A tranche in securitization refers to a portion of pooled assets segmented based on risk and return profiles. For example, a mortgage-backed security might be divided into senior, mezzanine, and junior tranches, each offering different credit ratings and interest rates. Investors select tranches according to their risk appetite, with senior tranches receiving priority for payments and junior tranches absorbing initial losses. Data on tranche performance is crucial for assessing securitized asset quality. Senior tranches often have lower default rates due to their priority in tranche waterfalls and strong credit enhancements. Mezzanine and junior tranches typically exhibit higher yield spreads to compensate for increased default risks and volatility in cash flow distributions.

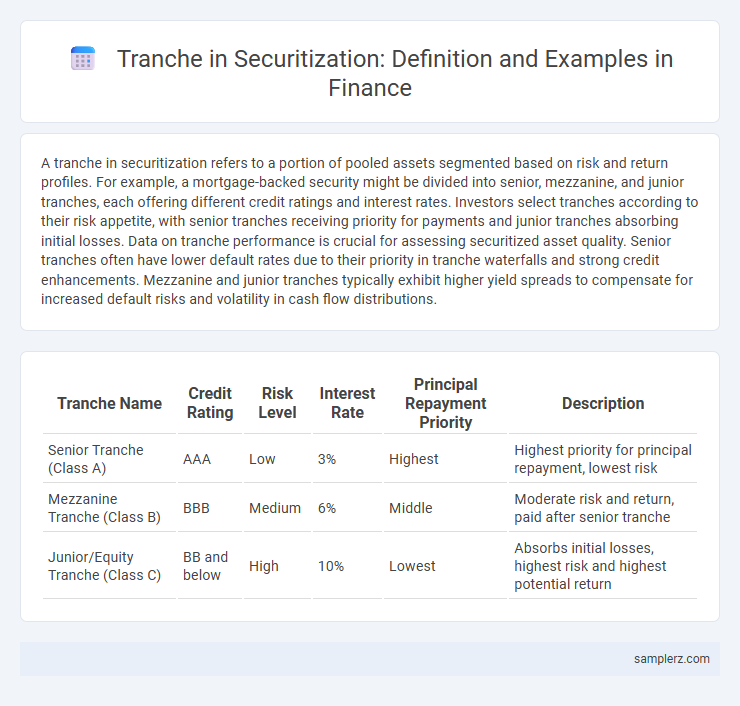

Table of Comparison

| Tranche Name | Credit Rating | Risk Level | Interest Rate | Principal Repayment Priority | Description |

|---|---|---|---|---|---|

| Senior Tranche (Class A) | AAA | Low | 3% | Highest | Highest priority for principal repayment, lowest risk |

| Mezzanine Tranche (Class B) | BBB | Medium | 6% | Middle | Moderate risk and return, paid after senior tranche |

| Junior/Equity Tranche (Class C) | BB and below | High | 10% | Lowest | Absorbs initial losses, highest risk and highest potential return |

Introduction to Tranche in Securitization

A tranche in securitization represents a specific segment of a pooled asset portfolio, typically classified by varying risk levels, interest rates, and maturities. Senior tranches usually offer lower risk and yield but have priority claim on cash flows, while junior or mezzanine tranches carry higher risk and potential returns. This structured division facilitates tailored investment opportunities and risk distribution among investors in asset-backed securities.

Understanding Securitization Structures

In securitization structures, a tranche represents a specific segment of pooled assets divided based on risk and return profiles, such as senior, mezzanine, and equity tranches. Each tranche carries different credit ratings and priority of payments, with senior tranches typically receiving lower risk and higher credit ratings, while equity tranches absorb initial losses with higher yields. Understanding these tranches is crucial for investors to assess exposure, potential returns, and default risk within structured finance products.

Senior Tranche Example in Asset-Backed Securities

In asset-backed securities, the senior tranche represents the highest priority debt, typically rated AAA or AA, carrying the lowest risk and lowest interest rates. This tranche receives principal and interest payments first from the cash flows generated by underlying assets such as auto loans or credit card receivables. Investors in the senior tranche benefit from credit enhancements like overcollateralization and reserve accounts that protect against defaults in subordinate tranches.

Mezzanine Tranche in Mortgage-Backed Securities

The mezzanine tranche in mortgage-backed securities (MBS) represents a mid-level risk class positioned between senior and equity tranches, often offering higher yields due to its subordinate claim on cash flows. These tranches absorb losses only after the senior tranche is depleted but before the equity tranche is affected, making them crucial for risk distribution in securitization. Investors in mezzanine tranches benefit from balanced exposure to credit risk and return, which enhances portfolio diversification strategies within mortgage-backed securities markets.

Equity Tranche: The First-Loss Example

The equity tranche in securitization represents the first-loss piece, absorbing initial losses before senior tranches incur any impact, which makes it the highest risk and highest potential return segment. This tranche typically holds a smaller portion of the total securities but is essential for credit enhancement, protecting more senior tranches by acting as a buffer. Investors in the equity tranche seek higher yields due to the increased risk exposure from the subordinated position in the capital structure.

Tranche Waterfall: How Payments Are Distributed

In securitization, the tranche waterfall dictates the order in which cash flows are distributed to different tranche holders based on priority, with senior tranches receiving payments before mezzanine and equity tranches. This hierarchical payment structure mitigates risk for senior investors by ensuring they are paid first, while subordinated tranches absorb losses or payment shortfalls. The waterfall mechanism is crucial in structuring collateralized debt obligations (CDOs) and mortgage-backed securities (MBS), optimizing risk allocation and investor returns.

Tranche Example in Collateralized Debt Obligations (CDOs)

In Collateralized Debt Obligations (CDOs), tranches represent layers of debt with varying risk and return profiles, such as senior, mezzanine, and equity tranches. Senior tranches receive priority on interest and principal payments, resulting in lower yields but reduced default risk, while mezzanine tranches offer moderate risk and returns, and equity tranches absorb initial losses but have the highest potential for gain. This tiered structure enables investors to select exposure based on their risk appetite and investment objectives.

Risk Profiling of Different Tranches

In securitization, tranches represent layers of debt with varying risk profiles, such as senior, mezzanine, and equity tranches. Senior tranches hold the highest credit quality and lowest risk due to priority in cash flow and principal repayment. Mezzanine tranches carry moderate risk with higher yields, while equity tranches absorb first losses, presenting the highest risk and potential return.

Real-World Case Study: Tranching in Auto Loan Securitizations

Auto loan securitizations commonly use tranches to allocate risk and returns among investors, with senior, mezzanine, and equity tranches reflecting varying credit priorities. In a notable real-world case, a $500 million auto loan asset-backed security issued by a leading financial institution featured senior tranches rated AAA, absorbing most principal repayments first, while subordinate tranches took on higher default risk in exchange for elevated yields. This structure allowed efficient capital distribution and enhanced investor appetite by matching distinct risk profiles to appropriate tranche levels.

Benefits and Drawbacks of Tranching in Finance

Tranching in securitization allocates varying risk levels to different creditor classes, enhancing investment appeal by matching risk tolerance with expected returns, which can lead to improved market liquidity and diversified funding sources. The primary benefit lies in efficiently distributing credit risk and attracting a broader investor base, while drawbacks include potential complexity in understanding tranche structures and the risk of credit rating agency misjudgments that may obscure underlying asset quality. Investors must carefully analyze each tranche's risk and reward profile to avoid mispricing and ensure alignment with their investment objectives.

example of tranche in securitization Infographic

samplerz.com

samplerz.com