A green shoe option in an IPO is a provision that allows underwriters to sell additional shares, typically up to 15% more than the original offering size. This mechanism helps stabilize the stock price by enabling underwriters to buy back shares if demand falls below expectations. Companies like Facebook used the green shoe option during their 2012 IPO to manage investor demand and price volatility effectively. The green shoe option benefits both issuers and investors by providing flexibility in the offering process. Data shows that IPOs with a green shoe clause often experience reduced post-offering price swings and improved market liquidity. This provision is now a common feature in high-profile IPOs, reflecting its strategic importance in modern financial markets.

Table of Comparison

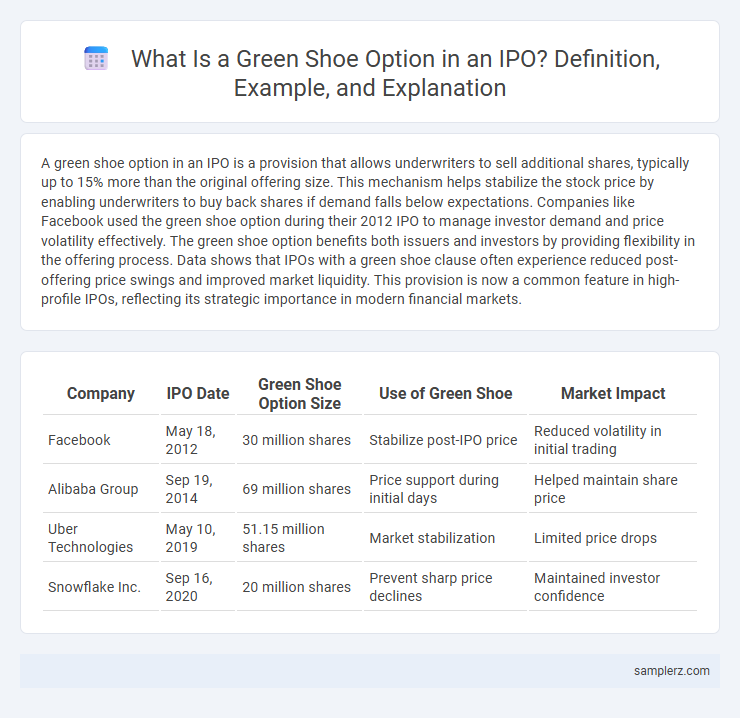

| Company | IPO Date | Green Shoe Option Size | Use of Green Shoe | Market Impact |

|---|---|---|---|---|

| May 18, 2012 | 30 million shares | Stabilize post-IPO price | Reduced volatility in initial trading | |

| Alibaba Group | Sep 19, 2014 | 69 million shares | Price support during initial days | Helped maintain share price |

| Uber Technologies | May 10, 2019 | 51.15 million shares | Market stabilization | Limited price drops |

| Snowflake Inc. | Sep 16, 2020 | 20 million shares | Prevent sharp price declines | Maintained investor confidence |

Understanding the Green Shoe Option in IPOs

The Green Shoe option in IPOs allows underwriters to sell additional shares, typically up to 15% more than the original offering size, to stabilize the stock price and meet excess demand. This overallotment feature helps prevent price volatility by enabling underwriters to buy back shares if the market price falls below the offering price. Recognizing the Green Shoe option's role is crucial for investors seeking to gauge IPO pricing dynamics and aftermarket support.

Historical Overview of Green Shoe Applications

The green shoe option, introduced during the 1960 IPO of the Ford Motor Company, serves as an over-allotment mechanism allowing underwriters to sell additional shares to stabilize price volatility. Historically, companies like Google and Facebook utilized green shoe clauses to manage aftermarket performance during their massive public offerings. This strategy has evolved into a standard practice, enhancing liquidity and investor confidence in IPOs across global financial markets.

Notable IPOs Utilizing the Green Shoe Option

Notable IPOs utilizing the green shoe option include Facebook's 2012 offering, which exercised the overallotment to stabilize shares amid high demand. Alibaba's 2014 IPO also deployed the green shoe to allow for increased share sales, boosting proceeds by $3 billion. Other significant examples include Snap Inc. and Uber, where the green shoe option provided underwriters flexibility to manage post-IPO price volatility.

Step-by-Step Example of Green Shoe Mechanism

The Green Shoe mechanism in an IPO allows underwriters to sell an additional 15% of shares if demand exceeds the original offering size, stabilizing prices post-launch. For instance, if a company issues 1 million shares, underwriters can sell up to 1.15 million shares by exercising the option within 30 days, helping manage price volatility. This step-by-step process starts with overallotment, followed by price stabilization through share purchases in the market, ensuring orderly trading and investor confidence.

How Green Shoe Benefits Issuers and Investors

The green shoe option in an IPO allows issuers to sell up to 15% additional shares, stabilizing the stock price by covering excess demand and reducing volatility post-listing. This mechanism benefits investors by minimizing price fluctuations and enhancing confidence in the market, leading to improved liquidity. Issuers gain the ability to raise extra capital while maintaining market stability, fostering long-term investor trust.

Case Study: Successful Use of Green Shoe in Recent IPO

The recent IPO of Rivian Automotive implemented a green shoe option to stabilize share price amid high demand, allowing underwriters to purchase up to 15% additional shares at the offering price. This mechanism helped reduce volatility and enhance investor confidence during the critical trading period post-IPO. The successful execution of the green shoe underscored its effectiveness in managing market risk and optimizing capital raise outcomes.

Impact of Green Shoe on Stock Price Stability

The green shoe option allows underwriters to sell additional shares, typically up to 15% more than the original offering, stabilizing stock price volatility during IPOs. By enabling market makers to buy back shares when prices fall below the offering price, the green shoe mechanism mitigates downward pressure and prevents sharp declines. Empirical data from IPOs using green shoe options demonstrate reduced post-listing price fluctuations and smoother market adjustments in early trading days.

Regulatory Framework for Green Shoe in Capital Markets

The regulatory framework for green shoe options in capital markets ensures the stabilization of IPO prices by permitting underwriters to sell additional shares, typically up to 15% of the offering size, within a specified timeframe post-IPO. Compliance with securities regulations, such as the SEC Rule 415 in the United States, mandates transparent disclosure requirements and strict adherence to overallotment provisions to prevent market manipulation. Effective implementation of these rules enhances market confidence and liquidity while protecting investor interests during the initial trading period.

Risks and Limitations of the Green Shoe Option

The green shoe option in an IPO carries risks such as potential market manipulation, where underwriters may artificially stabilize or inflate stock prices, leading to distorted market perception. Limitations include the fixed duration of the option, typically 30 days, restricting flexibility, and the risk that the overallotment shares cannot be sold if demand declines, potentially resulting in unsold inventory for underwriters. Uncertainty in post-IPO price performance can also exacerbate financial exposure for underwriters exercising the green shoe option.

Global Perspectives: Green Shoe Examples in International IPOs

International IPOs frequently implement green shoe options to stabilize post-offering prices and provide underwriters with price support during market volatility. Notable examples include Alibaba's 2014 New York IPO, where the green shoe option increased share allocation by 15% to meet high investor demand. Similarly, the 2019 Saudi Aramco IPO utilized an oversubscription mechanism akin to a green shoe option to enhance market stability in one of the world's largest public offerings.

example of green shoe in IPO Infographic

samplerz.com

samplerz.com