A Guaranteed Investment Certificate (GIC) is a low-risk financial product commonly offered by insurance companies as part of their investment portfolio. Insurance providers use GICs to offer policyholders a secure method to grow their savings with a fixed interest rate over a predetermined term. The principal amount invested in a GIC is protected, making it an attractive option for conservative investors seeking capital preservation. Insurance companies integrate GICs within their wealth management products to provide stability and predictable returns. These certificates are backed by the insurance provider or linked to government-backed securities, reducing the risk of loss. By including GICs, insurers help clients diversify their portfolios while ensuring a guaranteed return on investment for a specified period.

Table of Comparison

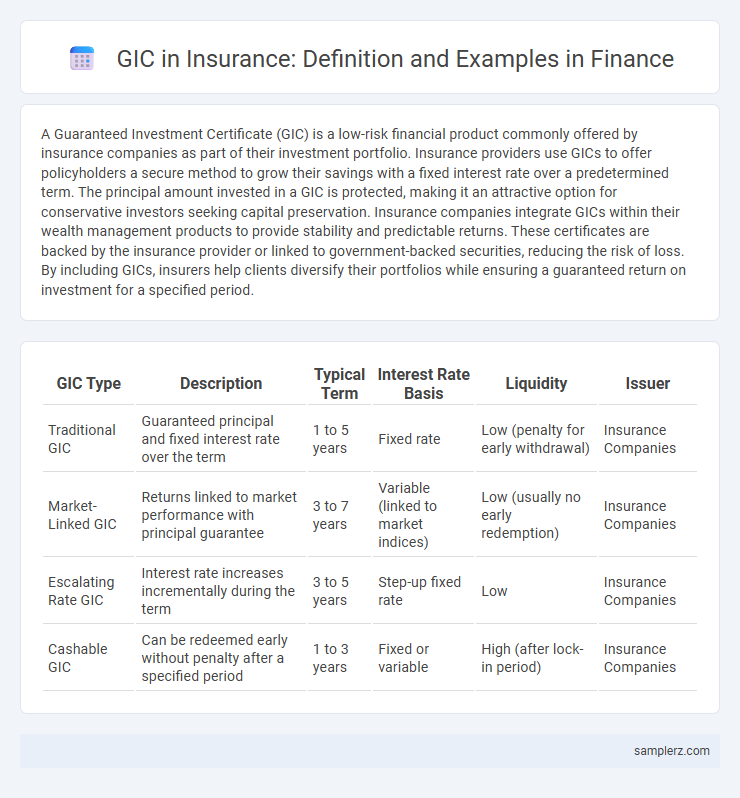

| GIC Type | Description | Typical Term | Interest Rate Basis | Liquidity | Issuer |

|---|---|---|---|---|---|

| Traditional GIC | Guaranteed principal and fixed interest rate over the term | 1 to 5 years | Fixed rate | Low (penalty for early withdrawal) | Insurance Companies |

| Market-Linked GIC | Returns linked to market performance with principal guarantee | 3 to 7 years | Variable (linked to market indices) | Low (usually no early redemption) | Insurance Companies |

| Escalating Rate GIC | Interest rate increases incrementally during the term | 3 to 5 years | Step-up fixed rate | Low | Insurance Companies |

| Cashable GIC | Can be redeemed early without penalty after a specified period | 1 to 3 years | Fixed or variable | High (after lock-in period) | Insurance Companies |

Understanding Guaranteed Investment Contracts (GIC) in Insurance

Guaranteed Investment Contracts (GICs) in insurance are fixed-income financial instruments providing a guaranteed rate of return over a specified period, typically used by insurance companies to manage liabilities and ensure stable cash flows. These contracts offer principal protection combined with interest payments, making them a reliable option for funding future policyholder obligations. GICs help insurers maintain solvency and meet long-term commitments by minimizing investment risk through predictable, contractually guaranteed returns.

Key Features of GICs for Policyholders

Guaranteed Investment Contracts (GICs) in insurance provide policyholders with principal protection, fixed interest rates, and predictable income streams over a specified term. They offer stability by insulating investments from market volatility, ensuring the return of the original investment amount upon maturity. Key features include guaranteed returns, low risk, and liquidity options aligned with the policyholder's financial goals and contract terms.

Types of GICs Offered by Insurance Companies

Insurance companies offer various types of Guaranteed Investment Certificates (GICs) including traditional fixed-rate GICs, market-linked GICs, and escalating-rate GICs. Traditional fixed-rate GICs provide a guaranteed interest rate for the term, while market-linked GICs offer returns tied to the performance of specific market indices, balancing growth potential with principal protection. Escalating-rate GICs feature increasing interest rates over time, catering to investors seeking progressively higher yields within a guaranteed framework.

Real-Life Example: How a GIC Works in an Insurance Policy

A Guaranteed Investment Certificate (GIC) in an insurance policy functions by providing a fixed return on premiums invested over a specified period, safeguarding the principal amount against market fluctuations. For example, a policyholder invests $50,000 in a GIC-backed insurance plan with a 3-year term and a guaranteed 2.5% annual interest rate, ensuring a minimum payout of $53,812.50 at maturity, which enhances the policy's cash value stability and supports long-term financial planning.

Comparing GICs with Other Insurance Investment Products

Guaranteed Investment Certificates (GICs) in insurance provide a fixed rate of return with principal protection, contrasting with products like variable annuities that expose investors to market risk for potentially higher gains. Unlike whole life or universal life policies that combine insurance with investment elements, GICs offer simplicity and capital preservation without the complexities of fees or fluctuating cash values. Comparing GICs with other insurance investment products highlights their suitability for conservative investors prioritizing stability over growth.

Benefits of Including GICs in Insurance Portfolios

Guaranteed Investment Certificates (GICs) in insurance portfolios provide predictable returns and principal protection, reducing overall investment risk. Their fixed interest rates enhance portfolio stability, making them ideal for matching liabilities and ensuring liquidity. Incorporating GICs supports risk management strategies and improves capital preservation within insurance asset allocations.

GIC Rates: What to Expect from Insurance Providers

Guaranteed Investment Certificates (GIC) rates offered by insurance providers typically range from 2% to 4% annually, depending on the term length and market conditions. Insurance companies often provide competitive GIC rates as part of their wealth management services, with longer terms generally yielding higher returns. Policyholders should review rate guarantees and early withdrawal penalties to maximize their investment benefits within insurance-backed GIC products.

Case Study: GIC Utilization in Retirement Planning

GICs (Guaranteed Investment Certificates) play a pivotal role in retirement planning by providing secure, fixed returns that help preserve retirees' capital while generating predictable income streams. In a case study involving a Canadian retiree portfolio, allocating 40% of funds to GICs ensured steady interest payments aligned with living expenses, reducing exposure to market volatility. This strategic utilization in insurance products enhances financial stability and complements more aggressive investments, safeguarding long-term retirement goals.

Risks and Considerations with Insurance GICs

Guaranteed Investment Certificates (GICs) in insurance present risks including interest rate fluctuations that can impact returns and inflation risk diminishing purchasing power over time. Policyholders should consider the issuer's creditworthiness and the potential penalties for early withdrawal from insurance GICs. Understanding liquidity constraints and tax implications is essential for optimizing insurance GIC investments.

Frequently Asked Questions About GICs in Insurance

Guaranteed Investment Certificates (GICs) in insurance offer a secure way to earn fixed returns, often used to back insurance policies or as part of annuity products. Common questions include the duration of GIC terms, interest rate guarantees, and the impact on insurance benefits if the GIC is cashed out early. Investors frequently ask about how GIC returns compare to other fixed-income options and the tax implications when GICs are held within insurance wrappers.

example of GIC in insurance Infographic

samplerz.com

samplerz.com