Churning in brokerage refers to the unethical practice where a broker excessively buys and sells securities in a client's account primarily to generate commissions rather than to meet the client's investment objectives. For example, a broker might frequently trade stocks or mutual funds within a short time frame, disregarding the client's risk tolerance and financial goals. This activity can result in significant transaction costs and taxes for the client, diminishing overall investment returns. Regulatory bodies like the SEC monitor trading patterns to detect churning by analyzing the frequency and volume of trades relative to the client's portfolio size and investment strategy. Data shows that churning often occurs in accounts with high turnover rates, where commissions disproportionately impact the account's value. Investors should review trade statements and consult compliance reports to identify possible churning activities and protect their assets.

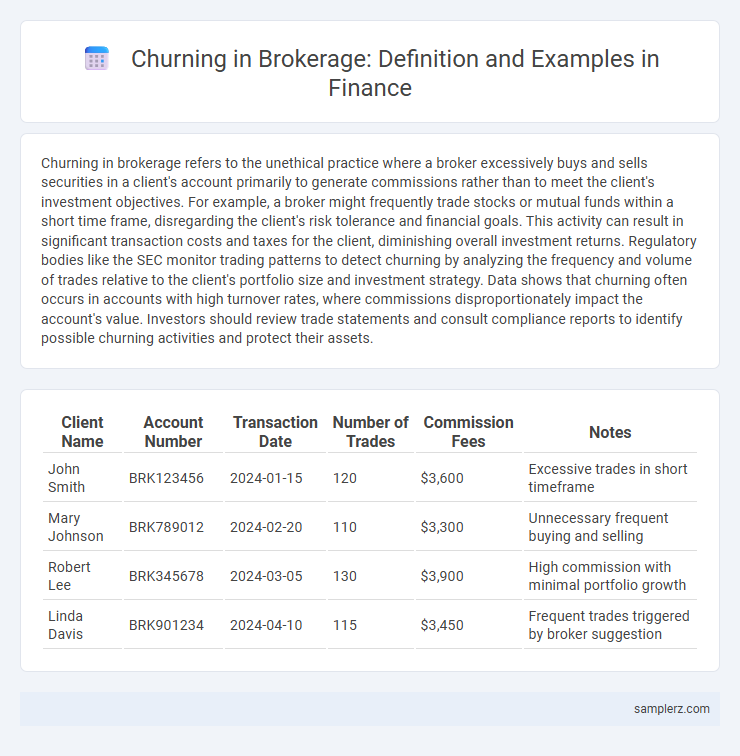

Table of Comparison

| Client Name | Account Number | Transaction Date | Number of Trades | Commission Fees | Notes |

|---|---|---|---|---|---|

| John Smith | BRK123456 | 2024-01-15 | 120 | $3,600 | Excessive trades in short timeframe |

| Mary Johnson | BRK789012 | 2024-02-20 | 110 | $3,300 | Unnecessary frequent buying and selling |

| Robert Lee | BRK345678 | 2024-03-05 | 130 | $3,900 | High commission with minimal portfolio growth |

| Linda Davis | BRK901234 | 2024-04-10 | 115 | $3,450 | Frequent trades triggered by broker suggestion |

Understanding Churning in Brokerage: Definition and Overview

Churning in brokerage refers to the unethical practice where brokers excessively buy and sell securities in a client's account primarily to generate higher commissions rather than to benefit the client's investment goals. This activity violates regulatory standards set by entities like the SEC and FINRA, which aim to protect investors from unnecessary trading costs and potential financial losses. Understanding churning is crucial for investors to recognize signs of such misconduct and to seek legal recourse or report suspicious broker behavior promptly.

Common Red Flags of Churning in Client Accounts

Frequent and excessive trading with little regard to client investment objectives signals potential churning in brokerage accounts. Sharp increases in commission costs disproportionate to portfolio growth often indicate manipulative trading activity. Rapid turnover and inconsistent investment strategies that generate high fees rather than client value serve as key red flags for regulatory scrutiny.

Real-World Examples of Brokerage Churning Cases

Brokerage churning occurs when brokers excessively trade securities in client accounts to generate higher commissions, often at the client's expense. One notable example is the 2013 case against Merrill Lynch, where the firm was penalized for frequent trading in customer accounts without regard for investment goals. Another instance involved Wachovia Securities, fined for orchestrating high-volume trading that weakened client portfolios and inflated fees.

How Churning Impacts Investor Portfolios

Churning in brokerage involves excessive buying and selling of securities within an investor's portfolio, primarily to generate commissions rather than to benefit the client. This practice significantly erodes portfolio value by increasing transaction costs, triggering unnecessary tax liabilities, and potentially exposing investors to heightened market risks. Investors often experience diminished returns and compromised long-term financial goals due to the detrimental effects of churning on asset allocation and portfolio stability.

Broker Tactics Used in Churning Practices

Brokers engaged in churning frequently exploit excessive trading by placing numerous buy and sell orders to generate high commissions regardless of client benefit. They may manipulate account activity through "ping-pong trading," rapidly buying and selling the same securities to inflate transaction volume. These tactics ultimately erode investor capital while maximizing brokerage fees, undermining fiduciary responsibility and ethical standards in financial advising.

Regulatory Actions Against Churning in Brokerages

Regulatory actions against churning in brokerages involve strict enforcement by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), resulting in substantial fines and suspension of licenses for offending brokers. These agencies require enhanced monitoring systems and impose mandatory disclosure rules to protect investors from excessive trading designed solely to generate commissions. High-profile cases, such as the SEC's penalties against major brokerage firms, underscore the commitment to upholding ethical trading practices and investor rights.

Legal Consequences for Brokerage Churning

Churning in brokerage involves excessive trading by brokers to generate commissions, often violating securities laws. Legal consequences for brokerage churning include regulatory sanctions such as fines, suspension, or revocation of licenses, along with potential civil liability and investor lawsuits. Courts frequently award damages to clients for losses caused by unauthorized or abusive trading practices under rules enforced by the SEC and FINRA.

Identifying Churning: Signs Clients Should Watch For

Frequent and excessive trading in a brokerage account, generating high commissions without regard to the client's investment objectives, is a primary sign of churning. Clients should monitor for unusually high transaction volumes, rapid buying and selling of the same securities, and recommendations that seem driven by commissions rather than financial goals. Tracking account statements for unexpected fees and inconsistent portfolio strategies can help detect potential brokerage churning.

Preventing Churning: Best Practices for Investors

Investors can prevent churning by regularly monitoring their brokerage account statements for excessive trade frequency and unusual commissions, ensuring alignment with their investment strategy. Requesting clear disclosures from brokers about transaction costs and holding periods enhances transparency and accountability. Establishing strict communication and authorization protocols before trades are executed helps maintain control and avoid fraudulent or unnecessary transactions.

Reporting and Addressing Suspected Churning Incidents

Brokerage firms implement robust reporting systems to identify and document suspected churning incidents, using transaction monitoring software to flag excessive trading activity inconsistent with client objectives. Compliance teams conduct thorough reviews and escalate verified cases to regulatory authorities, ensuring adherence to FINRA and SEC guidelines. Effective reporting mechanisms facilitate timely intervention, protecting clients from undue financial harm and maintaining institutional integrity.

example of churning in brokerage Infographic

samplerz.com

samplerz.com