A dark pool in the stock exchange is a private trading venue where institutional investors execute large orders without revealing their intentions to the public. These platforms allow for anonymous trading, reducing market impact and price slippage that can occur in traditional exchanges. Examples of well-known dark pools include Liquidnet, Credit Suisse Crossfinder, and Barclays LX. Dark pools operate outside of the major stock exchanges like the NYSE and NASDAQ, providing a discreet environment for high-volume trades. They aggregate buy and sell orders away from public order books, maintaining confidentiality and minimizing information leakage. Investors use dark pools to efficiently trade large blocks of shares while avoiding front-running and information arbitrage risks common on lit markets.

Table of Comparison

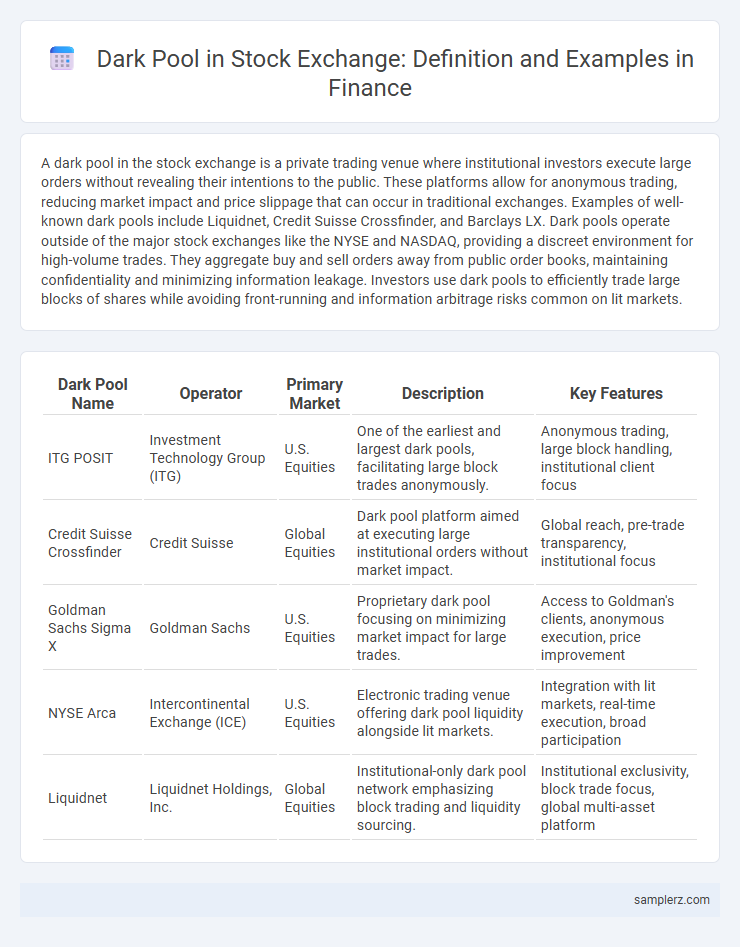

| Dark Pool Name | Operator | Primary Market | Description | Key Features |

|---|---|---|---|---|

| ITG POSIT | Investment Technology Group (ITG) | U.S. Equities | One of the earliest and largest dark pools, facilitating large block trades anonymously. | Anonymous trading, large block handling, institutional client focus |

| Credit Suisse Crossfinder | Credit Suisse | Global Equities | Dark pool platform aimed at executing large institutional orders without market impact. | Global reach, pre-trade transparency, institutional focus |

| Goldman Sachs Sigma X | Goldman Sachs | U.S. Equities | Proprietary dark pool focusing on minimizing market impact for large trades. | Access to Goldman's clients, anonymous execution, price improvement |

| NYSE Arca | Intercontinental Exchange (ICE) | U.S. Equities | Electronic trading venue offering dark pool liquidity alongside lit markets. | Integration with lit markets, real-time execution, broad participation |

| Liquidnet | Liquidnet Holdings, Inc. | Global Equities | Institutional-only dark pool network emphasizing block trading and liquidity sourcing. | Institutional exclusivity, block trade focus, global multi-asset platform |

Introduction to Dark Pools in Stock Exchanges

Dark pools are private, non-exchange trading venues where institutional investors execute large stock orders anonymously to minimize market impact and avoid price slippage. These alternative trading systems facilitate significant block trades away from public stock exchanges like the NYSE or NASDAQ, enhancing confidentiality and reducing information leakage. By operating outside traditional lit markets, dark pools contribute to improved liquidity management for large financial institutions.

Key Characteristics of Dark Pools

Dark pools are private trading venues where large institutional investors execute block trades without revealing their intentions to the public market, preserving anonymity and minimizing market impact. Key characteristics include limited pre-trade transparency, restricted access predominantly to institutional participants, and the ability to trade large volumes at prices often derived from public exchanges or reference prices. These features help reduce information leakage and price volatility compared to traditional exchanges.

How Dark Pools Differ from Traditional Exchanges

Dark pools are private trading venues where institutional investors execute large orders with minimal market impact, contrasting with traditional exchanges like the NYSE or NASDAQ that offer transparent order books and public price discovery. These alternative trading systems prioritize anonymity and reduced information leakage, allowing participants to trade significant volumes without influencing market prices instantly. Dark pools lack the centralized transparency and immediate order matching typical of conventional exchanges, often leading to concerns about fairness and market fragmentation.

Notable Examples of Dark Pools in the Market

Notable examples of dark pools in the stock exchange include Credit Suisse's Crossfinder, one of the largest with an average daily volume exceeding 500 million shares. Other significant dark pools are UBS's ATS, Barclays LX, and Goldman Sachs Sigma X, each facilitating large block trades to minimize market impact. These venues collectively handle a substantial portion of US equity trading volume, offering anonymity to institutional investors.

Major Players Operating Dark Pool Venues

Major players operating dark pool venues in the stock exchange include Citadel Securities, Goldman Sachs, and Credit Suisse, which manage some of the largest private trading networks. These institutions provide liquidity and facilitate large block trades away from public exchanges, minimizing market impact and preserving confidentiality. Dark pools handle billions of dollars in daily volume, playing a critical role in modern equity markets by enabling institutional investors to execute sizable orders discreetly.

Real-World Case Studies of Dark Pool Trades

Dark pools such as Liquidnet and Credit Suisse's Crossfinder facilitate large block trades away from public exchanges, minimizing market impact and price slippage. In a notable case, a $120 million institutional buy order was executed on Liquidnet, demonstrating how dark pools enable discreet transactions without signaling to the market. These venues provide institutional investors with the ability to trade significant volumes efficiently while maintaining confidentiality.

Benefits of Using Dark Pools in Stock Trading

Dark pools, such as Liquidnet and ITG POSIT, offer institutional investors the benefit of executing large stock trades with minimal market impact and reduced price slippage. These private trading venues enhance trade confidentiality by keeping order size and identities hidden from public exchanges, thereby preventing adverse price movements. Utilizing dark pools allows for improved liquidity and optimized trade execution, especially for sizable equity orders.

Regulatory Challenges Facing Dark Pools

Dark pools such as Liquidnet and Credit Suisse's Crossfinder operate as private exchanges for large-scale stock trades, bypassing public order books to reduce market impact. These venues face regulatory challenges including transparency requirements, potential conflicts of interest, and the need to prevent unfair trading advantages. Regulators like the SEC have increased scrutiny on dark pools to ensure fair market practices and improve investor protection.

Impact of Dark Pool Activity on Market Transparency

Dark pools, such as Liquidnet and Credit Suisse's Crossfinder, facilitate large block trades away from public exchanges, significantly reducing market transparency by limiting the visibility of order flow. This opacity can lead to information asymmetry, where retail investors and smaller traders lack the same insights as institutional players. The diminished transparency may result in wider bid-ask spreads and increased price volatility, ultimately impacting market efficiency and investor confidence.

Future Trends and Innovations in Dark Pool Operations

Dark pools, private financial forums for trading securities away from public exchanges, are evolving with innovations such as AI-driven algorithms that enhance trade execution and reduce market impact. Emerging trends include increased transparency protocols using blockchain technology to bolster trust and regulatory compliance. Advanced data analytics and machine learning models enable more efficient matchmaking of buy and sell orders, optimizing liquidity and minimizing information leakage.

example of Dark pool in stock exchange Infographic

samplerz.com

samplerz.com