Shariah-compliant sukuk are financial certificates that adhere to Islamic law by avoiding interest-based transactions and investments in prohibited industries like alcohol or gambling. One prominent example is the Ijara sukuk, which involves leasing assets where investors receive returns derived from lease payments instead of interest. This structure ensures compliance with Shariah principles by linking returns to tangible assets and legitimate business activities. Another example is the Mudarabah sukuk, where investors provide capital to an entrepreneur who manages the project and shares profits according to a pre-agreed ratio. This partnership-based certification avoids fixed interest payments and aligns with the risk-sharing concept central to Islamic finance. Both sukuk types demonstrate ethical investment opportunities compliant with Islamic economic guidelines, promoting transparency and fair returns.

Table of Comparison

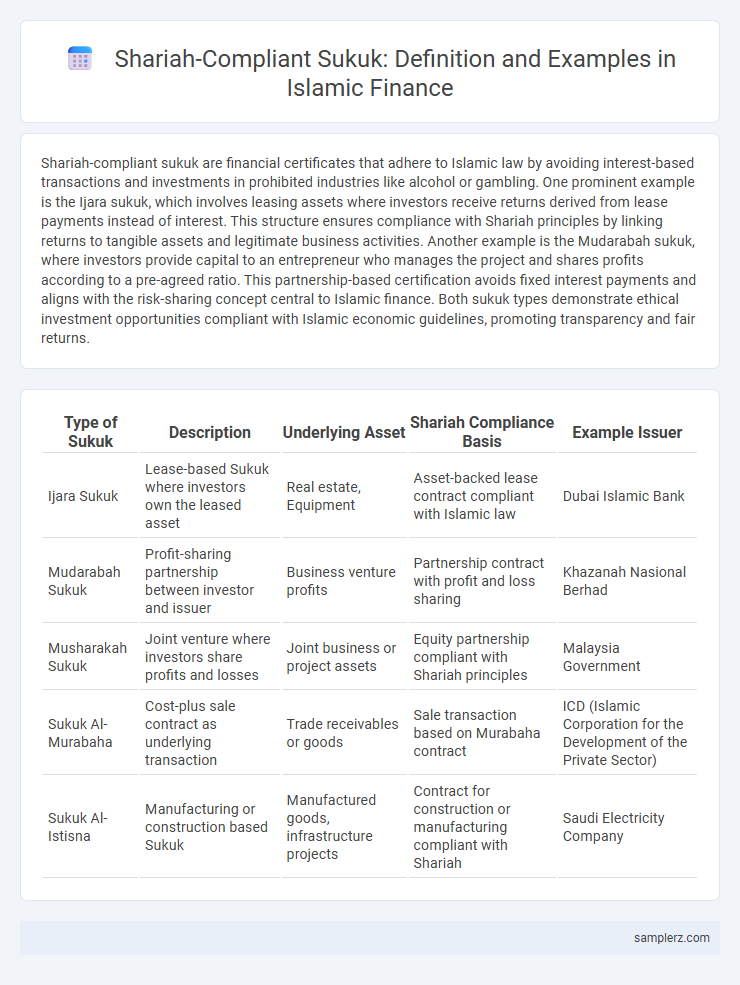

| Type of Sukuk | Description | Underlying Asset | Shariah Compliance Basis | Example Issuer |

|---|---|---|---|---|

| Ijara Sukuk | Lease-based Sukuk where investors own the leased asset | Real estate, Equipment | Asset-backed lease contract compliant with Islamic law | Dubai Islamic Bank |

| Mudarabah Sukuk | Profit-sharing partnership between investor and issuer | Business venture profits | Partnership contract with profit and loss sharing | Khazanah Nasional Berhad |

| Musharakah Sukuk | Joint venture where investors share profits and losses | Joint business or project assets | Equity partnership compliant with Shariah principles | Malaysia Government |

| Sukuk Al-Murabaha | Cost-plus sale contract as underlying transaction | Trade receivables or goods | Sale transaction based on Murabaha contract | ICD (Islamic Corporation for the Development of the Private Sector) |

| Sukuk Al-Istisna | Manufacturing or construction based Sukuk | Manufactured goods, infrastructure projects | Contract for construction or manufacturing compliant with Shariah | Saudi Electricity Company |

Understanding Shariah Compliance in Sukuk

Shariah compliance in sukuk is ensured by avoiding interest (riba) and structuring transactions based on profit-sharing or asset-backed models, such as ijara (leasing), mudarabah (partnership), and musharakah (joint venture). Sukuk represent ownership in tangible assets or investments, aligning financial returns with underlying assets and adhering to Islamic ethical standards. This structure promotes risk-sharing between issuer and investors, contrasting conventional bonds that rely on fixed interest payments.

Key Principles of Shariah-Compliant Sukuk

Shariah-compliant sukuk strictly adhere to Islamic finance principles, including the prohibition of interest (riba), ensuring asset-backing, and risk-sharing between investors and issuers. Key principles involve the underlying assets being tangible and halal, profit-and-loss sharing mechanisms, and avoiding uncertainty (gharar) and speculation. These sukuk structures, such as Ijarah (leasing) and Musharakah (partnership), provide ethical investment alternatives aligned with Islamic law.

Common Structures of Shariah-Compliant Sukuk

Common structures of Shariah-compliant sukuk include Ijarah, Musharakah, and Murabaha, each adhering to Islamic finance principles by avoiding interest and ensuring asset-backed transactions. Ijarah sukuk represent lease agreements where investors earn rental income, Musharakah involves joint partnership with profit-and-loss sharing, and Murabaha is based on cost-plus financing of tangible assets. These structures provide ethical investment opportunities aligned with Islamic law while supporting liquidity and capital mobilization in the Islamic financial markets.

Murabaha Sukuk: An Islamic Financing Example

Murabaha Sukuk represents an Islamic financing structure where the issuer sells a tangible asset to investors at a deferred price, including a profit margin, ensuring compliance with Shariah principles prohibiting interest (riba). Investors effectively purchase ownership of the asset through certificates and receive payments derived from the asset's Murabaha sale contract, aligning returns with real economic activities. This type of Sukuk is widely used to finance trade and asset acquisition, offering risk-sharing and transparency in accordance with Islamic law.

Ijarah Sukuk: Asset Leasing in Practice

Ijarah Sukuk exemplify Shariah-compliant finance by structuring asset leasing contracts that generate returns through rent instead of interest, aligning with Islamic law principles. Investors in Ijarah Sukuk gain ownership of tangible assets leased to a lessee, ensuring profit-sharing is tied to real economic activity and asset performance. This method fosters transparency and ethical investment, avoiding uncertainty and prohibited elements like riba (interest).

Musharakah Sukuk: Partnership-Based Models

Musharakah Sukuk represent partnership-based models where investors and project sponsors share profits and losses according to pre-agreed ratios, aligning with Shariah principles prohibiting interest (riba). These Sukuk structures enable collaborative financing for infrastructure, real estate, and business ventures by pooling capital and managing assets jointly while ensuring risk-sharing and ethical investment. Musharakah Sukuk are widely utilized in Islamic finance markets, promoting transparency, equity participation, and compliance with Islamic law.

Mudarabah Sukuk: Profit-Sharing Structures

Mudarabah Sukuk represents a profit-sharing structure where investors provide capital to an entrepreneur or project manager, sharing profits based on a pre-agreed ratio while losses are borne solely by the investors. This Shariah-compliant instrument aligns with Islamic finance principles by avoiding interest (riba) and emphasizing risk-sharing and ethical investment. Examples include sovereign Mudarabah Sukuk issued by governments and corporate Mudarabah Sukuk utilized by firms to finance projects compliant with Islamic law.

Wakalah Sukuk: Agency-Based Mechanisms

Wakalah Sukuk utilize agency-based mechanisms where the issuer acts as an agent (wakeel) on behalf of investors to manage the underlying assets. This structure aligns with Shariah principles by avoiding interest (riba) and ensures profit generation through trade and asset ownership. Investments in Wakalah Sukuk offer ethical returns by emphasizing transparency, risk-sharing, and compliance with Islamic finance regulations.

Real-World Case Studies of Shariah-Compliant Sukuk

The real-world case of the Dubai Islamic Bank Sukuk issuance in 2020 exemplifies Shariah-compliant financing by adhering to profit-sharing principles and asset-backed structures, generating $500 million through a Murabaha contract. Malaysia's sovereign Sukuk program, with over $40 billion issued since inception, demonstrates scalable Shariah-compliant investment using Ijarah and Wakalah contracts, effectively balancing risk and return. The Etihad Airways Sukuk, raised in 2014, highlights industry-specific Shariah-compliant funding by leveraging Sukuk Istisna certificates to finance aircraft purchases while ensuring compliance with Islamic finance principles.

Ensuring Ongoing Shariah Compliance in Sukuk Issuance

Ensuring ongoing Shariah compliance in sukuk issuance involves continuous monitoring by a dedicated Shariah supervisory board to verify that all financial activities align with Islamic principles, such as prohibiting interest (riba) and ensuring asset-backed structures. Regular audits and compliance reviews help maintain transparency and adherence to Shariah standards throughout the sukuk's lifecycle, mitigating risks associated with non-compliance. Issuers often engage Shariah scholars and use standardized guidelines from bodies like AAOIFI to uphold integrity and investor confidence in the sukuk market.

example of shariah-compliant in sukuk Infographic

samplerz.com

samplerz.com