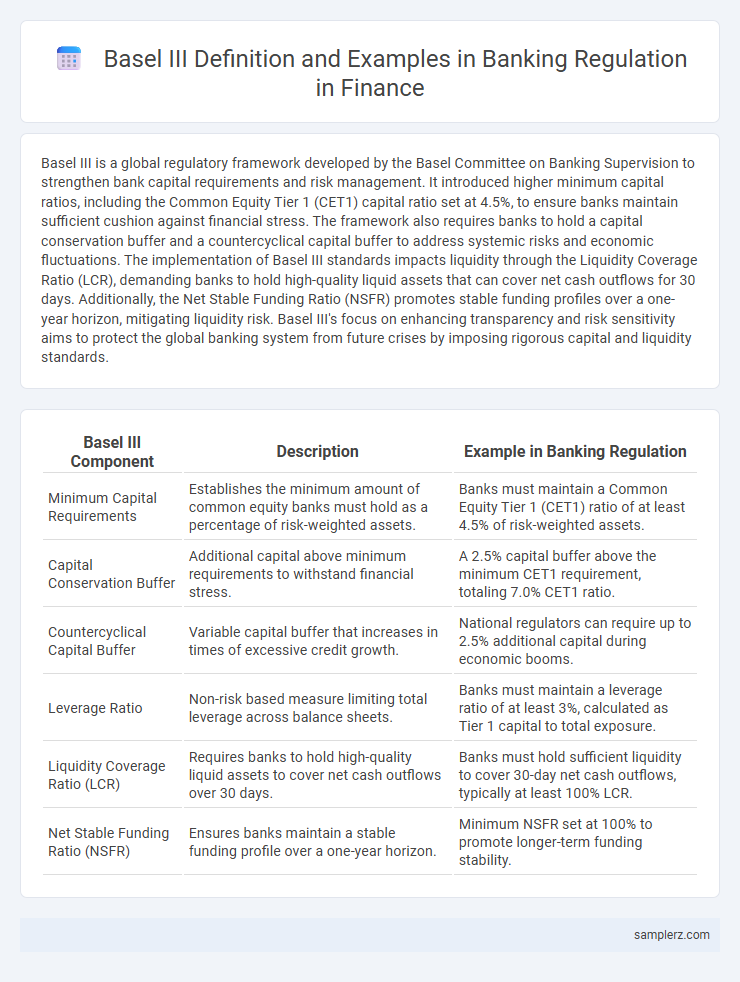

Basel III is a global regulatory framework developed by the Basel Committee on Banking Supervision to strengthen bank capital requirements and risk management. It introduced higher minimum capital ratios, including the Common Equity Tier 1 (CET1) capital ratio set at 4.5%, to ensure banks maintain sufficient cushion against financial stress. The framework also requires banks to hold a capital conservation buffer and a countercyclical capital buffer to address systemic risks and economic fluctuations. The implementation of Basel III standards impacts liquidity through the Liquidity Coverage Ratio (LCR), demanding banks to hold high-quality liquid assets that can cover net cash outflows for 30 days. Additionally, the Net Stable Funding Ratio (NSFR) promotes stable funding profiles over a one-year horizon, mitigating liquidity risk. Basel III's focus on enhancing transparency and risk sensitivity aims to protect the global banking system from future crises by imposing rigorous capital and liquidity standards.

Table of Comparison

| Basel III Component | Description | Example in Banking Regulation |

|---|---|---|

| Minimum Capital Requirements | Establishes the minimum amount of common equity banks must hold as a percentage of risk-weighted assets. | Banks must maintain a Common Equity Tier 1 (CET1) ratio of at least 4.5% of risk-weighted assets. |

| Capital Conservation Buffer | Additional capital above minimum requirements to withstand financial stress. | A 2.5% capital buffer above the minimum CET1 requirement, totaling 7.0% CET1 ratio. |

| Countercyclical Capital Buffer | Variable capital buffer that increases in times of excessive credit growth. | National regulators can require up to 2.5% additional capital during economic booms. |

| Leverage Ratio | Non-risk based measure limiting total leverage across balance sheets. | Banks must maintain a leverage ratio of at least 3%, calculated as Tier 1 capital to total exposure. |

| Liquidity Coverage Ratio (LCR) | Requires banks to hold high-quality liquid assets to cover net cash outflows over 30 days. | Banks must hold sufficient liquidity to cover 30-day net cash outflows, typically at least 100% LCR. |

| Net Stable Funding Ratio (NSFR) | Ensures banks maintain a stable funding profile over a one-year horizon. | Minimum NSFR set at 100% to promote longer-term funding stability. |

Introduction to Basel III in Banking Regulation

Basel III is a comprehensive set of reform measures developed by the Basel Committee on Banking Supervision to strengthen regulation, supervision, and risk management in the banking sector. It introduces higher capital requirements, including stricter definitions of capital and enhanced risk coverage, to improve banks' ability to absorb shocks arising from financial and economic stress. Key components include the leverage ratio, liquidity coverage ratio (LCR), and net stable funding ratio (NSFR), designed to promote banking sector resilience and stability.

Key Objectives of Basel III Framework

Basel III aims to strengthen bank capital requirements by increasing minimum capital ratios and introducing new regulatory buffers, such as the Capital Conservation Buffer and Countercyclical Buffer. It enhances risk management through stricter liquidity coverage ratios (LCR) and net stable funding ratios (NSFR) to ensure banks maintain adequate liquidity under stress. The framework also promotes improved transparency and supervisory oversight to reduce the likelihood of systemic financial crises.

Capital Requirements under Basel III: An Overview

Basel III capital requirements mandate banks to maintain a minimum Common Equity Tier 1 (CET1) capital ratio of 4.5% plus a capital conservation buffer of 2.5%, effectively requiring 7% CET1 to absorb losses and promote financial stability. Banks must also comply with a minimum Tier 1 capital ratio of 6% and a total capital ratio of 8%, ensuring sufficient high-quality capital is held against risk-weighted assets. These enhanced capital standards under Basel III improve the resilience of the banking sector by reducing the probability of bank insolvency during economic stress.

Real-World Example: Basel III Implementation by JPMorgan Chase

JPMorgan Chase has implemented Basel III by significantly increasing its Tier 1 capital ratio to exceed the 10.5% minimum requirement, enhancing its buffer against financial stress. The bank also improved its liquidity coverage ratio (LCR) to maintain high-quality liquid assets covering 120% of net cash outflows, ensuring resilience during market disruptions. Strict adherence to Basel III's leverage ratio of 5% further strengthens JPMorgan Chase's stability, aligning with global regulatory standards to mitigate systemic risk.

Impact of Basel III on European Banks: Case Study

The implementation of Basel III has significantly strengthened the capital adequacy and liquidity standards of European banks, reducing systemic risk and enhancing financial stability within the Eurozone. A case study of Deutsche Bank reveals improved Tier 1 capital ratios and adjusted risk-weighted assets, which increased resilience against market shocks post-2013 reforms. European banks also faced challenges in meeting stricter leverage ratios, prompting shifts towards higher-quality assets and more conservative lending practices.

Credit Risk Management: Basel III Approaches

Basel III sets stringent standards for credit risk management by introducing the standardized approach, foundation internal ratings-based (F-IRB) approach, and advanced internal ratings-based (A-IRB) approach to calculate risk-weighted assets. Banks using the standardized approach apply prescribed risk weights to various credit exposures, while the IRB approaches allow banks to use their internal models to estimate probability of default (PD), loss given default (LGD), and exposure at default (EAD). These differentiated methodologies enhance capital adequacy and promote more precise measurement and control of credit risk across banking institutions.

Leverage Ratio Example in Practice

Basel III regulation mandates a minimum leverage ratio of 3% for banks, ensuring capital adequacy and controlling excessive borrowing. For example, a bank with $1 trillion in total assets must maintain at least $30 billion in Tier 1 capital to meet this requirement. This leverage ratio limits financial institutions' risk exposure and enhances systemic stability within the banking sector.

Basel III Stress Testing: Illustrative Bank Scenarios

Basel III Stress Testing involves the simulation of adverse economic and financial conditions to evaluate a bank's capital adequacy and risk management under crisis scenarios. Illustrative bank scenarios typically include severe recession, market shocks, and liquidity crises to assess the resilience of banks' portfolios and ensure they maintain sufficient capital buffers. These stress tests help regulators identify vulnerabilities and enforce corrective measures to uphold systemic stability in the banking sector.

Compliance Challenges Faced by Small Banks

Small banks face significant compliance challenges under Basel III due to stringent capital adequacy requirements and complex liquidity coverage ratios that demand substantial financial and operational resources. Limited access to advanced risk management systems and higher costs of regulatory reporting strain their ability to meet enhanced disclosure and stress testing standards. These challenges often hinder small banks' competitive positioning and growth potential within the evolving regulatory landscape.

Future Implications of Basel III on Global Banking

Basel III introduces stricter capital requirements and leverage ratios, enhancing bank resilience to financial shocks and reducing systemic risk in global banking. Enhanced liquidity standards under Basel III ensure institutions maintain sufficient high-quality liquid assets, promoting stability during periods of market stress. The framework's emphasis on risk management and transparency is expected to drive more robust governance practices and foster greater investor confidence worldwide.

example of Basel III in banking regulation Infographic

samplerz.com

samplerz.com