A Dribble Out strategy in share buybacks involves a company repurchasing its own shares gradually over time instead of conducting a large, immediate buyback. This approach allows the firm to manage market impact and avoid significant price spikes while steadily reducing the number of outstanding shares. It helps maintain liquidity and provides flexibility in timing purchases based on stock price fluctuations. Companies employing the Dribble Out method typically conduct daily or weekly buybacks in smaller volumes, closely monitoring market trends and regulatory requirements. The data from such buybacks reflects incremental increases in treasury stock, influencing earnings per share and return on equity over an extended period. Investors often view Dribble Out buybacks as a disciplined capital allocation tool, signaling management's confidence without creating abrupt market distortions.

Table of Comparison

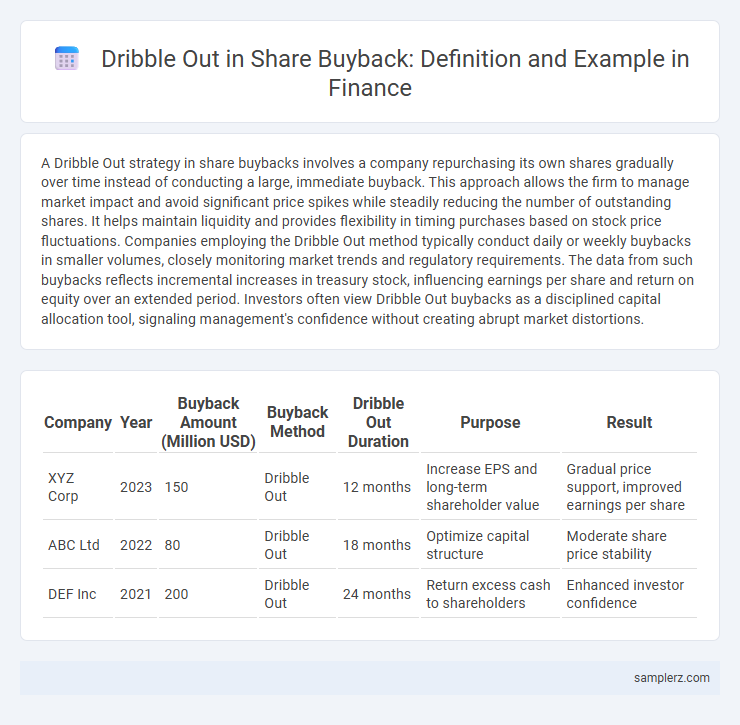

| Company | Year | Buyback Amount (Million USD) | Buyback Method | Dribble Out Duration | Purpose | Result |

|---|---|---|---|---|---|---|

| XYZ Corp | 2023 | 150 | Dribble Out | 12 months | Increase EPS and long-term shareholder value | Gradual price support, improved earnings per share |

| ABC Ltd | 2022 | 80 | Dribble Out | 18 months | Optimize capital structure | Moderate share price stability |

| DEF Inc | 2021 | 200 | Dribble Out | 24 months | Return excess cash to shareholders | Enhanced investor confidence |

Understanding Dribble Out Method in Share Buybacks

The Dribble Out method in share buybacks involves a company purchasing its own shares gradually over an extended period, rather than executing a large, immediate buyback. This approach helps minimize market impact and reduces the risk of driving up the stock price abruptly, allowing for more strategic capital allocation. It is commonly used by corporations aiming to return value to shareholders without signaling excessive market confidence or disrupting trading liquidity.

Key Features of Dribble Out Share Repurchase

Dribble out share repurchase involves a company gradually buying back its shares from the market over an extended period, typically to avoid large price fluctuations. Key features include flexibility in timing and volume, enabling the firm to optimize market conditions and minimize impact on stock price. This method contrasts with accelerated buybacks by providing a controlled, steady reduction in outstanding shares, supporting long-term shareholder value.

How Dribble Out Buyback Works in Practice

Dribble out buyback involves a company repurchasing its shares incrementally over an extended period, rather than executing a large, one-time buyback. This method allows the company to manage market impact and optimize price by purchasing shares gradually at prevailing market prices, often through open market transactions. The approach helps maintain liquidity and avoids sudden stock price distortions while steadily reducing the number of outstanding shares to enhance shareholder value.

Dribble Out vs. Other Share Buyback Methods

Dribble out share buybacks involve repurchasing shares gradually over an extended period, allowing companies like Apple or Microsoft to manage market impact and optimize timing. Unlike accelerated share repurchase programs or open market repurchases, dribble out methods avoid sudden price spikes, providing flexibility in varying market conditions. This approach helps maintain liquidity and reduces signaling effects compared to lump-sum buybacks or fixed-price tender offers.

Example Scenarios: Dribble Out in Public Companies

A dribble out in share buyback occurs when a public company repurchases its shares gradually over an extended period to avoid market disruption or signaling effects. For instance, Microsoft implemented a dribble out strategy by repurchasing small blocks of its shares consistently over several quarters rather than executing large, lump-sum buybacks. This approach helped stabilize the stock price while steadily reducing the share count, enhancing shareholder value without triggering significant market volatility.

Regulatory Framework for Dribble Out Buybacks

Dribble out buybacks in the finance sector are regulated under specific frameworks such as the Securities and Exchange Board of India (SEBI) guidelines, which allow companies to repurchase shares in multiple transactions over time rather than a single bulk buyback. These regulations set limits on the daily maximum volume of shares repurchased, disclosure obligations to maintain market transparency, and minimum time intervals between successive transactions. Compliance with these rules ensures orderly market conduct and protects shareholder interests during the buyback process.

Advantages of Using Dribble Out Buyback Strategy

Dribble out buyback strategy allows companies to repurchase shares gradually over an extended period, minimizing market disruption and avoiding sharp price spikes. This approach provides flexibility in capital allocation, enabling firms to capitalize on favorable market conditions and optimize repurchase timing. Incremental buybacks also signal management's confidence in long-term value creation, potentially enhancing investor sentiment and supporting stock price stability.

Potential Drawbacks of Dribble Out Approach

The dribble out approach in share buybacks, characterized by gradual repurchase of shares over an extended period, may lead to price uncertainty and market speculation, potentially diluting shareholder value. Prolonged intervals between purchases can cause missed opportunities to capitalize on favorable market conditions, reducing the overall effectiveness of the buyback program. This method can also increase administrative costs and complexity, impacting the company's financial efficiency and shareholder returns.

Impact of Dribble Out Buybacks on Share Price

Dribble out buybacks gradually reduce outstanding shares through small, frequent repurchases, often signaling management's confidence in the company's valuation. This approach can support the share price by steadily increasing earnings per share and reducing supply without causing abrupt market reactions. Studies show that dribble out buybacks tend to create a more stable upward pressure on share prices compared to lump-sum buybacks, enhancing long-term shareholder value.

Real-World Case Studies of Dribble Out Buybacks

In 2020, Apple Inc. employed a dribble out share buyback strategy by repurchasing shares incrementally to avoid stock price spikes, acquiring $72 billion worth of shares over several quarters. Similarly, Microsoft implemented a gradual repurchase program, disbursing $35 billion across fiscal 2019 and 2020, optimizing capital allocation without negatively impacting market liquidity. These real-world examples highlight how major corporations use dribble out buybacks to balance shareholder returns and market stability over time.

example of Dribble out in share buyback Infographic

samplerz.com

samplerz.com