A cross-default clause in a finance agreement triggers a default if the borrower defaults on another agreement with a different lender. For example, a loan agreement may state that if the borrower misses a payment on a separate bank loan, the current lender can declare the loan in default. This clause protects lenders by preventing borrowers from selectively defaulting on obligations while maintaining others. In practice, a cross-default provision might specify a threshold, such as defaults exceeding $1 million on other debts. The clause applies across various financing instruments like bonds, credit facilities, and term loans. Entities must carefully review cross-default terms to understand their risk exposure and the potential for cascading defaults.

Table of Comparison

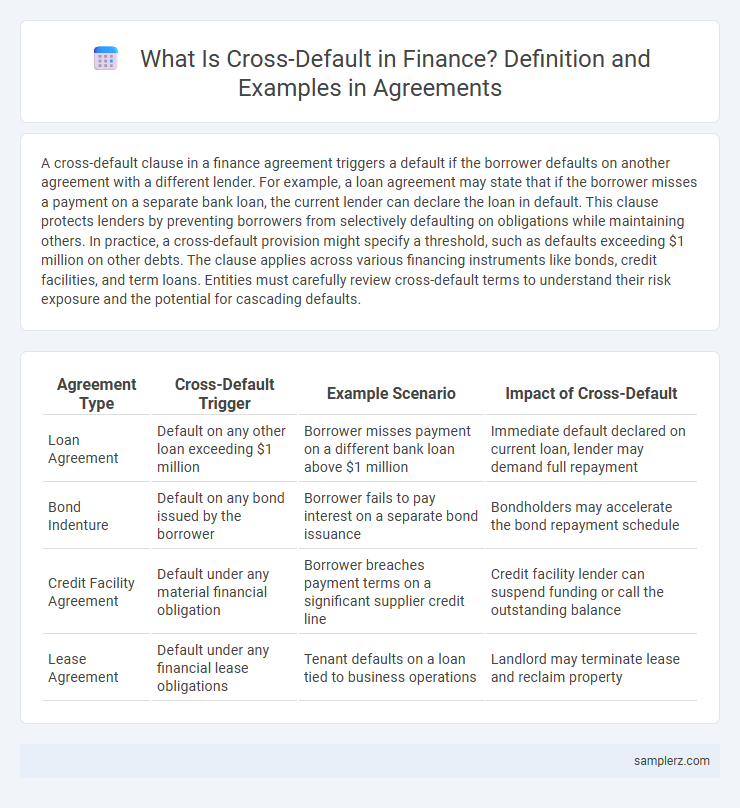

| Agreement Type | Cross-Default Trigger | Example Scenario | Impact of Cross-Default |

|---|---|---|---|

| Loan Agreement | Default on any other loan exceeding $1 million | Borrower misses payment on a different bank loan above $1 million | Immediate default declared on current loan, lender may demand full repayment |

| Bond Indenture | Default on any bond issued by the borrower | Borrower fails to pay interest on a separate bond issuance | Bondholders may accelerate the bond repayment schedule |

| Credit Facility Agreement | Default under any material financial obligation | Borrower breaches payment terms on a significant supplier credit line | Credit facility lender can suspend funding or call the outstanding balance |

| Lease Agreement | Default under any financial lease obligations | Tenant defaults on a loan tied to business operations | Landlord may terminate lease and reclaim property |

Understanding Cross-Default Clauses in Finance

Cross-default clauses trigger a default if a borrower fails to meet obligations on any other debt, not just the specific loan in question. This mechanism protects lenders by ensuring that a default in one agreement signals potential financial distress across all borrowings. In syndicated loans and bond indentures, cross-default provisions typically activate when missed payments or covenant breaches occur on related financial instruments.

Key Elements of Cross-Default Provisions

Cross-default provisions in finance agreements trigger a default if a borrower fails to meet obligations on any other debt, ensuring creditor protection across multiple contracts. Key elements include the definition of default events, the scope of related debts covered, and cure periods allowing the borrower to remedy the default before enforcement. These clauses enhance risk management by linking various financial agreements and promoting prompt resolution of payment issues.

Real-World Examples of Cross-Default in Agreements

In the 2008 Lehman Brothers bankruptcy, cross-default clauses triggered defaults across multiple loan agreements, exacerbating financial instability. Similarly, General Motors' 2005 restructuring invoked cross-default provisions linking its various credit facilities, accelerating creditor actions. These real-world incidents demonstrate how cross-default clauses connect diverse debt instruments, amplifying risk for borrowers and lenders.

Cross-Default in Loan Agreements: A Case Study

A cross-default clause in loan agreements activates a default if a borrower defaults on another obligation, protecting lenders by linking multiple loans. In a case study involving a multinational corporation, the borrower's failure to meet payments on a subsidiary's bond triggered a cross-default on the primary loan, accelerating the lender's right to demand repayment. This mechanism ensures comprehensive risk management by preventing a borrower from selectively defaulting on obligations.

How Cross-Default Impacts Bond Indentures

Cross-default clauses in bond indentures trigger an event of default if the issuer defaults on other debt obligations, enhancing creditor protection by allowing bondholders to accelerate repayment. This mechanism increases the risk of a cascade of defaults across multiple debt instruments, potentially raising the issuer's borrowing costs due to perceived higher credit risk. Cross-default provisions require issuers to maintain consistent compliance across all financial obligations, influencing covenant negotiations and refinancing strategies.

Cross-Default Triggers in Corporate Finance

Cross-default triggers in corporate finance occur when a borrower's default on one loan automatically causes defaults on other loans, even if payments on those are current. Common examples include bond indentures or credit agreements specifying that missed payments on any debt, breaches of financial covenants, or insolvency proceedings trigger cross-default clauses. These provisions protect lenders by enabling them to accelerate repayment or demand immediate remedies, mitigating risk across interconnected financings.

Sample Cross-Default Wording in Contracts

Sample cross-default wording in contracts typically states that a default under any other loan or financial agreement triggers a default under the current agreement, ensuring all obligations are interconnected. For instance, language such as "any default or event of default under any other agreement involving the Borrower shall constitute a default under this Agreement" is commonly used to protect lenders. This provision mitigates risk by enabling acceleration of debt or enforcement actions across multiple agreements if a default occurs in any linked contract.

Consequences of Cross-Default for Borrowers

Cross-default clauses in loan agreements trigger immediate repayment obligations if a borrower defaults on any other debt, significantly increasing financial pressure. This often leads to accelerated debt repayment, damage to credit ratings, and restricted access to future financing. Borrowers may also face renegotiation challenges or insolvency risks due to compounded liabilities.

Mitigating Cross-Default Risks in Agreements

Mitigating cross-default risks in agreements involves clearly defining trigger events and establishing thresholds that prevent automatic default declarations due to minor breaches in related contracts. Incorporating grace periods and cure clauses allows debtors time to rectify defaults before penalties are enforced, reducing the likelihood of a cross-default cascade. Structured negotiations can also include carve-outs that exempt certain financial obligations, providing flexibility and protecting overall credit stability.

Legal Considerations for Cross-Default Enforcement

Cross-default clauses in finance agreements trigger a default if the borrower defaults on another obligation, requiring careful legal drafting to define triggering events precisely and avoid ambiguity. Enforceability hinges on jurisdiction-specific interpretations of contract terms and the presence of clear, unambiguous language to mitigate litigation risks. Courts often examine the intent behind the clause and the proportionality of enforcement actions to balance creditor rights and borrower protections.

example of cross-default in agreement Infographic

samplerz.com

samplerz.com