In finance, a swingline is a short-term borrowing facility within a revolving credit agreement, allowing a borrower to access immediate cash up to a set limit. This feature is designed for urgent working capital needs or to cover temporary cash flow gaps. For example, a company with a $10 million revolving credit line might have a $1 million swingline sub-limit enabling quick, small loans without lengthy approval processes. Swingline loans often carry shorter maturities, usually repayable within 30 days, and are typically unsecured or lightly secured. The lender provides this facility to enhance liquidity and flexibility for the borrower's day-to-day operations. Data from revolving credit agreements highlight that swinglines improve a firm's ability to manage short-term obligations efficiently while maintaining access to larger credit amounts for long-term needs.

Table of Comparison

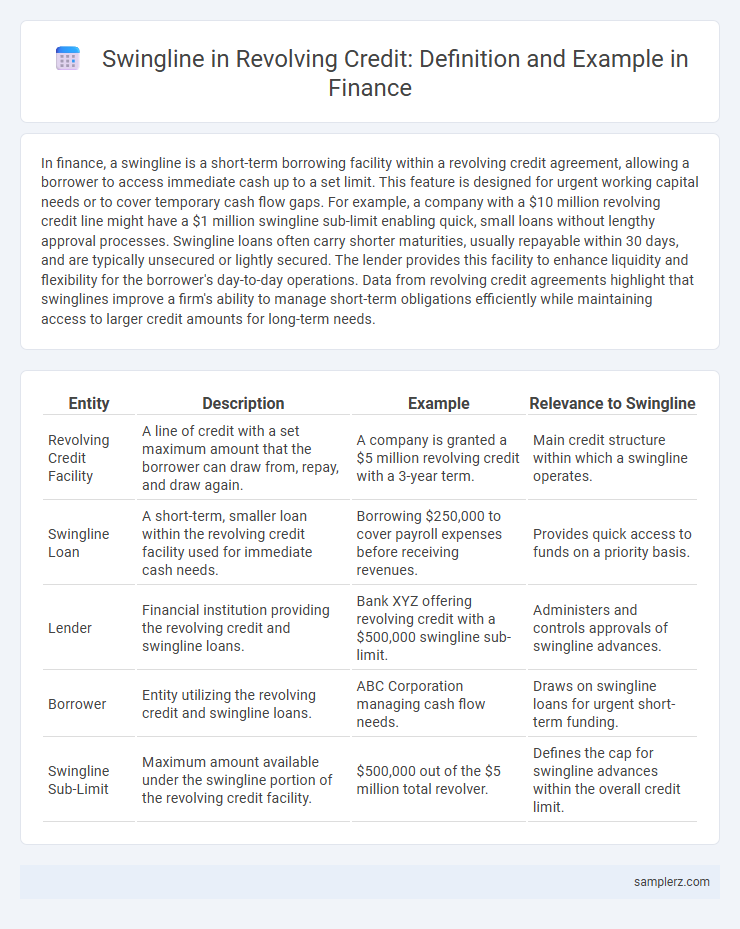

| Entity | Description | Example | Relevance to Swingline |

|---|---|---|---|

| Revolving Credit Facility | A line of credit with a set maximum amount that the borrower can draw from, repay, and draw again. | A company is granted a $5 million revolving credit with a 3-year term. | Main credit structure within which a swingline operates. |

| Swingline Loan | A short-term, smaller loan within the revolving credit facility used for immediate cash needs. | Borrowing $250,000 to cover payroll expenses before receiving revenues. | Provides quick access to funds on a priority basis. |

| Lender | Financial institution providing the revolving credit and swingline loans. | Bank XYZ offering revolving credit with a $500,000 swingline sub-limit. | Administers and controls approvals of swingline advances. |

| Borrower | Entity utilizing the revolving credit and swingline loans. | ABC Corporation managing cash flow needs. | Draws on swingline loans for urgent short-term funding. |

| Swingline Sub-Limit | Maximum amount available under the swingline portion of the revolving credit facility. | $500,000 out of the $5 million total revolver. | Defines the cap for swingline advances within the overall credit limit. |

Introduction to Swingline Features in Revolving Credit

Swingline facilities in revolving credit provide borrowers with short-term, high-speed access to funds within the overall credit limit, enabling quick liquidity for urgent cash flow needs. These features typically include a lower borrowing limit than the main revolving credit line and shorter maturity periods, often with automatic renewals to maintain continuous availability. Financial institutions use swinglines to enhance flexibility and operational efficiency for corporate clients managing fluctuating working capital requirements.

Understanding the Purpose of Swingline Loans

Swingline loans in revolving credit provide borrowers with quick access to short-term funds, enabling immediate liquidity for working capital needs or unexpected expenses. These loans typically have a higher priority in the borrowing base hierarchy, ensuring faster approval and disbursement compared to standard revolving credit advances. By offering a flexible, rapid financing option, swingline loans help businesses maintain operational continuity without disrupting their overall credit structure.

Key Components of a Swingline Facility

A swingline facility within a revolving credit agreement typically includes a maximum borrowing limit, short-term maturity often ranging from one to 30 days, and rapid availability to address immediate cash flow needs. Key components also involve specific interest rates, borrowing eligibility criteria, and repayment terms that enable swift access without extensive approval processes. These features collectively ensure liquidity flexibility while maintaining control over credit exposure for both lenders and borrowers.

How Swingline Works Within Revolving Credit

A swingline loan operates as a short-term borrowing option within a revolving credit facility, allowing borrowers to access funds quickly for immediate needs. It provides a flexible, smaller credit line with faster approval compared to the main revolving credit, often used to manage daily cash flow fluctuations. Swingline loans are typically repaid promptly, ensuring the overall revolving credit remains available for larger or longer-term financing requirements.

Real-World Example: Swingline Usage Scenario

A common real-world example of swingline usage in revolving credit is a corporation managing daily cash flow fluctuations by drawing short-term advances under the swingline facility to cover payroll or urgent vendor payments. This quick access to funds complements the broader revolving credit line, enabling businesses to maintain liquidity without initiating a formal loan drawdown. Swingline loans typically have shorter terms and smaller limits, optimizing operational flexibility in financial management.

Transaction Flow of Swingline Advances

Swingline advances in revolving credit facilities provide immediate, short-term liquidity by allowing borrowers to draw funds up to a specified sublimit without the typical approval delays. Transactions flow efficiently as borrowers request a swingline advance, the lender disburses the funds instantly, and repayments are applied directly to reduce the outstanding swingline balance before reverting to the broader revolving credit availability. This streamlined process supports operational cash flow needs and helps manage working capital through quick access to capital within the overall credit agreement.

Differences Between Swingline Loans and Standard Revolvers

Swingline loans within revolving credit facilities offer borrowers quick-access, short-term financing typically capped at a smaller amount compared to standard revolvers, which provide broader, longer-term borrowing capacity with flexible drawdowns. Unlike standard revolvers that allow multiple draw and repayment cycles over the facility term, swingline loans are designed for immediate liquidity needs and often have stricter refinancing or repayment terms. The distinct role of swingline loans in managing short-term cash flow contrasts with the comprehensive financing solution standard revolvers deliver for ongoing working capital requirements.

Risk Considerations for Lenders and Borrowers

Swingline loans in revolving credit increase liquidity but introduce heightened default risk due to their short-term, high-demand nature. Lenders must implement strict covenants and monitoring to mitigate exposure to borrower overextension and potential liquidity crunches. Borrowers should balance usage to avoid excessive reliance that could lead to financial strain during market volatility.

Documentation and Legal Aspects of Swingline Facilities

Swingline facilities in revolving credit agreements require precise documentation outlining the lender's rights to provide short-term loans within the credit line, often characterized by higher priority repayment terms. Legal provisions typically specify borrowing limits, availability conditions, and mandatory repayment schedules to ensure compliance and minimize default risk. Detailed covenants and representations in the credit agreement safeguard both parties by clearly defining the scope and execution of swingline advances.

Benefits of Integrating Swingline into Credit Agreements

Integrating a swingline facility into revolving credit agreements provides immediate access to short-term liquidity, enhancing a company's cash flow management by allowing quick, small-dollar borrowings without lengthy approval processes. This feature helps businesses efficiently address unforeseen expenses or working capital needs, reducing reliance on external emergency funding sources. Lenders benefit from improved risk management through structured loan terms and increased fee income from swingline usage within the overall credit framework.

example of swingline in revolving credit Infographic

samplerz.com

samplerz.com