Round-tripping in finance refers to a transaction where a company sells an asset with an agreement to repurchase it later, creating the appearance of increased revenue without any real economic benefit. An example involves a firm selling securities to another party while simultaneously agreeing to buy them back at a prearranged price. This practice can artificially inflate sales figures and mislead investors about the company's financial health. Such transactions often involve complex financial instruments or non-cash assets, making them difficult to detect in financial statements. Regulators scrutinize round-tripping because it distorts earnings and liquidity, impacting market transparency. Firms engaging in round-tripping face risks of penalties, reputational damage, and loss of investor trust.

Table of Comparison

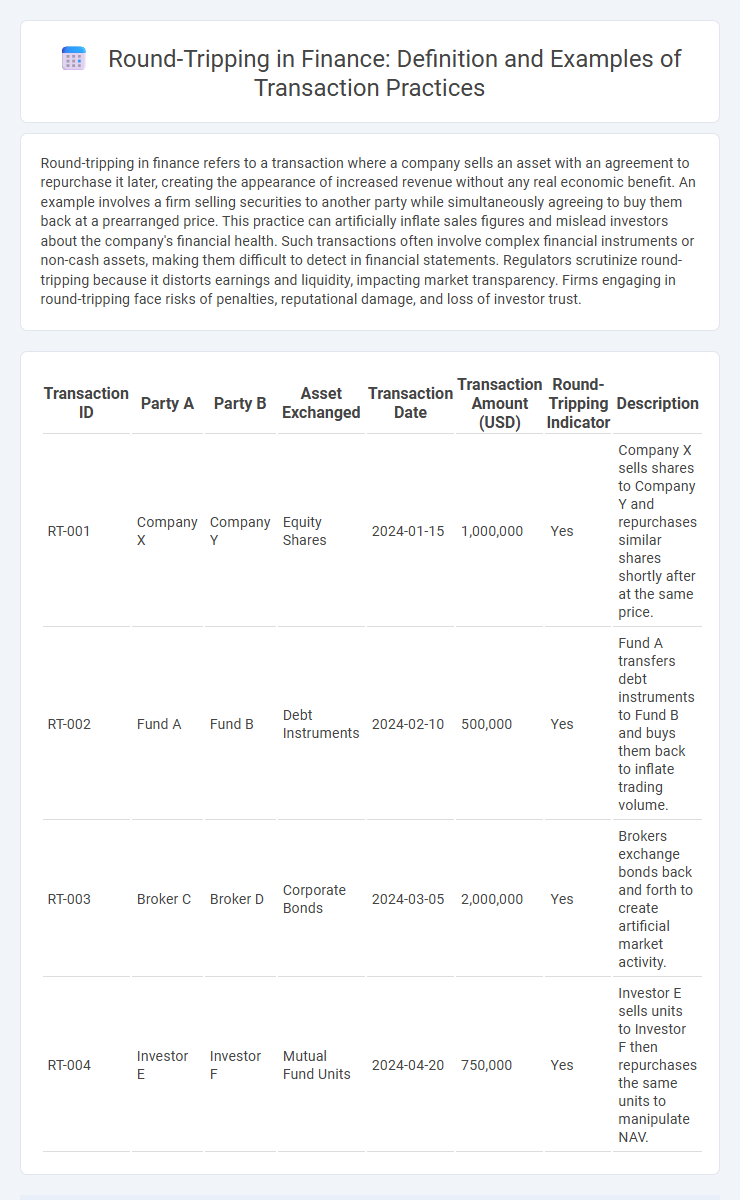

| Transaction ID | Party A | Party B | Asset Exchanged | Transaction Date | Transaction Amount (USD) | Round-Tripping Indicator | Description |

|---|---|---|---|---|---|---|---|

| RT-001 | Company X | Company Y | Equity Shares | 2024-01-15 | 1,000,000 | Yes | Company X sells shares to Company Y and repurchases similar shares shortly after at the same price. |

| RT-002 | Fund A | Fund B | Debt Instruments | 2024-02-10 | 500,000 | Yes | Fund A transfers debt instruments to Fund B and buys them back to inflate trading volume. |

| RT-003 | Broker C | Broker D | Corporate Bonds | 2024-03-05 | 2,000,000 | Yes | Brokers exchange bonds back and forth to create artificial market activity. |

| RT-004 | Investor E | Investor F | Mutual Fund Units | 2024-04-20 | 750,000 | Yes | Investor E sells units to Investor F then repurchases the same units to manipulate NAV. |

Introduction to Round-Tripping in Financial Transactions

Round-tripping in financial transactions involves the simultaneous sale and repurchase of an asset or service to create artificial revenue or inflate financial statements. Companies may use round-tripping schemes to manipulate earnings by recording sales without any genuine economic substance or cash flow impact. This practice often obscures the true financial health of a business and can mislead investors and regulators.

Understanding the Concept of Round-Tripping

Round-tripping in finance occurs when a company sells an asset to another party and simultaneously agrees to repurchase it at a later date, artificially inflating revenue or liquidity. This practice can mislead investors by creating the illusion of higher sales or cash flow without generating genuine economic value. Understanding round-tripping is crucial for analyzing financial statements accurately and detecting potential manipulative accounting strategies.

Common Techniques Used in Round-Tripping Schemes

Common techniques used in round-tripping schemes include selling an asset to a related party with an agreement to repurchase it later at a similar price, artificially inflating revenue without real economic substance. Another method involves simultaneously buying and selling securities between affiliated entities to create the illusion of increased trading volume and income. These practices manipulate financial statements, misleading investors and regulators about the true financial health of a company.

Real-World Examples of Round-Tripping in Finance

A well-known example of round-tripping in finance occurred in the energy sector when Enron used circular transactions to inflate revenue and mislead investors, contributing to its collapse in 2001. Another case involved the Chinese telecommunications company Huawei, which was accused of engaging in round-tripping by funneling capital through offshore entities to bypass regulatory restrictions and inflate financial statements. These real-world examples highlight how round-tripping can manipulate financial performance and distort transparency in corporate transactions.

Case Study: Round-Tripping in Corporate Accounting

Round-tripping in corporate accounting occurs when a company sells an asset and simultaneously agrees to repurchase it at a similar price, artificially inflating revenue figures. A notable case involved a technology firm that recorded billions in bogus sales by exchanging equipment with another company, misleading investors about its financial health. This practice distorts earnings reports, undermines market confidence, and often leads to regulatory sanctions.

The Role of Offshore Entities in Round-Tripping

Offshore entities play a crucial role in round-tripping transactions by facilitating the movement of capital across borders to exploit regulatory loopholes and minimize tax liabilities. These entities allow companies to disguise the origin of funds, making it appear as foreign investment when the capital has actually originated domestically. Such practices often involve complex ownership structures in jurisdictions known for secrecy and low tax rates, complicating regulatory oversight and increasing financial risk.

Regulatory Responses to Round-Tripping Practices

Regulatory responses to round-tripping in financial transactions involve stringent enforcement of anti-money laundering (AML) laws and enhanced transparency requirements under the Financial Action Task Force (FATF) guidelines. Agencies like the Securities and Exchange Commission (SEC) and the Financial Crimes Enforcement Network (FinCEN) implement rigorous audits and impose heavy penalties on entities engaging in circular fund movements aimed at manipulating earnings or evading taxes. These measures include mandatory reporting of suspicious activities and collaboration with international regulators to prevent the abuse of offshore accounts and shell companies used in round-tripping schemes.

Impacts of Round-Tripping on Financial Statements

Round-tripping in financial transactions artificially inflates revenue and assets, misleading stakeholders about a company's true financial health. This practice distorts net income, exaggerates cash flow from operations, and can trigger regulatory scrutiny due to violations of accounting standards. The resulting inflated financial statements compromise investor trust and may lead to significant financial restatements and legal consequences.

Detection Methods for Round-Tripping Transactions

Detection methods for round-tripping transactions in finance often involve advanced data analytics, including transaction pattern recognition and anomaly detection using machine learning algorithms. Auditors analyze cash flow cycles and compare transaction timelines to identify circular fund movements that artificially inflate revenues or assets. Regulatory bodies employ forensic accounting techniques and blockchain tracing to enhance transparency and uncover hidden round-tripping schemes.

Preventive Measures Against Round-Tripping Fraud

Implementing rigorous Know Your Customer (KYC) protocols and enhanced transaction monitoring systems can effectively detect and prevent round-tripping fraud in financial transactions. Utilizing blockchain technology ensures transparent, immutable records that reduce opportunities for circular fund flows used to inflate revenue artificially. Regular audits combined with advanced anomaly detection algorithms help identify suspicious transaction patterns early, safeguarding financial integrity.

example of round-tripping in transaction Infographic

samplerz.com

samplerz.com