Clawback in investment refers to the provision where investors recover previously distributed profits or fees due to certain conditions not being met. A common example is in private equity funds, where fund managers receive carried interest based on projected returns. If subsequent investments underperform, the fund requires managers to return excess profits paid out earlier to ensure fair allocation among investors. Another example involves hedge funds, which may enforce clawback clauses to reclaim performance fees if cumulative returns decline after initial payouts. This mechanism protects limited partners from overpayment and aligns the interests of fund managers with long-term performance. Clawbacks depend heavily on detailed contractual agreements and accurate financial data to calculate the exact recovery amount.

Table of Comparison

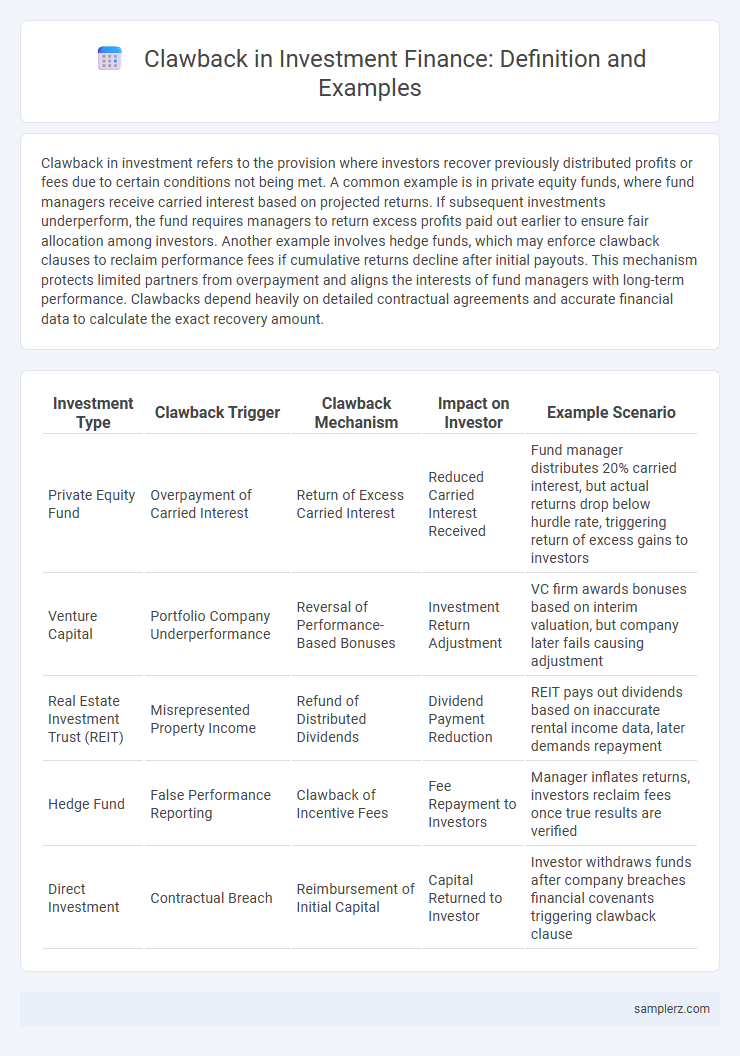

| Investment Type | Clawback Trigger | Clawback Mechanism | Impact on Investor | Example Scenario |

|---|---|---|---|---|

| Private Equity Fund | Overpayment of Carried Interest | Return of Excess Carried Interest | Reduced Carried Interest Received | Fund manager distributes 20% carried interest, but actual returns drop below hurdle rate, triggering return of excess gains to investors |

| Venture Capital | Portfolio Company Underperformance | Reversal of Performance-Based Bonuses | Investment Return Adjustment | VC firm awards bonuses based on interim valuation, but company later fails causing adjustment |

| Real Estate Investment Trust (REIT) | Misrepresented Property Income | Refund of Distributed Dividends | Dividend Payment Reduction | REIT pays out dividends based on inaccurate rental income data, later demands repayment |

| Hedge Fund | False Performance Reporting | Clawback of Incentive Fees | Fee Repayment to Investors | Manager inflates returns, investors reclaim fees once true results are verified |

| Direct Investment | Contractual Breach | Reimbursement of Initial Capital | Capital Returned to Investor | Investor withdraws funds after company breaches financial covenants triggering clawback clause |

Definition and Importance of Clawback Provisions in Investments

Clawback provisions in investments are contractual agreements that require investors or fund managers to return previously distributed profits if certain conditions, such as poor performance or breach of terms, arise. These provisions protect limited partners by ensuring fair allocation of returns and mitigating risks associated with overpayment or mismanagement. Incorporating clawbacks enhances transparency and accountability, fostering trust and aligning interests between stakeholders in private equity, hedge funds, and venture capital investments.

Notable Real-World Clawback Examples in Private Equity

In private equity, a notable clawback example occurred with KKR's 2006 flagship fund, where limited partners recovered over $100 million due to performance reversals during the fund's lifecycle. Another prominent case involved The Blackstone Group, which enforced clawbacks to ensure general partners returned excess carried interest after post-hoc valuation adjustments. These high-profile clawbacks highlight the importance of alignment mechanisms between general and limited partners to maintain fair profit distribution in private equity funds.

Clawback Clauses in Hedge Fund Agreements

Clawback clauses in hedge fund agreements ensure that fund managers return previously received carried interest if subsequent losses cause overall returns to fall below a predefined hurdle rate. These provisions protect investors by aligning manager incentives with long-term performance and minimizing the risk of overpayment during profitable periods followed by downturns. Typically, clawbacks are triggered during fund liquidation or specific performance review points, enforcing fair profit distribution between managers and limited partners.

How Clawbacks Work in Executive Compensation Packages

Clawbacks in executive compensation packages require executives to return bonuses or incentives if financial results are later restated or misconduct is uncovered, ensuring accountability and alignment with shareholder interests. These provisions are typically triggered by events such as earnings restatements, regulatory violations, or ethical breaches discovered within a specified timeframe after the compensation is awarded. By incorporating clawback clauses, companies mitigate risks associated with inaccurate financial reporting and reinforce prudent executive behavior in investment management.

Case Study: Clawback Enforcement After Financial Restatements

In investment finance, clawback enforcement often occurs after financial restatements reveal prior misstatements or inaccuracies, triggering the recovery of excess performance fees paid to fund managers. A notable case study involves a private equity firm that returned $20 million in incentive fees after an earnings restatement reduced the fund's reported returns, highlighting the importance of accurate financial reporting in fee calculations. This enforcement mechanism ensures fairness by aligning management compensation with true investment performance, protecting investors from overpayment due to accounting errors.

Clawback Examples in Venture Capital Deals

In venture capital deals, a clawback provision ensures limited partners recover excess carried interest if the general partner receives more than their agreed-upon share of profits. For example, if a fund distributes carried interest prematurely but subsequent losses occur, the general partner must return the excess to maintain the correct profit share ratio. This mechanism protects investors by aligning general partners' incentives with long-term fund performance.

Legal Framework Governing Investment Clawbacks

Investment clawbacks are contractual provisions allowing investors or fund managers to recover previously distributed profits if certain conditions, such as underperformance or breaches of fiduciary duty, occur. The legal framework governing these clawbacks typically includes securities laws, fund agreements, and regulatory oversight by entities like the SEC, which ensures transparency and enforces compliance. Jurisdictional variations influence enforceability, highlighting the importance of detailed contractual clauses and adherence to fiduciary standards in private equity and hedge fund arrangements.

Impact of Clawbacks on Investor Protection

Clawbacks in investment agreements serve as critical mechanisms to enhance investor protection by ensuring fund managers return excess profits when performance targets are not met or in case of financial misstatements. These provisions mitigate risks of overcompensation and align the interests of general partners with limited partners, reducing moral hazard and promoting transparency. The presence of clawback clauses strengthens fiduciary responsibility and supports long-term capital preservation for investors.

High-Profile Clawback Cases in Mergers and Acquisitions

High-profile clawback cases in mergers and acquisitions often involve executives returning large bonuses or profits due to post-deal discoveries of financial misstatements or regulatory violations. For instance, the Pfizer and Wyeth merger saw significant clawback actions when due diligence uncovered accounting irregularities impacting the deal valuation. Such cases highlight the critical role of clawbacks in protecting investors and ensuring transactional integrity in complex financial agreements.

Future Trends: Evolving Use of Clawbacks in Investment Contracts

Clawback provisions in investment contracts are increasingly being tailored to address emerging risks such as ESG compliance and performance-based incentives. These evolving clauses allow investors to reclaim funds if portfolio companies fail to meet sustainability benchmarks or financial targets, reflecting a shift towards accountability and long-term value creation. Enhanced data analytics and blockchain technology are also enabling more transparent and enforceable clawback mechanisms in private equity and venture capital agreements.

example of clawback in investment Infographic

samplerz.com

samplerz.com