A Greenshoe option, commonly used in underwriting during initial public offerings (IPOs), allows underwriters to sell additional shares, typically up to 15% more than the original allocation. This mechanism helps stabilize the stock price by providing underwriters the flexibility to meet excess demand. Data from various IPOs show that underwriting firms frequently exercise the Greenshoe option to manage market volatility and investor interest effectively. The entity involved in a Greenshoe agreement includes the issuing company, the underwriters, and investors. Underwriters monitor market data closely post-IPO launch to decide whether to exercise the Greenshoe option. This strategy optimizes pricing and mitigates downside risks, enhancing overall market confidence in the offering.

Table of Comparison

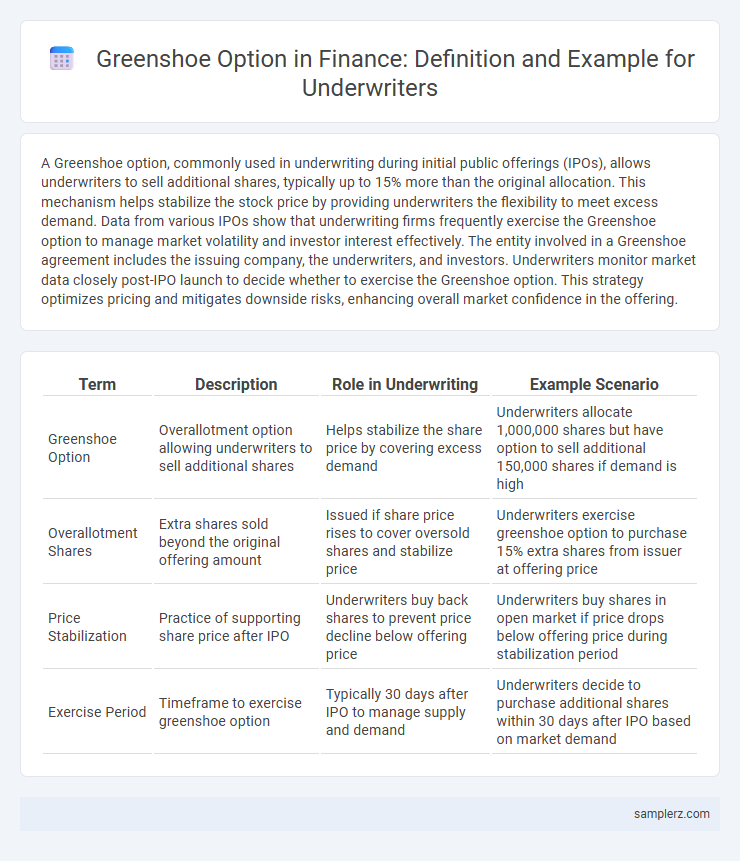

| Term | Description | Role in Underwriting | Example Scenario |

|---|---|---|---|

| Greenshoe Option | Overallotment option allowing underwriters to sell additional shares | Helps stabilize the share price by covering excess demand | Underwriters allocate 1,000,000 shares but have option to sell additional 150,000 shares if demand is high |

| Overallotment Shares | Extra shares sold beyond the original offering amount | Issued if share price rises to cover oversold shares and stabilize price | Underwriters exercise greenshoe option to purchase 15% extra shares from issuer at offering price |

| Price Stabilization | Practice of supporting share price after IPO | Underwriters buy back shares to prevent price decline below offering price | Underwriters buy shares in open market if price drops below offering price during stabilization period |

| Exercise Period | Timeframe to exercise greenshoe option | Typically 30 days after IPO to manage supply and demand | Underwriters decide to purchase additional shares within 30 days after IPO based on market demand |

Definition of Greenshoe Option in Underwriting

The Greenshoe option in underwriting is a contractual provision allowing underwriters to sell additional shares, usually up to 15% beyond the original offering size, to stabilize the price of a newly issued stock. This option helps underwriters manage excess demand and price volatility during an initial public offering (IPO). By exercising the Greenshoe, underwriters can buy shares from the issuer or the selling shareholders to cover over-allotments, ensuring market liquidity and price support.

Historical Background of the Greenshoe Mechanism

The Greenshoe mechanism, named after the Green Shoe Manufacturing Company, originated in the 1960s as a stabilizing tool for underwriters during initial public offerings (IPOs). It allows underwriters to sell additional shares, typically up to 15% more than the original offering size, to cover over-allotments and stabilize the stock price post-IPO. This practice became a standard feature in equity offerings, providing price support and reducing volatility in the aftermarket.

Notable Greenshoe Example: Facebook IPO

Facebook's IPO in 2012 prominently featured a Greenshoe option, allowing underwriters to buy up to 15% additional shares to stabilize the stock price. This mechanism helped manage excess demand and mitigate price volatility during the initial trading period. The effective use of the Greenshoe option contributed to smoother price discovery and investor confidence in Facebook's highly anticipated public offering.

Case Study: Alibaba’s Use of Greenshoe Option

Alibaba's initial public offering (IPO) in 2014 utilized a Greenshoe option, allowing underwriters to buy up to 15% more shares to stabilize the stock price amid high market demand. This mechanism helped underwriters manage price volatility and support Alibaba's stock post-listing on the New York Stock Exchange. The successful application of the Greenshoe option in Alibaba's IPO showcased its effectiveness in enhancing investor confidence and ensuring smoother market operations.

How Underwriters Execute the Greenshoe Provision

Underwriters execute the Greenshoe provision by initially allocating additional shares, typically up to 15% more than the original offering size, to stabilize the stock price post-IPO. During this process, underwriters may purchase these extra shares from the issuer if the stock price rises above the offering price, thereby preventing excessive volatility. This mechanism allows underwriters to cover short positions created during price stabilization, ensuring market liquidity and protecting investors.

Impact of Greenshoe on IPO Price Stability

The Greenshoe option allows underwriters to sell up to 15% additional shares during an IPO, providing a mechanism to stabilize the stock price by mitigating volatility. This over-allotment option helps maintain demand and supply equilibrium, reducing the likelihood of sharp price declines immediately after listing. Empirical studies show that IPOs utilizing a Greenshoe clause experience lower price fluctuations and enhanced investor confidence in the short term.

Regulatory Framework for Greenshoe Options

The regulatory framework for Greenshoe options is primarily outlined by the U.S. Securities and Exchange Commission (SEC) Rule 415, which governs overallotment provisions in public offerings. Under this framework, underwriters are allowed to purchase up to an additional 15% of shares from the issuer within 30 days to stabilize the aftermarket price without violating short selling regulations. Compliance with Regulation M ensures that these activities do not manipulate the market, maintaining fair trading practices during the initial public offering process.

Advantages of Greenshoe for Issuers and Investors

The Greenshoe option, allowing underwriters to sell additional shares up to 15% more than the original offering, provides issuers with price stability and increased capital by mitigating volatility during initial public offerings (IPOs). Investors benefit from enhanced liquidity and reduced risk as the option helps balance supply and demand, contributing to a more orderly trading environment. This mechanism aligns interests between issuers and investors, fostering investor confidence and supporting successful capital raising efforts.

Risks and Limitations of Greenshoe Arrangements

Greenshoe arrangements allow underwriters to stabilize share prices by over-allocating shares up to 15% beyond the original offering size, but this mechanism poses risks like potential market manipulation and increased volatility if the overallotment shares are exercised aggressively. Limitations include the underwriter's financial exposure if the share price declines below the offering price, potentially leading to losses when covering the short position. Furthermore, reliance on Greenshoe can create an artificial price floor that misleads investors regarding true market demand and price discovery.

Comparison: Greenshoe Usage in Global Capital Markets

Greenshoe options in global capital markets serve as a crucial mechanism for underwriters to stabilize stock prices post-IPO by allowing the sale of additional shares, typically up to 15% of the offering size. In the US, Greenshoe utilization is prevalent due to stringent regulatory frameworks and a mature market environment, enhancing investor confidence and mitigating price volatility. Conversely, emerging markets exhibit varied adoption rates; regions like Asia and Latin America are increasingly incorporating Greenshoe clauses, yet often with lower activation frequencies due to market liquidity constraints and differing regulatory landscapes.

example of Greenshoe in underwriter Infographic

samplerz.com

samplerz.com