A collar in equity finance is a risk management strategy that involves holding the underlying stock while simultaneously buying a protective put option and selling a call option. This strategy limits potential losses on the stock by the put's strike price while capping potential gains at the call's strike price. The collar is typically used by investors to protect gains or limit downside risk during volatile market conditions. In an example, suppose an investor owns 1,000 shares of a stock currently trading at $50 per share. The investor buys put options with a strike price of $45 and sells call options with a strike price of $55. This setup ensures that any losses below $45 per share are covered by the put, while gains above $55 per share are forfeited to the call buyer, effectively locking in a profit range between these two prices.

Table of Comparison

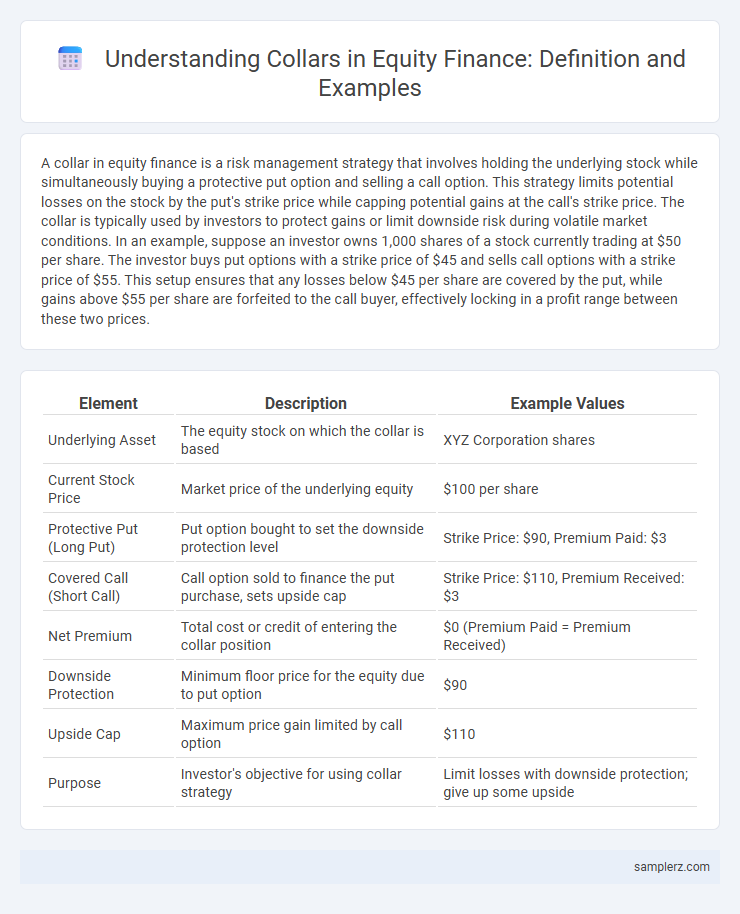

| Element | Description | Example Values |

|---|---|---|

| Underlying Asset | The equity stock on which the collar is based | XYZ Corporation shares |

| Current Stock Price | Market price of the underlying equity | $100 per share |

| Protective Put (Long Put) | Put option bought to set the downside protection level | Strike Price: $90, Premium Paid: $3 |

| Covered Call (Short Call) | Call option sold to finance the put purchase, sets upside cap | Strike Price: $110, Premium Received: $3 |

| Net Premium | Total cost or credit of entering the collar position | $0 (Premium Paid = Premium Received) |

| Downside Protection | Minimum floor price for the equity due to put option | $90 |

| Upside Cap | Maximum price gain limited by call option | $110 |

| Purpose | Investor's objective for using collar strategy | Limit losses with downside protection; give up some upside |

Understanding the Basics of a Collar Strategy in Equity

A collar strategy in equity involves holding shares of a stock while simultaneously buying a protective put option and selling a call option with higher strike price to limit downside risk and cap potential gains. For example, an investor owning 100 shares of XYZ Corp at $50 may buy a put option at $45 and sell a call option at $55, establishing a predefined price range that protects against loss while limiting upside. This strategy is effective in volatile markets to manage risk without completely sacrificing profit opportunities.

Key Components of an Equity Collar Example

An equity collar involves holding the underlying stock while simultaneously buying a protective put option and selling a call option to limit downside risk and cap potential gains. Key components include the strike price of the put, which sets the floor price, and the strike price of the call, which establishes the ceiling price, creating a predefined range for the stock's value. This strategy effectively manages risk exposure and preserves capital within specified limits in volatile equity markets.

Real-World Scenario: Implementing a Collar in Stock Investments

An investor holding 1,000 shares of a technology stock valued at $50 per share implements a collar by simultaneously buying put options with a strike price of $45 and selling call options with a strike price of $55 to hedge against downside risk while capping upside potential. This strategy effectively sets a protective floor at $45 and a selling ceiling at $55, limiting losses below the put strike price and gains above the call strike price. By using this collar, the investor balances risk management and cost, often financing the put purchase through the premium received from selling the call options.

Step-by-Step Guide: Setting Up a Collar with a Specific Stock

To set up a collar with a specific stock, first purchase the desired shares and simultaneously buy a protective put option at a strike price below the current market value to limit downside risk. Next, sell a call option at a strike price above the market price to generate premium income, effectively funding the put purchase and capping the upside potential. Monitor the position regularly and adjust the strike prices or expiration dates as needed to maintain the desired risk-reward profile.

Collar Strategy Example: Limiting Downside and Upside in Equity

A collar strategy in equity involves holding the underlying stock while simultaneously buying a protective put and selling a covered call, effectively limiting losses and capping gains within a specified price range. For example, an investor owning 100 shares of a stock priced at $50 may buy a put option with a strike price of $45 and sell a call option with a strike price of $55, creating a downside floor at $45 and an upside ceiling at $55. This approach mitigates risk by protecting against large declines while sacrificing some potential upside, making it a balanced strategy for managing equity exposure.

Risk Management: How a Collar Protects Your Equity Position

A collar in equity involves holding the underlying stock while simultaneously buying a protective put option and selling a call option, effectively setting a range for potential losses and gains. This strategy limits downside risk by establishing a floor price through the put, while capping upside potential via the sold call, thus providing a risk-managed approach to stock ownership. Investors utilize collars to protect their equity position against significant market declines without completely giving up upside exposure, enhancing portfolio stability.

Calculating Profit and Loss in a Typical Equity Collar Transaction

In a typical equity collar transaction, profit and loss calculations hinge on the simultaneous purchase of a protective put option and the sale of a call option, both based on the same underlying stock. The maximum loss is limited by the put strike price minus the stock purchase price and net premiums paid, while the maximum gain is capped by the call strike price minus the stock purchase price plus net premiums received. Monitoring these strike prices and option premiums is essential for accurately assessing potential returns and risks in collar strategies.

Common Stocks Used in Equity Collar Examples

Common stocks frequently used in equity collar examples include large-cap companies like Apple, Microsoft, and Amazon, which offer liquidity and price volatility suitable for hedging. Investors typically buy put options and sell call options on these stocks to establish downside protection while limiting upside gains. This strategy stabilizes portfolio value by managing risk in volatile market conditions, especially for widely held tech stocks.

Comparing Equity Collars to Other Hedging Strategies

Equity collars combine buying protective puts and selling covered calls to limit downside risk while capping upside potential, making them cost-effective compared to outright put purchases. Unlike simple stop-loss orders, collars provide a structured hedge that can generate premium income, enhancing risk-adjusted returns. Investors favor collars over synthetic puts or futures contracts due to their customizable strike prices and lower margin requirements, resulting in more precise risk management in volatile equity markets.

Considerations and Risks When Using a Collar in Equities

A collar in equities involves simultaneously buying a protective put and selling a call option to limit downside risk while capping upside potential. Investors must consider potential opportunity costs from capped gains and the risk of unforeseen market moves that exceed collar parameters. Counterparty risk and liquidity of options markets also affect the effectiveness and execution of collar strategies.

example of collar in equity Infographic

samplerz.com

samplerz.com