Mezzanine financing in corporate finance is a hybrid form of capital that combines debt and equity features, often used to fund expansion or acquisitions. This type of financing provides companies with access to capital without diluting ownership excessively, as mezzanine lenders receive repayment with interest and may also obtain equity warrants. An example is a private equity firm providing mezzanine debt to a mid-sized company seeking to acquire a smaller competitor, where the firm receives interest payments plus a potential equity stake. Companies typically use mezzanine financing when traditional loans are insufficient or too restrictive, balancing risk and return for both borrower and lender. The data surrounding mezzanine deals often includes interest rates higher than senior debt, maturity periods ranging from 5 to 7 years, and potential conversion to equity upon default. This financing strategy allows businesses to leverage growth opportunities while managing capital structure efficiently.

Table of Comparison

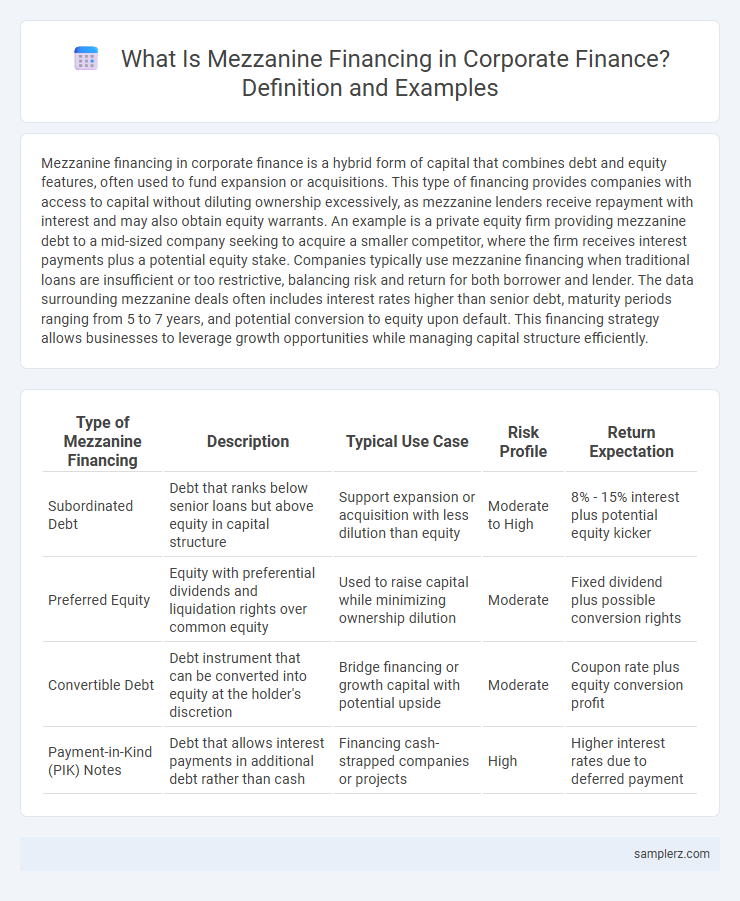

| Type of Mezzanine Financing | Description | Typical Use Case | Risk Profile | Return Expectation |

|---|---|---|---|---|

| Subordinated Debt | Debt that ranks below senior loans but above equity in capital structure | Support expansion or acquisition with less dilution than equity | Moderate to High | 8% - 15% interest plus potential equity kicker |

| Preferred Equity | Equity with preferential dividends and liquidation rights over common equity | Used to raise capital while minimizing ownership dilution | Moderate | Fixed dividend plus possible conversion rights |

| Convertible Debt | Debt instrument that can be converted into equity at the holder's discretion | Bridge financing or growth capital with potential upside | Moderate | Coupon rate plus equity conversion profit |

| Payment-in-Kind (PIK) Notes | Debt that allows interest payments in additional debt rather than cash | Financing cash-strapped companies or projects | High | Higher interest rates due to deferred payment |

Understanding Mezzanine Financing in Corporate Finance

Mezzanine financing in corporate finance typically involves a hybrid of debt and equity, often used by companies to fund expansion without diluting existing shareholders immediately. An example includes a middle-market company raising $10 million through mezzanine debt with warrants, providing lenders an option to convert debt to equity if the company meets performance targets. This financing tier bridges the gap between senior debt and equity, offering higher returns to investors due to its subordinated risk position.

Key Features of Mezzanine Debt

Mezzanine debt in corporate finance typically features subordinated claims that rank below senior debt but above equity, often secured by the company's assets or equity interests. It commonly includes warrants or options to enhance returns, providing lenders with potential equity upside alongside fixed interest payments. This form of financing is flexible, combining features of debt and equity, which allows companies to raise capital for expansion or acquisition without diluting ownership immediately.

Mezzanine Financing Structure: How It Works

Mezzanine financing in corporate finance typically involves subordinated debt that sits between senior debt and equity in the capital structure, often including warrants or convertible options to enhance returns. This structure provides companies with flexible capital, combining debt-like interest payments with equity-like upside potential for investors. Mezzanine financing is commonly used during expansion stages or leveraged buyouts to bridge the gap between senior loans and equity without diluting ownership significantly.

Real-World Examples of Mezzanine Financing

Mezzanine financing plays a crucial role in corporate acquisitions, often bridging the gap between senior debt and equity, as seen in the $2.5 billion leveraged buyout of Dell by Silver Lake Partners, which utilized mezzanine debt to optimize the capital structure. Another prominent example is the mezzanine financing used in the acquisition of Toys "R" Us by a consortium of private equity firms, providing flexible subordinated debt that enhanced deal viability without diluting equity ownership significantly. In the renewable energy sector, companies like NextEra Energy have incorporated mezzanine debt solutions to fund large-scale projects, balancing risk and return while minimizing the cost of capital.

Mezzanine Financing vs Senior Debt: Key Differences

Mezzanine financing typically involves subordinated debt or preferred equity positioned between senior debt and common equity in a company's capital structure, offering higher returns due to increased risk compared to senior debt. Senior debt is secured by collateral and has priority in repayment during liquidation, often carrying lower interest rates and stricter covenants. Mezzanine financing provides flexible capital solutions without immediate dilution of ownership, while senior debt emphasizes lower risk and cost with more stringent repayment terms.

Benefits of Mezzanine Financing for Corporations

Mezzanine financing provides corporations with flexible capital that bridges the gap between equity and senior debt, often including equity warrants or options to enhance returns for investors. This form of financing allows companies to access substantial funds without diluting ownership significantly, supporting growth initiatives such as acquisitions or expansions. Its subordinated position in the capital structure offers lenders higher yields, aligning risk and reward while strengthening the company's balance sheet.

Risks and Considerations in Mezzanine Financing

Mezzanine financing in corporate finance carries significant risks including high interest rates and potential dilution of equity for existing shareholders. Lenders often require warrants or options, increasing the cost of capital and impacting control. Companies must carefully assess cash flow stability to ensure they can meet the subordinated debt obligations without jeopardizing senior debt covenants.

Mezzanine Financing in Leveraged Buyouts (LBOs)

Mezzanine financing in leveraged buyouts (LBOs) provides a hybrid capital structure combining debt and equity features, typically filling the gap between senior debt and equity. This form of financing offers higher returns to investors through interest payments and equity warrants or options, allowing companies to raise additional capital without significant dilution of ownership. It enhances the overall leverage capacity, enabling firms to execute larger acquisitions while managing risk and preserving cash flow.

Case Study: Successful Use of Mezzanine Financing

In 2018, XYZ Corporation secured $50 million in mezzanine financing to support its $200 million acquisition of a competitor, blending debt and equity features to optimize capital structure. The mezzanine loan carried interest rates between 12-15%, coupled with equity warrants, enabling lenders to benefit from the company's future growth without immediate dilution of ownership. This strategic use of mezzanine financing facilitated a leveraged buyout while preserving cash flow and minimizing equity dilution, ultimately enhancing XYZ's competitive position in the market.

Choosing the Right Mezzanine Financing Partner

Selecting the right mezzanine financing partner involves evaluating firms with proven expertise in structured debt and equity hybrid instruments tailored for growth-stage companies. Key factors include the partner's track record in successful capital raises, flexible deal structures, and strategic value-added resources beyond capital infusion. Aligning interests with partners experienced in your specific industry sector maximizes the potential for scalable financing solutions and long-term business expansion.

example of mezzanine in corporate finance Infographic

samplerz.com

samplerz.com