Smoothing in pension finance refers to the method of stabilizing pension contribution rates and benefit payouts by averaging actuarial gains and losses over several years. This technique helps pension plans avoid sudden spikes or drops in funding requirements caused by short-term market volatility or unexpected demographic changes. Entities like public pension funds commonly use smoothing to maintain predictable financial demands and protect beneficiaries from abrupt benefit changes. One example of smoothing is the use of a five-year moving average to calculate the actuarial value of assets in a pension plan. By spreading investment gains and losses over five years, pension funds can reduce the impact of market fluctuations on their reported asset values. This data-driven approach ensures contributions remain more stable, promoting long-term financial health and sustainability of the pension system.

Table of Comparison

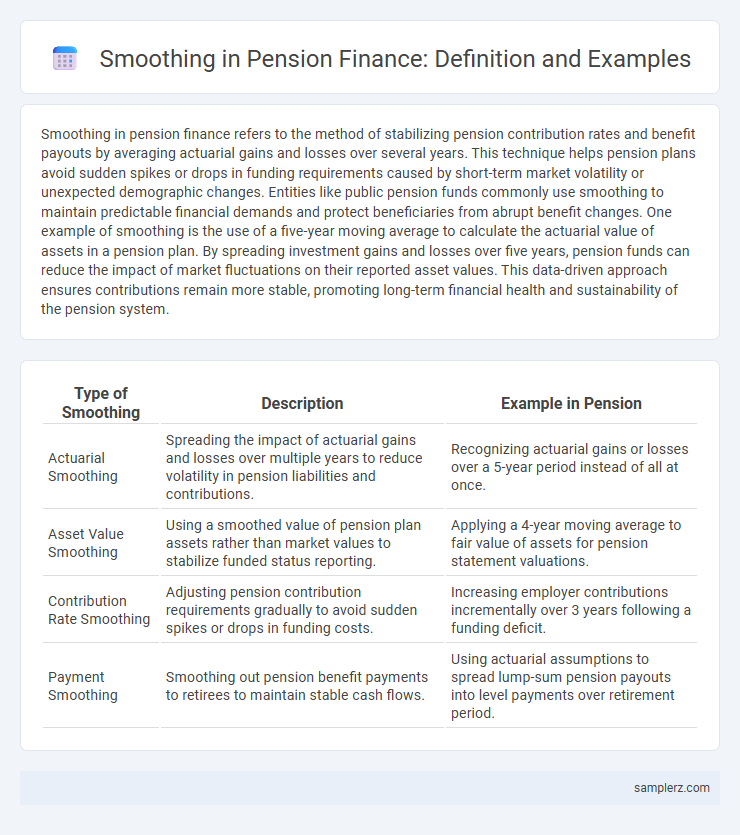

| Type of Smoothing | Description | Example in Pension |

|---|---|---|

| Actuarial Smoothing | Spreading the impact of actuarial gains and losses over multiple years to reduce volatility in pension liabilities and contributions. | Recognizing actuarial gains or losses over a 5-year period instead of all at once. |

| Asset Value Smoothing | Using a smoothed value of pension plan assets rather than market values to stabilize funded status reporting. | Applying a 4-year moving average to fair value of assets for pension statement valuations. |

| Contribution Rate Smoothing | Adjusting pension contribution requirements gradually to avoid sudden spikes or drops in funding costs. | Increasing employer contributions incrementally over 3 years following a funding deficit. |

| Payment Smoothing | Smoothing out pension benefit payments to retirees to maintain stable cash flows. | Using actuarial assumptions to spread lump-sum pension payouts into level payments over retirement period. |

Introduction to Smoothing in Pension Finance

Smoothing in pension finance refers to the technique of averaging asset values or liabilities over multiple periods to reduce volatility in pension fund valuations and contribution requirements. This method helps stabilize pension plan funding by mitigating the impact of short-term market fluctuations on actuarial calculations. Common practices include asset smoothing, where gains and losses are recognized gradually, and liability smoothing, which adjusts assumptions like interest rates or mortality over time to ensure consistent funding levels.

Why Smoothing is Used in Pension Fund Management

Smoothing in pension fund management reduces the impact of short-term market volatility on pension plan valuations, providing more stable and predictable funding status over time. This technique helps maintain consistent contribution rates for employers and employees, avoiding sudden spikes that could strain financial resources. By spreading investment gains and losses across multiple periods, smoothing supports long-term financial sustainability and improves stakeholders' confidence in the pension fund's health.

Common Smoothing Techniques in Pension Schemes

Common smoothing techniques in pension schemes include asset smoothing, where investment gains and losses are averaged over multiple years to reduce volatility in pension fund valuations. Another method is salary smoothing, which uses an average of several years' salary instead of just the final salary to calculate pension benefits, stabilizing the pension liability estimates. Liability smoothing adjusts the discount rates or amortizes actuarial gains and losses over time, promoting consistency in contribution requirements and financial reporting.

Example: Asset Smoothing for Pension Plans

Asset smoothing in pension plans involves averaging the market value of pension plan assets over multiple years to reduce volatility in the plan's funded status. For example, instead of recognizing a 20% drop in asset value immediately, a pension plan might spread that loss over a three to five-year period, mitigating sudden funding ratio fluctuations. This technique helps stabilize contribution requirements and financial reporting by avoiding abrupt changes driven by short-term market movements.

Liabilities Smoothing in Defined Benefit Pensions

Liabilities smoothing in defined benefit pensions involves spreading out the recognition of actuarial gains and losses over multiple years to reduce volatility in a pension plan's funded status. This technique helps stabilize the pension expense reported on financial statements, enhancing predictability for both employers and stakeholders. By amortizing fluctuations in actuarial assumptions, liabilities smoothing supports consistent pension funding and improved financial planning.

Case Study: Smoothing Contribution Rates Over Time

Smoothing contribution rates in pension plans involves adjusting employer and employee payments to reduce volatility caused by fluctuating investment returns and demographic changes. A notable case study demonstrated how a multi-year averaging method helped a public pension fund stabilize contributions by spreading actuarial gains and losses over a five-year period, reducing sudden spikes in payment requirements. This approach enhanced fiscal predictability and safeguarded the fund's long-term solvency.

Pros and Cons of Smoothing Methods in Pensions

Smoothing methods in pensions, such as asset value smoothing or actuarial smoothing, help stabilize contribution rates by reducing the impact of market volatility on pension fund valuations. Pros include enhanced financial predictability and avoidance of sharp contribution spikes, which benefit both employers and employees. However, cons involve potential underestimation of liabilities during market downturns and delayed reflection of true fund performance, which can mask financial risks.

Regulatory Perspectives on Pension Smoothing

Regulatory perspectives on pension smoothing emphasize maintaining actuarial soundness while reducing volatility in funding requirements. Pension smoothing methods, such as asset value smoothing and actuarial gain/loss amortization, are regulated to ensure consistent contribution levels and protect beneficiary interests. Regulators mandate transparent disclosure of smoothing techniques to balance financial stability and intergenerational equity in pension plans.

Real-World Example: Pension Asset Value Smoothing

Pension asset value smoothing is a technique used by pension funds to reduce volatility in reported asset values by averaging returns over several years. For example, if a pension fund experiences a 15% gain in one year followed by a 10% loss the next, smoothing might record a more stable 2.5% annual return instead of reflecting the sharp fluctuations. This approach helps stabilize pension contribution rates and funding status, ensuring predictable financial planning for both employers and beneficiaries.

Impact of Smoothing on Pension Plan Funding Status

Smoothing in pension plans involves averaging asset values or liabilities over multiple periods to reduce volatility in the plan's funding status. This technique stabilizes reported funded ratios, minimizing abrupt fluctuations that could trigger drastic contribution adjustments from employers. By mitigating short-term market impact, smoothing supports more predictable pension costs and enhances long-term funding strategy effectiveness.

example of smoothing in pension Infographic

samplerz.com

samplerz.com