In finance, the basis in futures refers to the difference between the spot price of an asset and its corresponding futures price. For example, if the current spot price of crude oil is $70 per barrel and the futures price for delivery in three months is $75 per barrel, the basis is -$5. This concept is crucial for traders and investors to assess arbitrage opportunities and manage risk in futures contracts. Basis fluctuations occur due to factors such as storage costs, interest rates, and market supply and demand dynamics. A positive basis indicates that the spot price is higher than the futures price, often signaling short-term shortages or increased demand. Understanding basis behavior helps market participants implement effective hedging strategies and improve their forecasting of asset price movements.

Table of Comparison

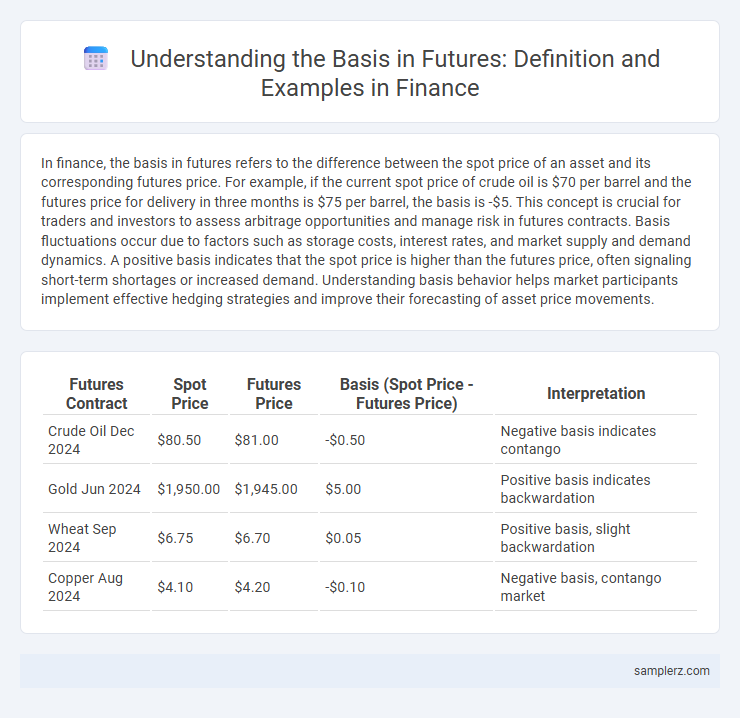

| Futures Contract | Spot Price | Futures Price | Basis (Spot Price - Futures Price) | Interpretation |

|---|---|---|---|---|

| Crude Oil Dec 2024 | $80.50 | $81.00 | -$0.50 | Negative basis indicates contango |

| Gold Jun 2024 | $1,950.00 | $1,945.00 | $5.00 | Positive basis indicates backwardation |

| Wheat Sep 2024 | $6.75 | $6.70 | $0.05 | Positive basis, slight backwardation |

| Copper Aug 2024 | $4.10 | $4.20 | -$0.10 | Negative basis, contango market |

Understanding Basis in Futures Contracts

Basis in futures contracts represents the difference between the spot price of an asset and its futures price, reflecting the cost of carry and market expectations. A positive basis, known as backwardation, occurs when the spot price exceeds the futures price, indicating demand for immediate delivery. Conversely, a negative basis, called contango, signifies futures prices are higher than the spot price, often due to storage costs or interest rates influencing the futures premium.

Key Components Affecting Futures Basis

The futures basis is primarily influenced by the spot price of the underlying asset and the futures contract price, reflecting the cost of carry, which includes storage costs, interest rates, and dividends. Market supply and demand dynamics, as well as time to contract expiration, also play critical roles in shaping the basis. Understanding these key components enables traders to predict convergence between spot and futures prices at settlement.

Real-World Example: Basis in Commodity Futures

In the crude oil market, the basis represents the price difference between the spot price of West Texas Intermediate (WTI) crude and its futures contract price traded on the NYMEX. For instance, if the spot price of WTI crude is $70 per barrel and the nearby futures contract is priced at $72 per barrel, the basis is -$2, reflecting a contango market structure. Traders and producers closely monitor this basis to decide on hedging strategies and optimal timing for selling or buying physical commodities.

How Basis Changes Over Time

The basis in futures is the difference between the spot price of an asset and its futures price, which fluctuates as expiration approaches due to factors like storage costs, interest rates, and supply-demand dynamics. Over time, the basis typically converges towards zero as the futures contract nears settlement, reflecting the alignment of spot and futures prices. Market events, seasonality, and changes in carrying costs cause the basis to widen or narrow, impacting hedging effectiveness and trading strategies.

Basis Risk and Its Financial Implications

Basis risk in futures trading refers to the risk that the difference between the spot price of an asset and the futures price, known as the basis, will change unfavorably before the contract's expiration. This risk impacts hedgers who rely on futures contracts to lock in prices, as an unexpected basis fluctuation can lead to ineffective hedges and potential financial losses. Understanding and managing basis risk is crucial for optimizing hedge strategies and minimizing adverse impacts on portfolio value.

Calculating Basis: Step-by-Step Example

The basis in futures trading is calculated by subtracting the futures price from the spot price of the underlying asset. For example, if the spot price of crude oil is $70 per barrel and the futures price for the same delivery month is $68, the basis is $2 (70 - 68). A positive basis indicates contango, while a negative basis signals backwardation, influencing hedging and arbitrage decisions.

Seasonal Patterns in Futures Basis

Seasonal patterns in futures basis often occur in agricultural commodities like corn and soybeans, where basis tends to strengthen approaching harvest due to increased supply and weaken during planting seasons when demand for storage rises. For example, corn futures basis typically narrows in the fall as local cash prices align with futures prices amid harvest influx, while in spring, basis may widen reflecting elevated storage costs and market uncertainty. Understanding these seasonal basis trends enables traders to optimize hedging strategies and capitalize on timing advantages in futures contracts.

Basis in Hedging Strategies

Basis in futures refers to the difference between the spot price of an asset and its futures price, playing a critical role in hedging strategies by indicating the cost or benefit of carrying the asset until the contract's expiration. Effective basis management allows producers and consumers to minimize risk by locking in prices while anticipating the convergence of futures and spot prices at contract maturity. Monitoring basis fluctuations helps optimize hedge effectiveness and predict potential gains or losses arising from price movements in the underlying asset.

Impact of Supply and Demand on Basis

The basis in futures, defined as the difference between the spot price and futures price of a commodity, is heavily influenced by supply and demand dynamics. When demand for the physical asset increases relative to available supply, the spot price often rises faster than futures prices, causing a narrowing or even a negative basis. Conversely, an oversupply situation tends to depress spot prices relative to futures, resulting in a wider, positive basis.

Basis and Arbitrage Opportunities in Futures Markets

Basis in futures markets is the difference between the spot price of an asset and its futures price, often reflecting storage costs, interest rates, and convenience yields. A positive basis indicates futures prices exceed spot prices, creating potential arbitrage opportunities by buying the asset in spot markets and selling futures contracts simultaneously. Traders exploit basis discrepancies to earn riskless profits until the basis converges at contract expiration, ensuring market efficiency.

example of basis in futures Infographic

samplerz.com

samplerz.com