In treasury finance, a strip refers to a fixed income security created by separating the interest and principal payments of a bond into individual components. Each component, or strip, represents a zero-coupon security with a distinct maturity date and cash flow. These instruments allow investors to target specific future dates for cash flow receipts, enhancing portfolio management and risk matching. Government bonds, particularly U.S. Treasury securities, are commonly used to create strips. The Treasury Department periodically issues separate trading of registered interest and principal securities, known as STRIPS, allowing investors to buy or sell the individual cash flow elements of a bond. These strips trade at a discount and mature at par value, providing predictable returns based on their yield curves.

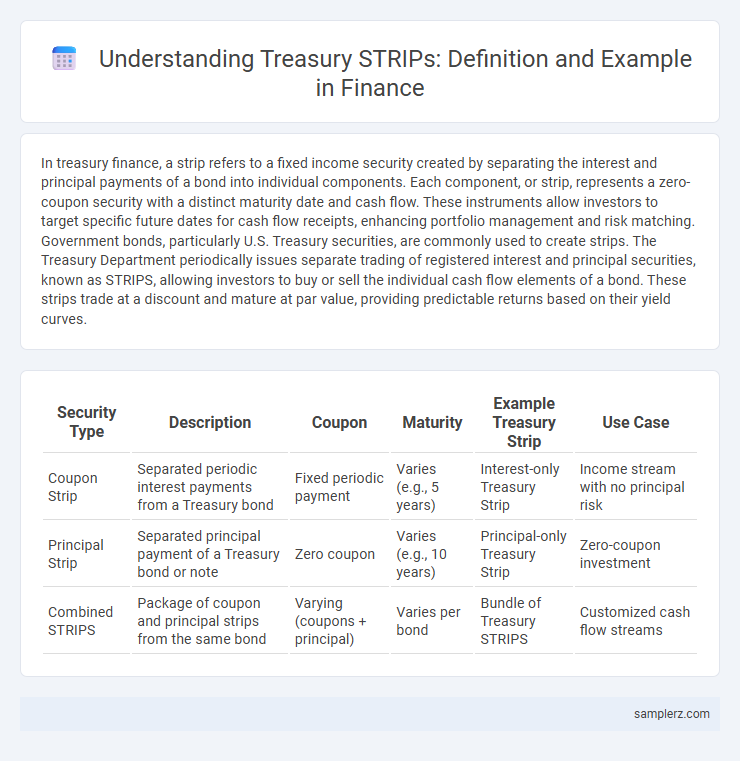

Table of Comparison

| Security Type | Description | Coupon | Maturity | Example Treasury Strip | Use Case |

|---|---|---|---|---|---|

| Coupon Strip | Separated periodic interest payments from a Treasury bond | Fixed periodic payment | Varies (e.g., 5 years) | Interest-only Treasury Strip | Income stream with no principal risk |

| Principal Strip | Separated principal payment of a Treasury bond or note | Zero coupon | Varies (e.g., 10 years) | Principal-only Treasury Strip | Zero-coupon investment |

| Combined STRIPS | Package of coupon and principal strips from the same bond | Varying (coupons + principal) | Varies per bond | Bundle of Treasury STRIPS | Customized cash flow streams |

Understanding Treasury STRIPS: An Overview

Treasury STRIPS (Separate Trading of Registered Interest and Principal of Securities) allow investors to hold and trade the individual interest and principal components of U.S. Treasury bonds or notes as separate zero-coupon securities. Each STRIP represents a future payment from the original Treasury security, enabling precise duration management and tax planning. This process enhances liquidity and provides customized investment opportunities in fixed income markets.

How Treasury STRIPS Work in Practice

Treasury STRIPS (Separate Trading of Registered Interest and Principal of Securities) function by separating a U.S. Treasury bond or note into individual interest and principal components, allowing investors to trade these components as zero-coupon securities. Each stripped component is sold at a discount and matures at face value, providing a fixed payment upon maturity without periodic interest payments. This structure enables precise cash flow planning and enhances portfolio diversification by matching liabilities with zero-coupon instruments.

Real-World Example of STRIPS in the U.S. Treasury Market

U.S. Treasury STRIPS (Separate Trading of Registered Interest and Principal of Securities) allow investors to hold and trade the individual interest and principal components of Treasury bonds as zero-coupon securities. For example, a 30-year Treasury bond with semiannual coupons can be separated into multiple interest-only and principal-only strips, each sold at a discount and maturing at different dates. This enables precise cash flow management and enhanced portfolio diversification in fixed income investing.

Investor Benefits of Using Treasury STRIPS

Treasury STRIPS allow investors to hold individual interest and principal components of Treasury bonds as separate zero-coupon securities, providing predictable cash flows and eliminating reinvestment risk. These securities offer deep liquidity and are backed by the full faith and credit of the U.S. government, enhancing portfolio safety. Investors benefit from precise income planning and potential tax advantages by purchasing STRIPS at a discount and realizing capital gains at maturity.

Comparing Treasury STRIPS to Traditional Treasury Bonds

Treasury STRIPS are zero-coupon securities created by separating the interest and principal payments of traditional Treasury bonds, offering investors exposure to individual cash flows without periodic interest. Unlike traditional Treasury bonds that pay semiannual interest, STRIPS provide a lump-sum payment at maturity, making them highly sensitive to interest rate changes and ideal for long-term investment strategies. The absence of interim coupon payments in STRIPS results in different tax implications and pricing dynamics compared to conventional Treasury bonds.

Tax Implications of Investing in Treasury STRIPS

Investing in Treasury STRIPS involves specific tax implications as the imputed interest on these zero-coupon securities is taxable as ordinary income annually, despite no cash interest payment received until maturity. Investors must report the phantom income each year, which can result in a tax liability without corresponding cash flow. Understanding the deferral and reporting requirements is crucial for managing tax consequences effectively in Treasury STRIPS investments.

STRIPS Example: Pricing and Yield Calculation

STRIPS (Separate Trading of Registered Interest and Principal Securities) allow investors to hold individual interest and principal components of Treasury bonds as zero-coupon securities. For example, a $1,000 Treasury bond with a 4% coupon stripped into semiannual payments results in multiple STRIPS, each priced by discounting future cash flows at the prevailing spot rates. Yield calculation for STRIPS involves using the formula Yield = (Face Value / Purchase Price)^(1/Time) - 1, reflecting the bond's compounded annual return until maturity.

Risks and Considerations When Buying Treasury STRIPS

Purchasing Treasury STRIPS involves interest rate risk, as their prices fluctuate significantly with changes in market rates, potentially leading to capital losses if sold before maturity. Inflation risk also affects STRIPS since they do not provide periodic interest payments to offset inflation's impact on purchasing power. Investors must consider market liquidity risk, as STRIPS can be less liquid than other Treasury securities, potentially complicating timely sales.

STRIPS vs. Zero-Coupon Bonds: Key Differences

STRIPS (Separate Trading of Registered Interest and Principal Securities) are Treasury securities that have been separated into individual interest and principal components, allowing investors to purchase each component independently. Zero-coupon bonds, while similar in offering no periodic interest payments, are issued at a discount and mature at face value without separation of cash flows. The primary difference lies in STRIPS being created by the Treasury through separation of coupons and principal, whereas zero-coupon bonds can be issued directly by corporations or governments with a single payment at maturity.

Treasury STRIPS Applications in Portfolio Management

Treasury STRIPS (Separate Trading of Registered Interest and Principal Securities) enable investors to isolate and trade the individual interest and principal components of U.S. Treasury bonds as zero-coupon securities. Portfolio managers utilize STRIPS to precisely match future cash flow needs, enhancing duration matching and immunization strategies against interest rate risk. The ability to purchase zero-coupon bonds at a discount while locking in a fixed yield until maturity offers valuable tools for liability-driven investment and strategic bond allocation.

example of strip in treasury Infographic

samplerz.com

samplerz.com