A margin call occurs when the value of an investor's margin account falls below the broker's required maintenance level. For example, if an investor buys 100 shares of stock on margin at $50 per share with a 50% initial margin, they need to maintain a minimum equity level, often 25%, in the account. If the stock price drops to $30, the account equity may fall below the maintenance margin, triggering a margin call from the broker. In this situation, the investor must either deposit additional funds or sell some securities to restore the required margin. Failure to meet the margin call can lead to forced liquidation of positions by the broker to cover the deficit. Margin calls safeguard brokers by reducing credit risk linked to leveraged trading positions in volatile markets.

Table of Comparison

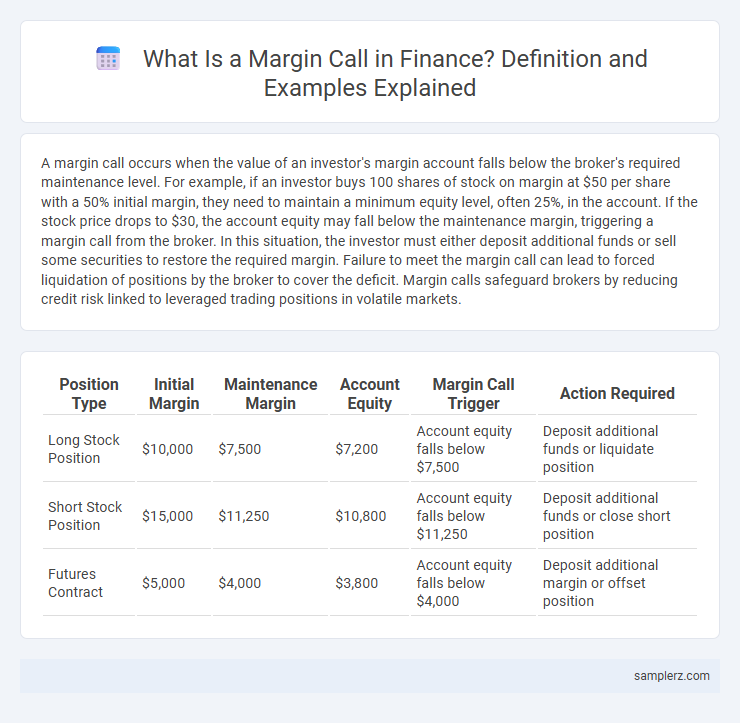

| Position Type | Initial Margin | Maintenance Margin | Account Equity | Margin Call Trigger | Action Required |

|---|---|---|---|---|---|

| Long Stock Position | $10,000 | $7,500 | $7,200 | Account equity falls below $7,500 | Deposit additional funds or liquidate position |

| Short Stock Position | $15,000 | $11,250 | $10,800 | Account equity falls below $11,250 | Deposit additional funds or close short position |

| Futures Contract | $5,000 | $4,000 | $3,800 | Account equity falls below $4,000 | Deposit additional margin or offset position |

Understanding Margin Calls: Key Concepts

A margin call occurs when the equity in a trader's margin account falls below the broker's required maintenance margin, prompting the trader to deposit additional funds or liquidate positions to cover losses. For instance, if an investor buys stock on 50% margin and the stock price drops significantly, the broker may issue a margin call to restore the account balance to the minimum maintenance level. Understanding margin calls involves recognizing the risks of leveraged positions and maintaining sufficient collateral to avoid forced liquidation.

Real-Life Margin Call Scenarios

A trader holding a leveraged long position in crude oil futures faces a margin call when the price drops 10% overnight, triggering a sharp decline in account equity below the maintenance margin requirement set by the broker. This scenario forces the trader to either deposit additional funds immediately or liquidate part of the position to cover losses and avoid forced closure by the brokerage. Real-life margin call events like these highlight the risks in volatile markets and underscore the importance of monitoring margin levels continuously.

Step-by-Step Breakdown of a Margin Call Event

A margin call occurs when an investor's equity falls below the broker's required maintenance margin, prompting a demand for additional funds. For example, if an investor buys $10,000 worth of stock with $5,000 borrowed on margin and the stock price drops 20%, their equity decreases to $3,000, triggering a margin call if the maintenance margin requirement is 30%. The investor must either deposit extra capital or sell assets to restore the required equity level and avoid forced liquidation by the broker.

Impact of Leverage on Margin Calls

High leverage amplifies both potential gains and losses in a trading position, increasing the likelihood of a margin call when market movements move against the investor. For instance, with a 10:1 leverage, a mere 10% drop in asset value can trigger a margin call, forcing the trader to deposit additional funds or liquidate positions to meet margin requirements. This heightened risk underscores the critical impact of leverage on margin calls and the necessity of prudent risk management in leveraged trading.

Example: Margin Call in Stock Trading

A margin call occurs when the equity in a trader's account falls below the broker's required maintenance margin, prompting the trader to deposit additional funds or liquidate positions to cover losses. For example, if an investor buys $10,000 worth of stock on 50% margin and the stock value drops to $7,000, the equity reduces to $2,000, triggering a margin call if the maintenance margin is set at 30%. Failure to meet the margin call results in forced selling of securities to restore the minimum equity level.

Example: Margin Call in Forex Trading

A margin call in forex trading occurs when the account's equity falls below the required maintenance margin due to adverse price movements. For example, if a trader opens a $100,000 position with 1% margin ($1,000), and the market moves against their position reducing their equity to $900, the broker issues a margin call requiring additional funds to maintain the trade. Failure to meet the margin call can lead to automatic position liquidation to prevent further losses.

How Brokers Notify Investors During a Margin Call

During a margin call, brokers notify investors primarily through email alerts, phone calls, and notifications on their trading platforms to ensure timely communication. These notifications specify the required additional funds or securities needed to maintain the minimum margin level. Clear and prompt alerts help investors manage their positions and avoid forced liquidation due to insufficient margin.

Financial Consequences of Ignoring Margin Calls

Ignoring margin calls in trading positions leads to forced liquidation of assets, resulting in significant losses that can exceed the initial investment. Brokers typically sell securities without client consent to cover the margin deficit, which can trigger a debt obligation if the proceeds fall short. Failure to address margin calls promptly also damages credit standing and may restrict future borrowing capacity.

Tips to Avoid Margin Calls in Your Portfolio

Maintaining a diversified portfolio and monitoring leverage ratios regularly helps prevent margin calls by reducing exposure to volatile assets and ensuring sufficient equity cushion. Setting stop-loss orders and keeping cash reserves readily available enables quick responses to adverse market movements without breaching margin requirements. Using risk management tools like portfolio stress tests and staying informed on market trends further safeguards against sudden margin calls in leveraged positions.

Lessons Learned from Notable Margin Call Cases

One notable margin call case involved the collapse of LTCM in 1998, where excessive leverage and market volatility led to a liquidity crisis, highlighting the critical importance of risk management and liquidity buffers. The Archegos Capital collapse in 2021 exemplified the risks of high leverage and concentrated positions, teaching that transparency and diversification are essential to avoiding catastrophic margin calls. These cases underscore the need for robust monitoring systems and prudent leverage limits to mitigate the risk of forced asset liquidations and significant financial losses.

example of margin call in position Infographic

samplerz.com

samplerz.com