A drawdown in a hedge fund refers to the peak-to-trough decline in the fund's asset value during a specific period. For instance, if a hedge fund's net asset value (NAV) drops from $100 million to $75 million, this represents a 25% drawdown. This metric is crucial for investors to assess the risk and volatility associated with the fund's investment strategies. Hedge funds often experience drawdowns due to market fluctuations, leverage, or specific sector risks. A notable example is the Long-Term Capital Management (LTCM) fund, which faced a drawdown exceeding 90% during the 1998 financial crisis. Monitoring drawdowns helps fund managers adjust portfolios and implement risk management practices to protect investor capital.

Table of Comparison

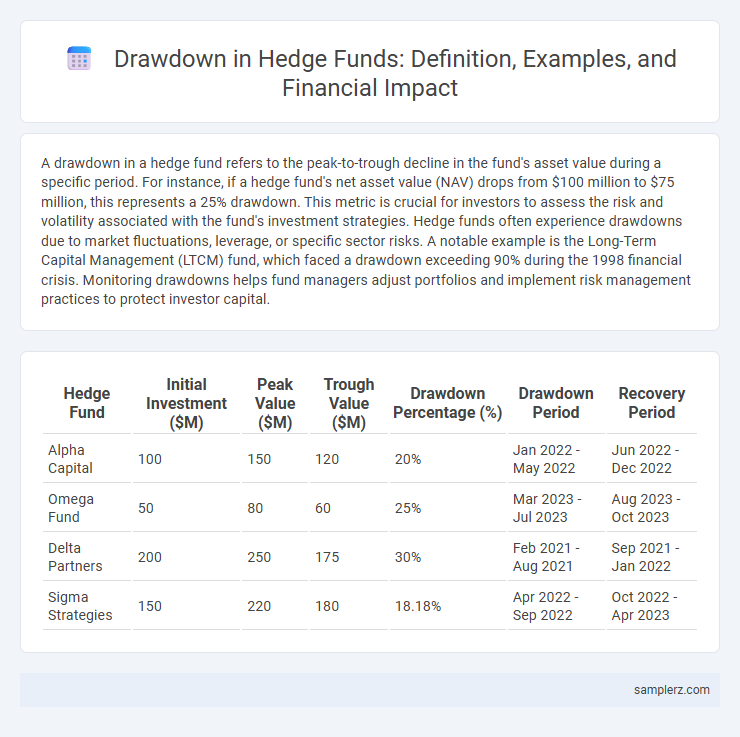

| Hedge Fund | Initial Investment ($M) | Peak Value ($M) | Trough Value ($M) | Drawdown Percentage (%) | Drawdown Period | Recovery Period |

|---|---|---|---|---|---|---|

| Alpha Capital | 100 | 150 | 120 | 20% | Jan 2022 - May 2022 | Jun 2022 - Dec 2022 |

| Omega Fund | 50 | 80 | 60 | 25% | Mar 2023 - Jul 2023 | Aug 2023 - Oct 2023 |

| Delta Partners | 200 | 250 | 175 | 30% | Feb 2021 - Aug 2021 | Sep 2021 - Jan 2022 |

| Sigma Strategies | 150 | 220 | 180 | 18.18% | Apr 2022 - Sep 2022 | Oct 2022 - Apr 2023 |

Defining Drawdown in Hedge Funds

Drawdown in hedge funds refers to the peak-to-trough decline in the fund's net asset value (NAV) before a new peak is achieved, measuring investment risk and capital loss magnitude. For example, a hedge fund that experiences a 20% drop from its highest NAV during a market downturn illustrates a significant drawdown impacting investor confidence and portfolio stability. Understanding drawdown helps in assessing the fund's risk management effectiveness and resilience during volatile market conditions.

Common Causes of Hedge Fund Drawdowns

Hedge fund drawdowns often result from market volatility, poor risk management, and excessive leverage. Common causes include sudden asset price declines due to geopolitical events, liquidity crunches, and errors in strategy execution. These factors cumulatively erode portfolio value, triggering significant investor losses and redemption pressures.

Historical Drawdown Events in Major Hedge Funds

The 2008 financial crisis caused significant drawdowns for major hedge funds, with Renaissance Technologies experiencing losses exceeding 20% in its flagship Medallion Fund. Tiger Global Management faced a drawdown of around 30% during the 2021 tech sector sell-off, reflecting exposure to overvalued growth stocks. Bridgewater Associates encountered a 15% drawdown amid the 2020 COVID-19 market turmoil, driven by unprecedented volatility and market uncertainty.

Case Study: The Long-Term Capital Management Collapse

The Long-Term Capital Management (LTCM) collapse in 1998 illustrates a significant hedge fund drawdown, where leveraged positions lost over 90% of their value within months. LTCM's overly aggressive arbitrage strategies amplified market volatility impacts, resulting in a $4.6 billion loss and triggering a federal bailout to stabilize financial markets. This case underscores the critical risk management failure linked to excessive leverage and insufficient liquidity in hedge fund portfolios.

Drawdown During the 2008 Financial Crisis

The 2008 financial crisis triggered significant drawdowns in hedge funds, with average losses reaching approximately 20-30% as global markets plummeted. Strategies such as long-short equity and credit arbitrage suffered severe capital erosion due to extreme market volatility and liquidity constraints. Many hedge funds faced prolonged recovery periods, highlighting the importance of robust risk management and diversification in turbulent economic environments.

Quantitative Hedge Funds and Sudden Drawdowns

Quantitative hedge funds often experience sudden drawdowns due to model mis-specification or rapid market regime shifts that disrupt statistical arbitrage strategies. A notable example occurred in August 2007 when several quantitative funds faced sharp losses as liquidity crises triggered abrupt price movements, causing drawdowns exceeding 10%. These sudden drawdowns highlight vulnerabilities in algorithmic trading models reliant on historical correlations and market stability assumptions.

How Leverage Amplifies Hedge Fund Drawdowns

Leverage magnifies hedge fund drawdowns by increasing exposure to market fluctuations beyond the initial investment, causing losses to escalate rapidly during downturns. For example, a hedge fund using 3:1 leverage on a $100 million portfolio can experience a $30 million loss from a mere 10% market decline, compared to a $10 million loss without leverage. This amplification effect heightens risk, necessitating rigorous risk management strategies to mitigate substantial capital erosion.

Risk Management Strategies to Limit Drawdown

Hedge funds implement risk management strategies such as stop-loss orders, dynamic asset allocation, and diversification across uncorrelated asset classes to limit drawdown periods. Utilizing volatility targeting and stress testing helps identify potential losses and adjust exposures before severe drawdowns occur. Effective drawdown control enhances capital preservation and improves long-term portfolio resilience in volatile markets.

Recovery Periods After Significant Drawdowns

Hedge funds often experience significant drawdowns, with recovery periods varying based on market conditions and management strategies. For example, during the 2008 financial crisis, some hedge funds faced drawdowns exceeding 30%, taking an average of 18 to 24 months to fully recover their losses. The length of the recovery period is influenced by factors such as asset allocation, risk management practices, and overall market volatility.

Lessons Learned from Notable Hedge Fund Drawdowns

Notable hedge fund drawdowns, such as the 2007 crisis experienced by Amaranth Advisors with losses exceeding $6 billion, highlight the critical importance of rigorous risk management and diversification strategies. Long-Term Capital Management's 1998 collapse, triggered by excessive leverage and exposure to Russian debt, underscores the dangers of relying on complex financial models without accounting for extreme market scenarios. These cases demonstrate that robust stress testing and transparent risk disclosure are essential to mitigate catastrophic losses in volatile markets.

example of drawdown in hedge fund Infographic

samplerz.com

samplerz.com