Negative convexity in mortgage-backed securities (MBS) arises when prepayment risk causes the price-yield relationship to bend inward, deviating from the positive convexity seen in traditional bonds. This phenomenon occurs because homeowners tend to refinance or prepay their mortgages when interest rates fall, reducing the expected cash flows for investors. As a result, the duration of the MBS shortens, causing prices to increase less than expected when yields decline. In an MBS with negative convexity, the price increases at a slower pace during falling interest rates but decreases more rapidly when rates rise. This asymmetry in price movement exposes investors to higher risk compared to traditional fixed income securities. MBS investors must account for this convexity behavior when assessing portfolio risk and volatility under changing interest rate environments.

Table of Comparison

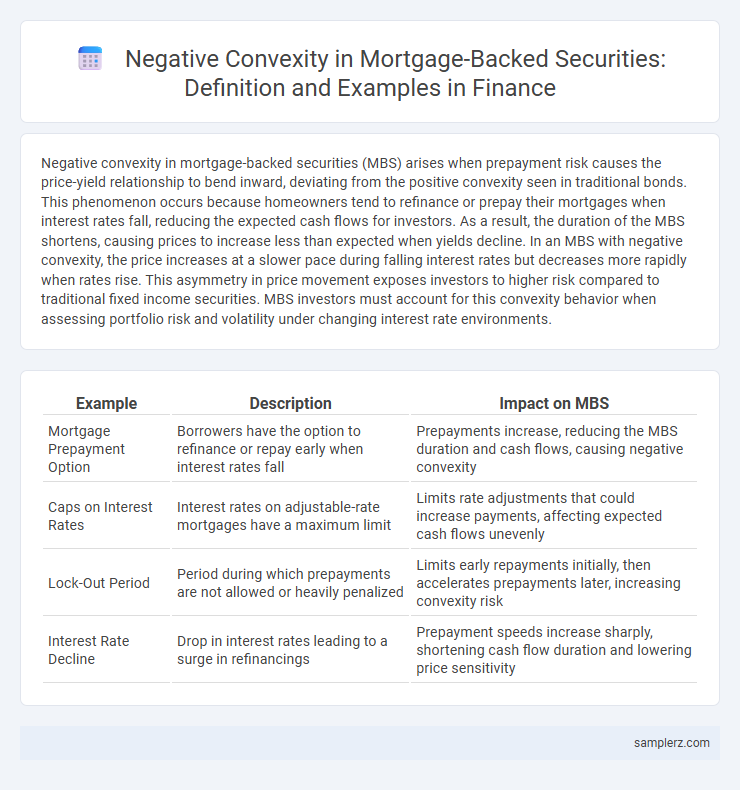

| Example | Description | Impact on MBS |

|---|---|---|

| Mortgage Prepayment Option | Borrowers have the option to refinance or repay early when interest rates fall | Prepayments increase, reducing the MBS duration and cash flows, causing negative convexity |

| Caps on Interest Rates | Interest rates on adjustable-rate mortgages have a maximum limit | Limits rate adjustments that could increase payments, affecting expected cash flows unevenly |

| Lock-Out Period | Period during which prepayments are not allowed or heavily penalized | Limits early repayments initially, then accelerates prepayments later, increasing convexity risk |

| Interest Rate Decline | Drop in interest rates leading to a surge in refinancings | Prepayment speeds increase sharply, shortening cash flow duration and lowering price sensitivity |

Understanding Negative Convexity in Mortgage-Backed Securities

Negative convexity in mortgage-backed securities (MBS) occurs when prepayment options embedded in the underlying mortgages cause the bond's duration to shorten as interest rates decline, limiting price appreciation. This behavior contrasts with traditional bonds, where prices typically increase more rapidly as rates drop, exposing investors to reinvestment risk when borrowers refinance early. Understanding this dynamic is critical for managing the interest rate sensitivity and risk profile of MBS portfolios in fluctuating rate environments.

Key Characteristics of MBS with Negative Convexity

Mortgage-backed securities (MBS) with negative convexity exhibit price declines that accelerate as interest rates fall due to increased prepayment risk from borrowers refinancing their mortgages. Key characteristics include a reduction in duration when interest rates drop, leading to heightened price volatility and reinvestment risk for investors. These securities often feature embedded call options that limit price appreciation, causing traditional duration measures to underestimate interest rate sensitivity.

Negative Convexity: How Prepayments Affect Returns

Negative convexity in mortgage-backed securities (MBS) occurs when prepayments accelerate as interest rates drop, reducing the expected duration and potential gains from price appreciation. This prepayment risk diminishes the security's sensitivity to interest rate declines, causing estimated returns to decrease despite favorable rate movements. Investors must account for this effect, as it complicates hedging strategies and impacts portfolio yield stability.

Real-World Example: MBS Under Falling Interest Rates

Mortgage-backed securities (MBS) exhibit negative convexity when interest rates fall, causing prepayment speeds to increase as homeowners refinance their mortgages. For instance, during the 2019 Federal Reserve rate cuts, many MBS investors faced reinvestment risk as prepayments surged, shortening the average life of the securities and reducing their duration benefit. This dynamic led to price appreciation limits despite declining rates, exemplifying the challenges of negative convexity in real-world MBS portfolios.

Comparing Positive vs Negative Convexity in MBS

Mortgage-backed securities (MBS) with negative convexity experience price declines when interest rates fall due to increased prepayment risks, contrasting with positive convexity where prices rise as rates drop. Negative convexity in MBS arises because borrowers tend to refinance during declining rates, shortening the security's duration and capping price appreciation. In comparison, MBS with positive convexity benefit from longer durations and greater price sensitivity to interest rate changes without the prepayment constraint.

Yield Curve Impacts on Mortgage-Backed Securities

Negative convexity in mortgage-backed securities (MBS) occurs when rising interest rates lead to slower prepayment speeds, causing the MBS price to decline more than a comparable Treasury bond. This effect distorts the yield curve impact, flattening the yield curve as investors demand higher yields for MBS risk relative to Treasuries. Consequently, MBS durations increase during rate hikes, intensifying yield curve risk and complicating portfolio hedging strategies.

Duration Risk in MBS with Negative Convexity

Negative convexity in mortgage-backed securities (MBS) arises when prepayment options embedded in mortgages cause duration to increase as interest rates rise, heightening duration risk for investors. This phenomenon occurs because higher interest rates reduce prepayment speeds, extending the life of the MBS and increasing its sensitivity to rate changes. As a result, portfolios holding MBS with negative convexity face greater exposure to interest rate volatility and potential losses during rate increases.

Investor Challenges with Negative Convexity in MBS

Negative convexity in mortgage-backed securities (MBS) occurs when prepayment risk causes price depreciation to accelerate as interest rates fall, creating challenges for investors attempting to hedge interest rate exposure. Investors face difficulties in managing duration and convexity risk because MBS prices can increase less than expected during rate declines and drop more sharply during rate rises. This negative convexity leads to uncertain cash flows and increases volatility in portfolio performance, complicating risk management and valuation processes.

Case Study: Negative Convexity During Quantitative Easing

During the quantitative easing period from 2008 to 2014, mortgage-backed securities (MBS) exhibited pronounced negative convexity as falling interest rates prompted widespread prepayment risk. Investors in agency MBS faced asymmetric price appreciation, where gains were limited by increased prepayment speeds while losses amplified with rising yields. This case study highlights how Federal Reserve bond-buying programs intensified negative convexity, complicating duration management and hedging strategies for fixed income portfolios.

Risk Management Strategies for Negative Convexity in MBS

Negative convexity in mortgage-backed securities (MBS) arises when prepayment risk causes duration to shorten as interest rates decline, increasing price volatility for investors. Risk management strategies include implementing dynamic hedging techniques using interest rate derivatives such as swaptions and Treasury futures to offset adverse price movements. Portfolio diversification and stress testing models also play critical roles in mitigating the impact of negative convexity on MBS valuations and overall credit risk exposure.

example of Negative convexity in mortgage-backed security Infographic

samplerz.com

samplerz.com