A whipsaw in trading refers to a situation where an asset's price moves sharply in one direction and then quickly reverses, causing traders to incur losses. For example, a stock might break above a resistance level, prompting investors to buy, but then suddenly drop below that level, triggering stop-loss orders. This rapid back-and-forth price action creates confusion and emotional stress for traders, often leading to poor decision-making. In the forex market, whipsaws commonly occur during periods of low liquidity or high volatility. A currency pair such as EUR/USD may surge upward due to positive economic data, only to reverse direction minutes later as market sentiment shifts. Understanding the causes of whipsaws helps traders implement strategies like wider stop-losses or waiting for confirmation before entering positions.

Table of Comparison

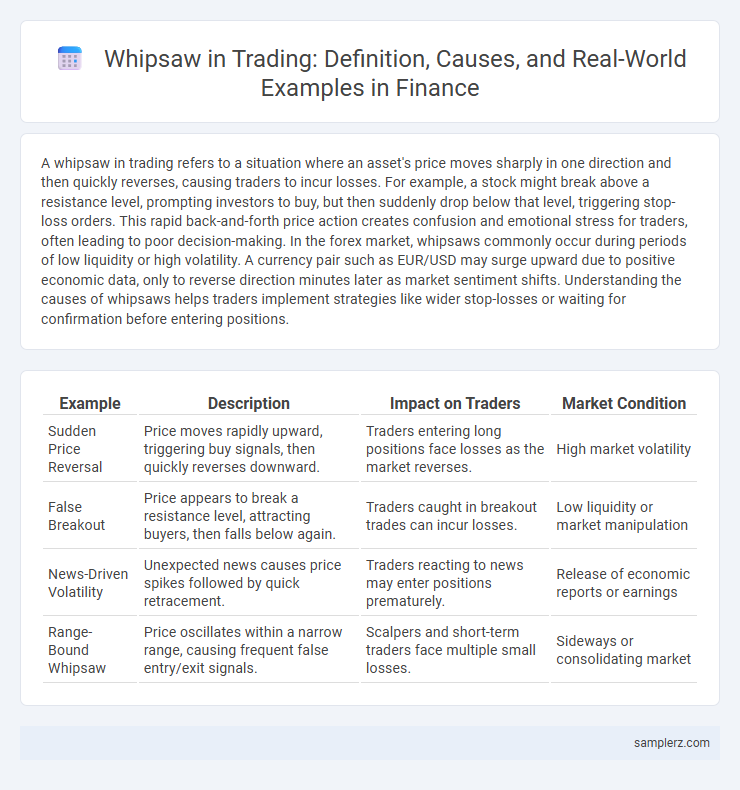

| Example | Description | Impact on Traders | Market Condition |

|---|---|---|---|

| Sudden Price Reversal | Price moves rapidly upward, triggering buy signals, then quickly reverses downward. | Traders entering long positions face losses as the market reverses. | High market volatility |

| False Breakout | Price appears to break a resistance level, attracting buyers, then falls below again. | Traders caught in breakout trades can incur losses. | Low liquidity or market manipulation |

| News-Driven Volatility | Unexpected news causes price spikes followed by quick retracement. | Traders reacting to news may enter positions prematurely. | Release of economic reports or earnings |

| Range-Bound Whipsaw | Price oscillates within a narrow range, causing frequent false entry/exit signals. | Scalpers and short-term traders face multiple small losses. | Sideways or consolidating market |

Understanding Whipsaw in Financial Trading

Whipsaw in financial trading occurs when an asset's price sharply reverses direction, triggering stop-loss orders and causing traders to incur losses from rapid price swings. For example, a stock may surge above a resistance level, prompting buy orders, only to quickly fall below support levels, forcing traders to sell at a loss. Understanding whipsaw helps traders develop risk management strategies and avoid being caught in volatile market conditions.

Classic Whipsaw Pattern Explained

The classic whipsaw pattern in trading occurs when a stock price rapidly reverses direction after a false breakout above resistance or below support, trapping traders who entered positions prematurely. This pattern often leads to sudden losses as stop-loss orders are triggered during the rapid price swings, causing high volatility and increased market risk. Recognizing the classic whipsaw helps traders avoid false signals and improves strategic entry and exit decisions in volatile financial markets.

Real-World Whipsaw Example in Stock Markets

A real-world example of a whipsaw in stock markets occurred during the 2020 coronavirus pandemic when major indices like the S&P 500 experienced rapid swings between sharp declines and quick recoveries, confusing many traders. Investors faced significant losses as price movements triggered stop-loss orders amid extreme volatility, reflecting the difficulty of predicting market direction during global crises. Such whipsaw patterns highlight the importance of cautious risk management and adaptive trading strategies in turbulent financial environments.

Whipsaw Scenarios in Forex Trading

Whipsaw scenarios in Forex trading occur when a currency pair's price sharply reverses direction after a trend breakout, causing false signals that trap traders on the wrong side of the market. For example, the EUR/USD might break above a key resistance level only to quickly reverse and fall below support, triggering stop-loss orders and frustrating momentum traders. These volatile reversals often result from sudden economic news releases or geopolitical events, increasing the risk of losses in high-leverage forex positions.

Whipsaw Example Using Technical Indicators

A common whipsaw example in trading occurs when the Relative Strength Index (RSI) signals an oversold condition, prompting a buy, but price quickly reverses, triggering a sell signal from the Moving Average Convergence Divergence (MACD). This rapid shift causes traders to enter and exit positions prematurely, resulting in losses. Such false signals highlight the importance of confirming trades with multiple technical indicators to avoid whipsaw effects.

How Whipsaw Affects Day Traders

Whipsaw in trading occurs when a stock's price rapidly moves in one direction and then reverses sharply, causing losses for day traders relying on short-term price trends. This volatility forces day traders to execute quick trades, often resulting in frequent stop-loss triggers and reduced profit margins. High-frequency price reversals undermine trading strategies, increase transaction costs, and elevate emotional stress for traders managing intraday positions.

Whipsaw Events Caused by Economic News

Whipsaw events in trading often occur when economic news releases, such as non-farm payroll data or Federal Reserve interest rate announcements, trigger rapid price reversals within short timeframes. For instance, during the U.S. jobs report, forex pairs like EUR/USD can spike higher initially before sharply reversing as traders digest the full implications. These sudden, contradictory price movements create challenging conditions for traders relying on trend-following strategies, increasing the risk of stop-loss triggers and unexpected losses.

Whipsaw Example During Market Volatility

During periods of market volatility, a whipsaw typically occurs when a stock price sharply reverses direction multiple times in a short span, causing traders to enter and exit positions prematurely. For instance, a sudden drop in a major index like the S&P 500 followed by a rapid rebound can trigger stop-loss orders, resulting in significant losses for momentum traders. This erratic price movement complicates technical analysis and emphasizes the risk of false signals in volatile trading environments.

Risk Management Strategies Against Whipsaw

Whipsaw in trading occurs when rapid price movements trigger stop-loss orders only for the market to reverse direction immediately, causing unexpected losses. Effective risk management strategies against whipsaw include implementing wider stop-loss limits to avoid premature exits and using trailing stops that adjust with market trends. Combining technical indicators like moving averages with volume analysis helps traders differentiate genuine trend reversals from false signals, reducing exposure to whipsaws.

Lessons Learned from Famous Whipsaw Cases

Famous whipsaw cases in trading, such as the 2010 Flash Crash and the 2015 Swiss Franc shock, highlight the dangers of rapid market reversals impacting high-frequency and algorithmic traders. These events demonstrate the critical importance of implementing robust risk management strategies, including stop-loss orders and dynamic position sizing, to mitigate losses during volatile conditions. Traders learn to avoid emotional reactions and rely on systematic approaches to navigate unpredictable price swings efficiently.

example of whipsaw in trading Infographic

samplerz.com

samplerz.com