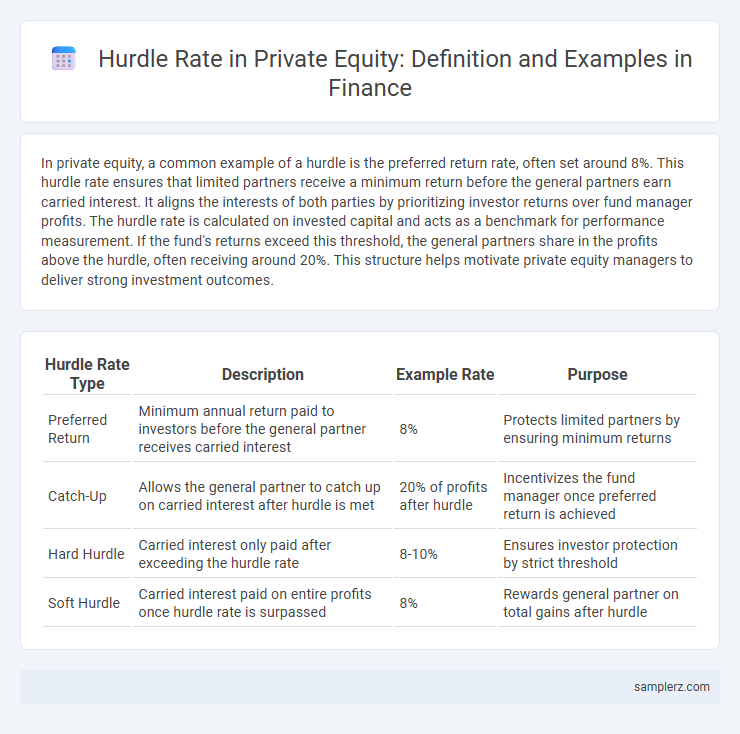

In private equity, a common example of a hurdle is the preferred return rate, often set around 8%. This hurdle rate ensures that limited partners receive a minimum return before the general partners earn carried interest. It aligns the interests of both parties by prioritizing investor returns over fund manager profits. The hurdle rate is calculated on invested capital and acts as a benchmark for performance measurement. If the fund's returns exceed this threshold, the general partners share in the profits above the hurdle, often receiving around 20%. This structure helps motivate private equity managers to deliver strong investment outcomes.

Table of Comparison

| Hurdle Rate Type | Description | Example Rate | Purpose |

|---|---|---|---|

| Preferred Return | Minimum annual return paid to investors before the general partner receives carried interest | 8% | Protects limited partners by ensuring minimum returns |

| Catch-Up | Allows the general partner to catch up on carried interest after hurdle is met | 20% of profits after hurdle | Incentivizes the fund manager once preferred return is achieved |

| Hard Hurdle | Carried interest only paid after exceeding the hurdle rate | 8-10% | Ensures investor protection by strict threshold |

| Soft Hurdle | Carried interest paid on entire profits once hurdle rate is surpassed | 8% | Rewards general partner on total gains after hurdle |

Common Hurdles in Private Equity Investments

Common hurdles in private equity investments typically include achieving a preferred return rate, often around 8%, before general partners receive carried interest. These hurdles serve as performance benchmarks that align incentives between investors and fund managers. Failure to meet these rates can delay or reduce profit distributions, impacting overall investment returns.

Regulatory Barriers Facing Private Equity Firms

Regulatory barriers such as stringent compliance requirements and increased reporting obligations significantly impact private equity firms by limiting investment flexibility and increasing operational costs. Complex cross-border regulations often result in lengthy approval processes, delaying deal closures and reducing returns. These hurdles necessitate robust legal strategies and may deter participation in certain high-potential markets, affecting overall portfolio diversification.

Due Diligence Challenges in Private Equity Deals

Due diligence challenges in private equity deals often arise from incomplete financial data and undisclosed liabilities, complicating accurate valuation. Assessing operational risks and verifying the target company's compliance with regulatory requirements requires extensive analysis, which can delay deal closure. These hurdles increase the complexity of structuring transactions and negotiating terms to protect investor interests.

Fundraising Difficulties for New Private Equity Funds

New private equity funds often face significant fundraising difficulties due to intense competition and limited track records, making it challenging to attract institutional investors. The hurdle rate, which sets the minimum return required before managers receive carried interest, adds pressure to demonstrate strong potential returns. Regulatory scrutiny and shifting market conditions further complicate the fundraising process, increasing the risk of undercapitalization.

Valuation Issues in Private Equity Transactions

Valuation issues in private equity transactions often arise from the lack of transparent market prices for portfolio companies, leading to challenges in accurately assessing their fair value. Subjective assumptions in discounted cash flow models and inconsistent application of valuation multiples can create discrepancies that affect investment decisions and performance reporting. These hurdles complicate due diligence processes and may result in disputes between parties over pricing and deal terms.

Portfolio Company Management Hurdles

Portfolio company management hurdles in private equity often include misalignment of strategic goals between investors and management teams, leading to execution delays. Operational inefficiencies and lack of talent acquisition can impede value creation and scalability within portfolio companies. These challenges require targeted interventions to optimize performance and maximize investor returns.

Exit Strategy Complications in Private Equity

Exit strategy complications in private equity often arise from market volatility affecting timing and valuation, leading to challenges in achieving target returns. Limited secondary market liquidity can delay or reduce opportunities for portfolio company sales, impacting fund performance. Regulatory changes and geopolitical risks further complicate exit routes, increasing uncertainty for investors and sponsors.

Financing Constraints in Private Equity Acquisitions

Financing constraints in private equity acquisitions often manifest as limited access to affordable debt capital, which restricts the scale and timing of leveraged buyouts. These constraints arise from stringent lender requirements, including high collateral valuations and robust cash flow projections, making it challenging for private equity firms to secure necessary financing. Overcoming these barriers requires strategic capital structuring and leveraging relationships with alternative financing sources.

Market Volatility: Impact on Private Equity Performance

Market volatility significantly affects private equity performance by altering asset valuations and investment exit opportunities. Sudden market fluctuations can delay exit timing, reducing returns and increasing the risk profile of portfolio companies. Investors often implement risk management strategies to mitigate the impact of volatile market conditions on fund performance.

Limited Partner Expectations and Pressure Points

Limited Partners (LPs) often set a hurdle rate, commonly around 8%, as a minimum Internal Rate of Return (IRR) before General Partners (GPs) can earn carried interest. LPs' expectations include consistent capital preservation and alignment with fund lifecycle timelines, exerting pressure on GPs to prioritize risk management and timely exits. Failure to meet hurdle rates can lead to LP dissatisfaction, impacting future fundraising capabilities and partnership longevity.

example of hurdle in private equity Infographic

samplerz.com

samplerz.com