Mortality credit in annuities refers to the financial gain that results from pooling longevity risk among annuity holders. When some individuals in the pool die earlier than expected, their unused funds are redistributed to surviving members, increasing the payout for those who live longer. This mechanism enhances the overall return for annuity investors by leveraging the statistical likelihood of mortality. An example of mortality credit occurs in a fixed immediate life annuity, where a retiree pays a lump sum to an insurer in exchange for guaranteed lifetime payments. As some annuitants pass away sooner than projected, their remaining funds boost the monthly income of the survivors. This mortality credit offsets inflation and market risks, ensuring income stability despite uncertain lifespan outcomes.

Table of Comparison

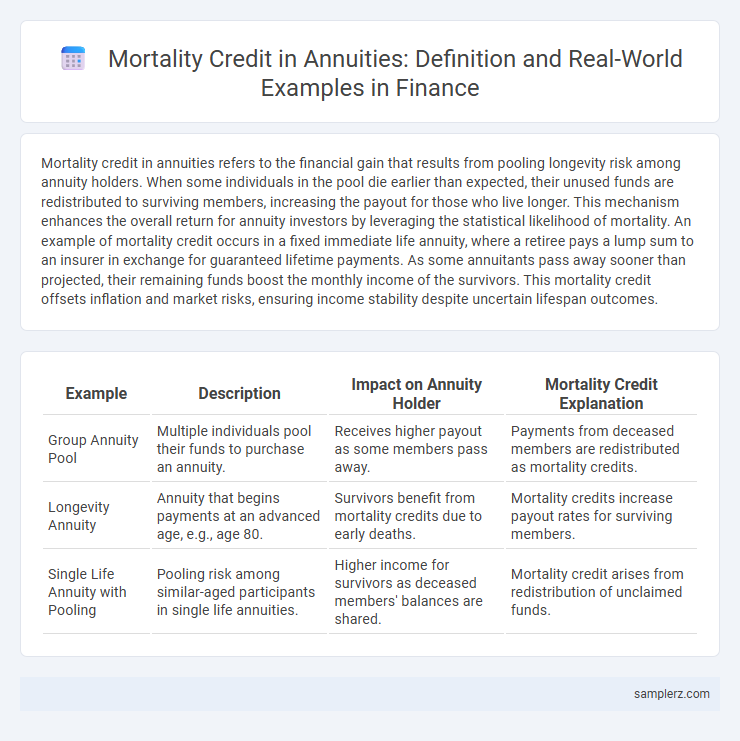

| Example | Description | Impact on Annuity Holder | Mortality Credit Explanation |

|---|---|---|---|

| Group Annuity Pool | Multiple individuals pool their funds to purchase an annuity. | Receives higher payout as some members pass away. | Payments from deceased members are redistributed as mortality credits. |

| Longevity Annuity | Annuity that begins payments at an advanced age, e.g., age 80. | Survivors benefit from mortality credits due to early deaths. | Mortality credits increase payout rates for surviving members. |

| Single Life Annuity with Pooling | Pooling risk among similar-aged participants in single life annuities. | Higher income for survivors as deceased members' balances are shared. | Mortality credit arises from redistribution of unclaimed funds. |

Introduction to Mortality Credits in Annuities

Mortality credits in annuities represent the financial gains shared among surviving annuitants, arising from the pooled funds of those who have passed away. This mechanism enhances the income streams for survivors by redistributing unclaimed benefits based on actuarial life expectancy. Understanding mortality credits is crucial for evaluating the true value and sustainability of lifetime income annuities in retirement planning.

Understanding the Concept of Mortality Credit

Mortality credit in annuities refers to the financial gain that arises when a portion of the payments intended for deceased annuitants is redistributed among surviving policyholders, enhancing their returns. This mechanism leverages pooled longevity risk, allowing annuities to provide higher periodic payments compared to individual life expectancy projections. Understanding mortality credit is crucial for investors seeking stable income streams, as it directly impacts the annuity's payout structure and overall value.

How Mortality Credits Enhance Annuity Returns

Mortality credits increase annuity returns by pooling longevity risk among participants, allowing those who live longer to benefit from the payments of those who pass away earlier. These credits effectively boost the expected income beyond the initial premium by redistributing funds from deceased members to survivors. This mechanism improves the overall yield of lifetime annuities, making them a valuable tool for retirement income planning.

Real-Life Example of Mortality Credit in Action

Mortality credit in annuities is exemplified when a 65-year-old retiree purchases a fixed immediate annuity, receiving higher monthly payments because some annuitants will not live as long as expected. For instance, if the average life expectancy is 85, but a portion of the pool passes away earlier, their unused funds are redistributed as mortality credits to surviving annuitants, boosting their income. This mechanism enhances retirement income security by leveraging pooled longevity risk in pension finance.

Mortality Credit vs. Investment Returns

Mortality credit in annuities represents the financial benefit received when insured individuals live shorter than expected, allowing insurers to redistribute those funds to surviving annuitants, which can enhance payout stability beyond standard investment returns. Unlike traditional investment income, mortality credit is a unique risk-sharing mechanism that can increase the effective yield of an annuity by pooling longevity risk among participants. This feature makes mortality credits a crucial component in the overall return profile of life annuities, distinguishing them from purely investment-driven products.

Annuity Payouts: The Role of Mortality Credits

Mortality credits significantly enhance annuity payouts by redistributing funds from deceased participants to survivors, increasing the income stream over time. This risk pooling mechanism allows annuity providers to offer higher guaranteed payments compared to self-managed withdrawals. Mortality credits play a critical role in maximizing retirement income sustainability and financial security for annuitants.

Impact of Longevity Risk on Mortality Credits

Mortality credits in annuities arise from the pooled longevity risk among participants, where individuals who live longer receive greater payouts funded by those with shorter lifespans. Longevity risk, the uncertainty of individual life spans exceeding actuarial expectations, directly impacts mortality credits by reducing the pool of mortality gains available to survivors. As life expectancy increases, insurers face higher payout obligations, diminishing the size of mortality credits and affecting the overall sustainability of annuity pricing models.

Mortality Credits in Immediate vs. Deferred Annuities

Mortality credits in immediate annuities provide enhanced income by redistributing funds from deceased participants to survivors, resulting in higher monthly payouts. Deferred annuities accumulate mortality credits over the deferral period, boosting the eventual payout by allowing the pool of participants to decrease before payments begin. Understanding the dynamics of mortality credits helps investors optimize income streams based on the timing of annuity commencement and longevity expectations.

Benefits of Mortality Credits for Retirees

Mortality credits in annuities increase payout amounts as some participants pass away, effectively redistributing their share to surviving retirees. This mechanism enhances income stability and purchasing power, providing a reliable hedge against longevity risk. Retirees benefit by receiving higher, sustainable payments throughout their lifetime, improving financial security during retirement.

Key Considerations When Evaluating Mortality Credit Potential

Mortality credit in annuities arises as insurers pool longevity risk, allowing survivors to receive higher payouts funded by those who pass away earlier than expected. Key considerations when evaluating mortality credit potential include the insured population's mortality assumptions, policyholder behavior such as lapse and withdrawal rates, and the accuracy of mortality tables used in pricing. Assessing the variability in mortality experience and its impact on cash flows is essential for accurately estimating the embedded mortality credit value.

example of mortality credit in annuity Infographic

samplerz.com

samplerz.com