricted from selling equity or stock options for 3 months | Retain talent and ensure long-term commitment | 30% - 50% |

| 12 | Strategic Partners | Locked from selling shares for a longer period | Maintain strategic alignment and market stability | 20% - 40% |

Understanding IPO Lockup Periods

IPO lockup periods typically last 90 to 180 days, preventing insiders such as company executives, employees, and early investors from selling shares immediately after the initial public offering. This restriction helps stabilize the stock price by reducing supply volatility and signaling confidence in the company's future performance. Understanding IPO lockup agreements is crucial for investors to anticipate potential stock price fluctuations once the lockup expires.

Importance of Lockup Agreements in IPOs

Lockup agreements in IPOs prevent insiders from selling shares for a specified period, typically 90 to 180 days, stabilizing the stock price post-offering. These agreements reduce volatility by limiting immediate supply, reassuring investors and supporting market confidence. Enforcement of lockups helps maintain orderly trading, protecting the company's valuation and long-term shareholder value.

Common Lockup Period Lengths in IPOs

Common lockup period lengths in IPOs typically range from 90 to 180 days, during which insiders and major shareholders are restricted from selling their shares to stabilize stock prices post-listing. A 180-day lockup is the industry standard enforced by underwriters to prevent excessive volatility and maintain investor confidence in the newly public company. Some companies may extend lockup agreements beyond six months to align with strategic business objectives and market conditions.

How Lockup Expirations Affect Stock Prices

Lockup expirations in IPOs typically lead to increased stock volatility as a significant number of shares become eligible for sale, often resulting in downward pressure on stock prices. Institutional investors and insiders may sell shares once the lockup period ends, increasing supply and potentially triggering price declines. Market participants closely monitor these expiration dates to anticipate potential price adjustments and trading volume spikes.

Real-Life Examples of IPO Lockup Expirations

During Facebook's 2012 IPO, the 180-day lockup expiration led to a significant stock price decline as early investors sold shares, increasing market supply. Similarly, Snapchat's 2017 IPO saw volatility when its 180-day lockup expired, with founder shares unlocking and impacting share price. These real-life IPO lockup expirations demonstrate how release of restricted shares by insiders can affect stock liquidity and market valuation.

Impacts on Employees and Early Investors

Lockup periods in IPOs typically restrict employees and early investors from selling their shares for 90 to 180 days, stabilizing the stock price post-offering. This mandated holding period can enhance market confidence but may also delay liquidity for these stakeholders, impacting their financial planning and potential gains. The restriction helps prevent sudden stock price drops caused by mass sell-offs, protecting long-term shareholder value.

Strategies for Managing IPO Lockup Risk

Managing IPO lockup risk involves strategic planning such as diversifying shareholder sell-off timelines to prevent market oversupply and stabilizing stock prices. Employing staggered release schedules and implementing secondary offerings can mitigate downward price pressure post-lockup expiration. Coordination with underwriters and clear communication with investors enhances market confidence and reduces volatility during lockup periods.

Regulatory Requirements for IPO Lockups

IPO lockup periods are regulatory requirements imposed by securities commissions to restrict insiders from selling shares immediately after the public offering, typically lasting 90 to 180 days. These restrictions aim to stabilize stock prices by preventing a sudden surge in supply that could negatively impact market valuation. Compliance with SEC Rule 144 and similar regulations ensures orderly market behavior and protects investor interests during the crucial post-IPO phase.

Notable IPOs with Significant Lockup Effects

The Facebook IPO in 2012 featured a 180-day lockup period that significantly suppressed stock supply, causing an initial price depression before a sharp rebound after the lockup expired. Alibaba's 2014 IPO also imposed a 180-day lockup on insiders, leading to a notable increase in share liquidity and subsequent price volatility post-lockup. These lockup agreements are critical in managing post-IPO market stability and investor confidence in high-profile public offerings.

Key Takeaways for Investors During Lockup Periods

Lockup periods in IPOs typically last 90 to 180 days, during which insiders are restricted from selling their shares to stabilize the stock price. Investors should monitor potential share sell-offs post-lockup expiration, as increased supply may lead to price volatility or downward pressure. Understanding lockup terms helps investors assess short-term risks and make informed decisions about timing entry or exit strategies.

example of lockup in IPO Infographic

samplerz.com

samplerz.com