A lockup period in a hedge fund is a predetermined timeframe during which investors are prohibited from redeeming or withdrawing their capital. This mechanism helps stabilize the fund's capital base, ensuring managers have sufficient time to execute long-term investment strategies without sudden liquidity demands. For example, a hedge fund might impose a one-year lockup period after an investor's initial subscription, meaning the investor cannot redeem shares until that period expires. During the lockup, investors typically capitalize on potential gains as the fund aims for optimized returns without interruption. The data surrounding lockups often highlights that funds with longer lockup periods tend to pursue less liquid and higher-return investments, which can lead to improved performance metrics. Entities such as institutional investors or high-net-worth individuals are often attracted to hedge funds with lockup provisions due to their focus on sustained capital growth and strategic asset allocation.

Table of Comparison

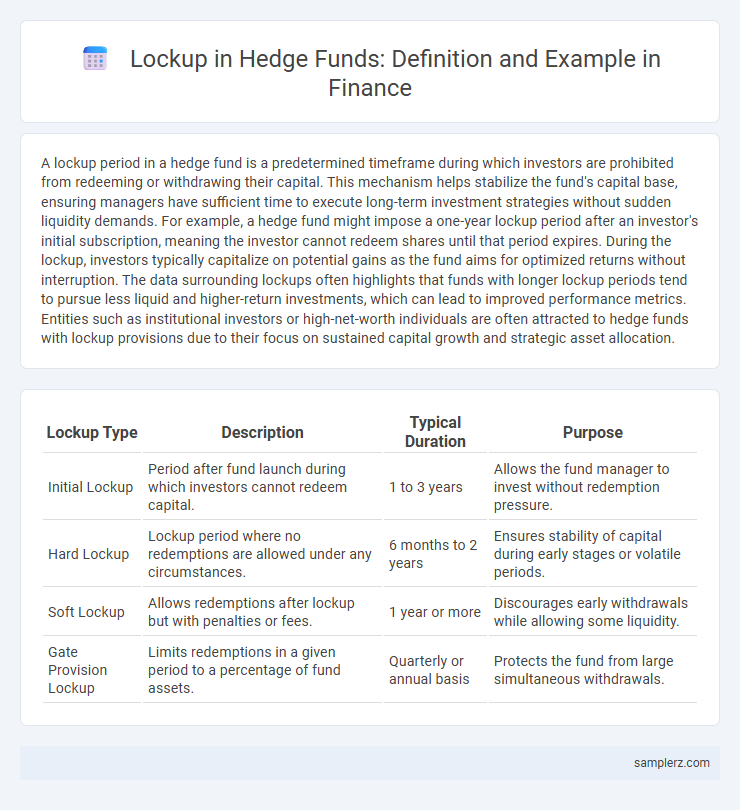

| Lockup Type | Description | Typical Duration | Purpose |

|---|---|---|---|

| Initial Lockup | Period after fund launch during which investors cannot redeem capital. | 1 to 3 years | Allows the fund manager to invest without redemption pressure. |

| Hard Lockup | Lockup period where no redemptions are allowed under any circumstances. | 6 months to 2 years | Ensures stability of capital during early stages or volatile periods. |

| Soft Lockup | Allows redemptions after lockup but with penalties or fees. | 1 year or more | Discourages early withdrawals while allowing some liquidity. |

| Gate Provision Lockup | Limits redemptions in a given period to a percentage of fund assets. | Quarterly or annual basis | Protects the fund from large simultaneous withdrawals. |

Understanding Lockup Periods in Hedge Funds

Lockup periods in hedge funds refer to the predetermined timeframe during which investors are restricted from withdrawing their capital, often ranging from one to five years. This mechanism provides fund managers with stable capital to pursue long-term investment strategies without the pressure of sudden redemptions. Understanding lockup periods is crucial for investors to align their liquidity needs with the fund's investment horizon and risk profile.

Common Examples of Hedge Fund Lockup Structures

Common examples of hedge fund lockup structures include initial lockup periods ranging from six months to two years, during which investors cannot redeem their shares, ensuring fund stability and capital commitment. Soft lockups allow redemptions after the initial period but impose redemption fees if investors exit too early, aligning investor and manager interests. Hard lockups entirely restrict redemptions for a fixed term, typically seen in funds employing illiquid or complex strategies to maintain long-term investment horizons.

Purpose of Lockups in Hedge Fund Investments

Lockups in hedge fund investments serve to secure capital commitments by restricting investor redemptions for a predefined period, enhancing fund stability and enabling long-term strategy execution. This mechanism allows fund managers to deploy capital confidently in illiquid assets without the pressure of sudden withdrawal requests. By minimizing redemption risk, lockups foster alignment between investor interests and the fund's performance goals.

Case Study: Classic 1-Year Lockup with Quarterly Redemptions

A classic 1-year lockup in hedge funds restricts investor withdrawals for the first 12 months, aligning with quarterly redemption windows that follow. This structure helps hedge fund managers maintain capital stability and strategically manage portfolio liquidity, minimizing forced asset sales during volatile markets. An example includes a fund allowing redemptions only every quarter after the lockup, ensuring predictable cash flows for reinvestment and risk management.

Rolling vs. Hard Lockup: Key Differences

Rolling lockups in hedge funds allow investors to redeem shares periodically after an initial lockup period, offering greater liquidity flexibility compared to hard lockups. Hard lockups require investors to commit their capital for a fixed duration with no redemption allowed, enhancing fund stability and enabling long-term investment strategies. Understanding these differences helps investors balance liquidity needs against potential returns and fund risk profiles.

Example: Soft Lockup with Early Withdrawal Penalties

A soft lockup in hedge funds typically restricts investor redemptions for a specified period, such as 12 to 24 months, while allowing early withdrawals subject to penalties, often a percentage fee deducted from the redeemed amount. This structure balances investor liquidity preferences with the fund's need for stable capital to execute long-term strategies effectively. Early withdrawal penalties can range from 1% to 5%, decreasing incrementally over the lockup duration to discourage premature exits and protect remaining investors.

How Lockup Terms Impact Hedge Fund Liquidity

Lockup terms in hedge funds restrict investors from redeeming shares for a specified period, directly reducing immediate liquidity availability. These periods allow fund managers to invest in less liquid assets without facing sudden redemption pressures, enhancing long-term performance stability. Prolonged lockup durations often correlate with increased liquidity risk but can result in higher returns due to more strategic asset allocation.

Notable Hedge Funds with Strict Lockup Agreements

Notable hedge funds like Renaissance Technologies and Bridgewater Associates enforce strict lockup agreements, requiring investors to commit capital for extended periods, often ranging from one to three years. These lockups prevent premature redemptions, enabling fund managers to execute long-term strategies without liquidity pressures, optimizing portfolio stability and performance. Such agreements are critical in maintaining hedge fund operational efficiency and safeguarding investor interests by aligning time horizons.

Investor Considerations Before Accepting Lockup Periods

Investors should evaluate the lockup period length to assess liquidity constraints and potential impact on portfolio flexibility when committing capital to hedge funds. Understanding the lockup terms, including any early withdrawal penalties and the fund's typical redemption windows, is crucial for managing cash flow needs and risk tolerance. Careful review of the hedge fund's performance history during previous lockup periods helps gauge whether the expected returns justify the temporary illiquidity.

Trends in Hedge Fund Lockup Period Structures

Hedge fund lockup periods increasingly range from three months to three years, reflecting investors' demand for both liquidity and sustained asset management. Recent trends highlight flexible lockups with intermittent redemption windows to balance capital commitment and investor access. These evolving structures aim to optimize fund stability while accommodating shifting market conditions and investor preferences.

example of lockup in hedge fund Infographic

samplerz.com

samplerz.com