A dark pool is a private financial forum or exchange for trading securities not openly available on public stock exchanges. One prominent example of a dark pool in trading is the Liquidnet platform, which allows institutional investors to buy and sell large blocks of shares anonymously. This helps minimize market impact and reduces the chances of price slippage during significant transactions. Another example is the Goldman Sachs Sigma X platform, an electronic dark pool designed to facilitate large trades for institutional clients. Dark pools like Sigma X provide a venue where participants can transact without revealing their trade intentions to the public market. These platforms play a critical role in maintaining liquidity and confidentiality for large-scale investors in the financial ecosystem.

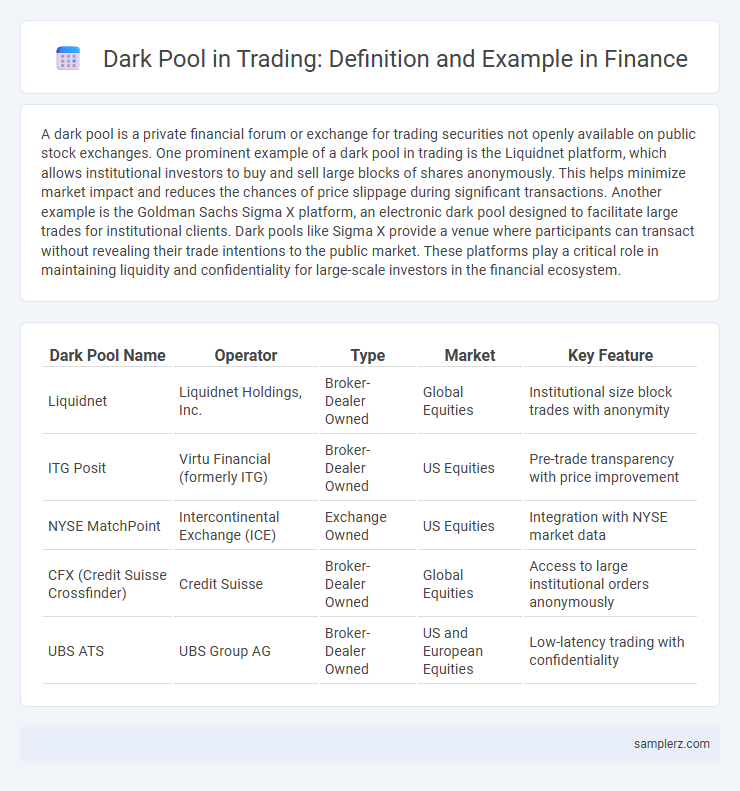

Table of Comparison

| Dark Pool Name | Operator | Type | Market | Key Feature |

|---|---|---|---|---|

| Liquidnet | Liquidnet Holdings, Inc. | Broker-Dealer Owned | Global Equities | Institutional size block trades with anonymity |

| ITG Posit | Virtu Financial (formerly ITG) | Broker-Dealer Owned | US Equities | Pre-trade transparency with price improvement |

| NYSE MatchPoint | Intercontinental Exchange (ICE) | Exchange Owned | US Equities | Integration with NYSE market data |

| CFX (Credit Suisse Crossfinder) | Credit Suisse | Broker-Dealer Owned | Global Equities | Access to large institutional orders anonymously |

| UBS ATS | UBS Group AG | Broker-Dealer Owned | US and European Equities | Low-latency trading with confidentiality |

Introduction to Dark Pools in Trading

Dark pools are private financial forums or exchanges for trading securities that allow investors to buy and sell large blocks of shares anonymously, minimizing market impact and price fluctuations. Major examples include Liquidnet, Credit Suisse Crossfinder, and Barclays LX, which facilitate institutional trading away from public exchanges like the NYSE or NASDAQ. These venues improve liquidity and reduce information leakage but often face criticism for reduced market transparency.

How Dark Pools Operate in Financial Markets

Dark pools operate as private, off-exchange trading venues where large institutional investors execute sizable orders anonymously to minimize market impact and price slippage. These alternative trading systems match buy and sell orders without displaying quotes on public exchanges, thus providing liquidity without influencing public market prices. By using sophisticated algorithms and maintaining confidentiality, dark pools enable efficient block trades while preserving anonymity and reducing transaction costs.

Major Dark Pool Venues: Key Examples

Major dark pool venues include Liquidnet, known for institutional equity trading with high liquidity and low market impact. Barclays LX offers advanced algorithmic trading solutions within its dark pool, facilitating large block trades discreetly. Credit Suisse Crossfinder provides a global platform connecting institutional investors to execute large orders anonymously, enhancing price discovery and reducing market impact.

Notable Dark Pool Trades and Their Impact

Notable dark pool trades include the acquisition of large blocks by institutional investors such as hedge funds and mutual funds, which can significantly affect market liquidity and price discovery. For example, trades executed in dark pools by firms like BlackRock and Citadel have impacted stock volatility and reduced market transparency. These transactions often lead to price inefficiencies in public exchanges due to delayed reporting and lower overall market participation.

Regulatory Overview of Dark Pools

Dark pools, private trading venues where large blocks of securities are bought and sold away from public exchanges, are subject to regulatory oversight by agencies such as the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Regulations focus on transparency requirements, trade reporting, and market fairness to prevent abuses like insider trading and market manipulation. The SEC's Regulation ATS mandates dark pools to register and comply with standardized reporting rules to ensure investor protection and market integrity.

Advantages of Using Dark Pools for Institutions

Dark pools offer institutional investors enhanced privacy by allowing large trades to be executed without immediate market impact, reducing price slippage. These private exchanges improve liquidity access and enable better price discovery for sizable transactions. By minimizing information leakage, dark pools help institutions achieve more efficient trade execution and lower transaction costs.

Risks and Criticisms Surrounding Dark Pools

Dark pools, private trading venues like Liquidnet and Credit Suisse's Crossfinder, face criticism for lack of transparency, as they shield large trades from public markets, potentially leading to price manipulation and reduced market quality. The opacity in these venues can increase counterparty risk, making it difficult for investors to assess true market liquidity and execution quality. Regulatory scrutiny intensifies due to concerns that dark pools may contribute to market fragmentation and undermine price discovery in traditional exchanges.

Dark Pool vs. Traditional Exchanges

Dark pools are private trading venues where institutional investors execute large orders anonymously to minimize market impact, contrasting with traditional exchanges like the NYSE or NASDAQ, which provide transparent order books and public price discovery. Dark pools enable discreet liquidity aggregation without revealing trade intentions, reducing price slippage typically experienced on lit markets. This anonymity can lead to less market transparency but offers strategic advantages for high-frequency traders and large asset managers seeking to optimize execution costs.

Case Studies: Dark Pool Trading Examples

Dark pool trading examples highlight instances such as the Barclays dark pool, which facilitated large block trades without revealing investor intentions to the public market, thereby reducing market impact and price slippage. Another case involves UBS's dark pool, where institutional investors executed substantial orders anonymously, enhancing confidentiality and execution speed. These case studies demonstrate how dark pools serve as private venues for high-volume trades, providing strategic advantages in equity markets.

Future Trends in Dark Pool Trading

Dark pools, such as Liquidnet and ITG Posit, continue to evolve through increased adoption of algorithmic trading tailored for large block orders, minimizing market impact and enhancing anonymity. The integration of artificial intelligence and machine learning is driving more sophisticated order execution strategies within these private exchanges, optimizing liquidity and price discovery. Future trends also indicate regulatory scrutiny intensifying to ensure transparency without compromising the benefits of dark pool trading for institutional investors.

example of dark pool in trading Infographic

samplerz.com

samplerz.com