Fintech innovation is exemplified by the rise of blockchain technology, which revolutionizes financial transactions through decentralized ledgers. Companies like Ripple utilize blockchain to enable faster and more secure cross-border payments, reducing costs for banks and consumers. This technology enhances transparency and efficiency, making financial services more accessible on a global scale. Another significant fintech innovation is the use of artificial intelligence (AI) in credit scoring and risk assessment. Firms such as Zest AI leverage machine learning algorithms to analyze vast amounts of financial data, providing more accurate credit evaluations than traditional methods. This approach helps lenders make better-informed decisions, expanding access to credit for underserved populations while minimizing default risks.

Table of Comparison

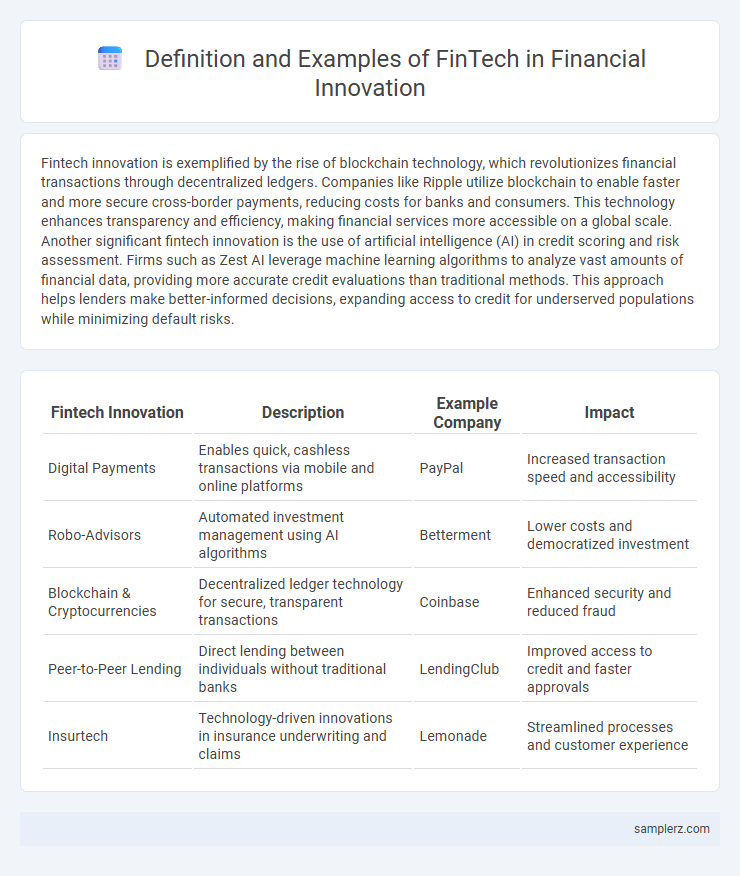

| Fintech Innovation | Description | Example Company | Impact |

|---|---|---|---|

| Digital Payments | Enables quick, cashless transactions via mobile and online platforms | PayPal | Increased transaction speed and accessibility |

| Robo-Advisors | Automated investment management using AI algorithms | Betterment | Lower costs and democratized investment |

| Blockchain & Cryptocurrencies | Decentralized ledger technology for secure, transparent transactions | Coinbase | Enhanced security and reduced fraud |

| Peer-to-Peer Lending | Direct lending between individuals without traditional banks | LendingClub | Improved access to credit and faster approvals |

| Insurtech | Technology-driven innovations in insurance underwriting and claims | Lemonade | Streamlined processes and customer experience |

Revolutionary Payment Solutions in Fintech

Revolutionary payment solutions in fintech, such as blockchain-based platforms like Ripple and decentralized finance (DeFi) applications, are transforming cross-border transactions by reducing costs and settlement times. Mobile payment technologies like Apple Pay and Google Wallet enable seamless, contactless payments with enhanced security through biometric authentication. These innovations promote financial inclusion by enabling unbanked populations to access digital financial services via smartphones and decentralized networks.

Digital Lending Platforms Transforming Credit

Digital lending platforms leverage artificial intelligence and big data analytics to streamline credit assessment, enabling faster loan approvals and personalized interest rates. These platforms increase financial inclusion by providing access to credit for underserved populations without traditional credit histories. Enhanced by blockchain technology, digital lending ensures transparent and secure transactions, reducing fraud and operational costs.

The Rise of Robo-Advisors in Wealth Management

Robo-advisors have transformed wealth management by leveraging artificial intelligence and machine learning to provide automated, personalized investment advice at lower costs. Companies like Betterment and Wealthfront utilize algorithms to optimize portfolio allocation, risk assessment, and tax-loss harvesting, making sophisticated financial planning accessible to a broader population. The rise of robo-advisors reflects a paradigm shift in financial technology, driving efficiency and democratizing wealth management services.

Blockchain Applications in Financial Services

Blockchain applications in financial services revolutionize transaction transparency and security by enabling decentralized ledgers that reduce fraud and streamline settlements. Smart contracts automate complex financial agreements, cutting costs and enhancing efficiency in areas like lending, insurance, and asset management. Leading fintech companies leverage blockchain technology to offer rapid cross-border payments and improved regulatory compliance through immutable data records.

Insurtech: Innovating the Insurance Industry

Insurtech companies leverage artificial intelligence, machine learning, and big data analytics to transform traditional insurance underwriting, claims processing, and customer engagement. Platforms like Lemonade use AI-driven chatbots to provide instant policy issuance and claim settlements, significantly reducing operational costs and improving customer experience. Advanced risk assessment models enable personalized insurance products, boosting efficiency and fostering innovation within the insurance sector.

Peer-to-Peer Lending: Redefining Borrowing

Peer-to-peer lending platforms like LendingClub and Prosper have transformed traditional borrowing by directly connecting individual borrowers with investors, bypassing conventional banks. These fintech innovations utilize advanced algorithms and data analytics to assess credit risk more efficiently, enabling faster loan approvals and competitive interest rates. By decentralizing lending, peer-to-peer platforms increase financial inclusion and offer alternative financing solutions for borrowers underserved by traditional financial institutions.

AI-Driven Risk Assessment Tools

AI-driven risk assessment tools revolutionize fintech by leveraging machine learning algorithms to analyze vast datasets, enabling precise credit scoring and fraud detection. These tools enhance decision-making processes through real-time risk evaluation and predictive analytics, reducing default rates and improving loan approval accuracy. Leading fintech companies integrate natural language processing and neural networks to identify subtle patterns in financial behavior, optimizing portfolio management and compliance monitoring.

Mobile Banking and Digital Wallet Innovations

Mobile banking platforms such as Chime leverage AI-driven personalization and biometric security to enhance user experience and safeguard transactions. Digital wallets like Apple Pay use tokenization technology, enabling secure, contactless payments worldwide while integrating loyalty programs for added convenience. These fintech innovations significantly increase accessibility and reduce transaction friction for consumers across diverse financial ecosystems.

RegTech for Compliance and Fraud Prevention

RegTech innovations leverage AI-powered analytics and blockchain technology to enhance compliance monitoring and detect fraudulent transactions in real-time. Solutions such as automated KYC verification and continuous transaction surveillance reduce regulatory risks and improve operational efficiency. Leading platforms like ComplyAdvantage and Trulioo exemplify how RegTech drives transparent, secure, and compliant financial ecosystems.

Crowdfunding Platforms: Empowering Entrepreneurs

Crowdfunding platforms like Kickstarter and Indiegogo revolutionize finance by enabling entrepreneurs to raise capital directly from a global audience, bypassing traditional financial intermediaries. These platforms utilize blockchain technology and smart contracts to increase transparency, reduce funding risks, and ensure secure transactions. By democratizing access to investment opportunities, crowdfunding fosters innovation and accelerates the growth of startups worldwide.

example of fintech in innovation Infographic

samplerz.com

samplerz.com