A ladder in a bond portfolio refers to a structured investment strategy where bonds mature at regular intervals over a set period. Investors allocate funds across bonds with staggered maturity dates, spreading risk and improving liquidity. For example, an investor might purchase bonds maturing in one, three, five, seven, and ten years, creating a steady stream of income and opportunities to reinvest at prevailing interest rates. This strategy helps mitigate interest rate risk by reducing the impact of market fluctuations on the entire portfolio. A laddered bond portfolio often includes government, municipal, or corporate bonds to diversify credit risk further. By maintaining bonds with varying maturities, investors can balance income needs with capital preservation goals efficiently.

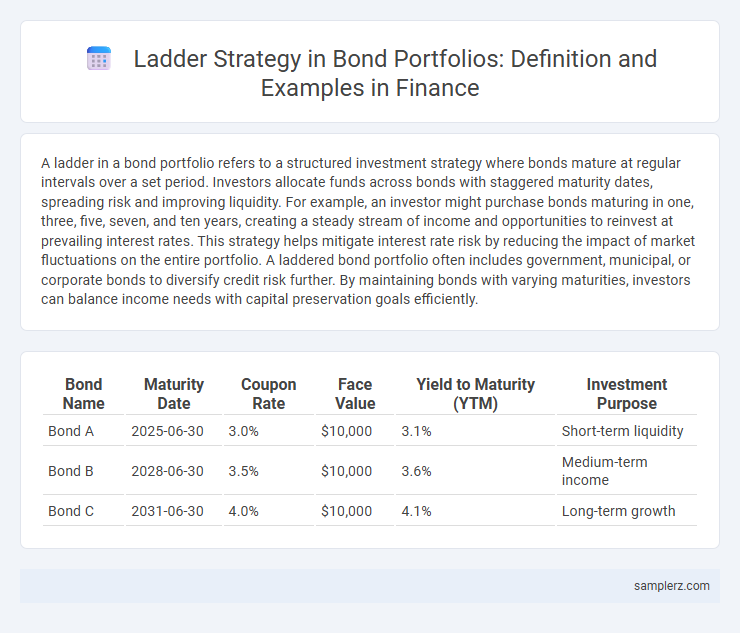

Table of Comparison

| Bond Name | Maturity Date | Coupon Rate | Face Value | Yield to Maturity (YTM) | Investment Purpose |

|---|---|---|---|---|---|

| Bond A | 2025-06-30 | 3.0% | $10,000 | 3.1% | Short-term liquidity |

| Bond B | 2028-06-30 | 3.5% | $10,000 | 3.6% | Medium-term income |

| Bond C | 2031-06-30 | 4.0% | $10,000 | 4.1% | Long-term growth |

Introduction to Bond Laddering Strategies

Bond laddering involves purchasing bonds with staggered maturities to manage interest rate risk and ensure consistent income streams. For example, an investor might buy bonds maturing in one, three, five, seven, and ten years, creating a portfolio that systematically matures over time. This strategy enhances liquidity, diversifies reinvestment risk, and allows for potential reinvestment at higher rates as bonds mature.

Key Benefits of Laddering a Bond Portfolio

Laddering a bond portfolio involves purchasing bonds with staggered maturities, which helps manage interest rate risk and provides consistent liquidity. This strategy ensures a steady stream of income as bonds mature at different intervals, allowing reinvestment opportunities at potentially higher rates. Laddering also enhances diversification across time horizons, reducing exposure to market volatility and interest rate fluctuations.

Step-by-Step Guide to Building a Bond Ladder

Building a bond ladder involves purchasing bonds with staggered maturities to manage interest rate risk and provide steady income streams. Start by selecting bonds with varying maturities, typically ranging from one to ten years, ensuring diversification across issuers and credit qualities. Reinvest proceeds from maturing bonds into new long-term issues to maintain the ladder structure and optimize portfolio yield.

Selecting Bonds for a Laddered Portfolio

Selecting bonds for a laddered portfolio involves choosing bonds with staggered maturities to manage interest rate risk and provide consistent income. Investors typically pick high-quality government or corporate bonds with maturities spaced evenly over periods such as 1, 3, 5, 7, and 10 years to balance yield and liquidity. This strategy enables reinvestment opportunities at varying market rates while maintaining a diversified and stable fixed-income allocation.

Example: Five-Year Bond Ladder Structure

A five-year bond ladder structure consists of purchasing bonds with maturities staggered evenly over five years, such as bonds maturing in one, two, three, four, and five years. This strategy provides steady income streams at regular intervals while reducing interest rate risk by reinvesting proceeds from maturing bonds. Investors benefit from increased liquidity and the potential to adjust the portfolio annually to changing market conditions.

Managing Cash Flow with Bond Ladders

Bond ladders improve cash flow management by staggering bond maturities across different dates, ensuring regular income streams. For example, a portfolio may hold bonds maturing annually over five years, providing consistent liquidity and reducing reinvestment risk. This structured approach enhances financial stability by aligning bond payouts with anticipated cash needs.

Risk Mitigation Using a Bond Ladder

A bond ladder mitigates interest rate risk by spreading investments across bonds with staggered maturities, ensuring regular cash flows and reducing reinvestment timing uncertainty. This strategy provides liquidity and stability, as maturing bonds can be reinvested at prevailing rates, balancing risk during fluctuating markets. By diversifying maturity dates, a bond ladder minimizes exposure to rising interest rates and potential price volatility within the portfolio.

Tax Considerations in Bond Laddering

Implementing a bond ladder involves staggering maturities across different tax-advantaged accounts to optimize after-tax returns, especially when holding municipal bonds that offer tax-exempt interest income. Allocating taxable bonds, such as corporate bonds or Treasury securities, in tax-deferred accounts like IRAs can minimize tax liabilities on accrued interest. Careful consideration of state and federal tax brackets, along with the timing of maturities, enhances the efficiency of bond laddering in managing tax exposure and cash flow planning.

Reinvestment Strategies for Maturing Bonds

A laddered bond portfolio typically staggers maturities across intervals such as one, three, five, seven, and ten years to balance liquidity and yield. Upon maturity, reinvestment strategies prioritize deploying proceeds into longer-term bonds aligned with the portfolio's ladder structure to capture higher interest rates and manage interest rate risk. This approach ensures consistent income streams while optimizing yield through selective reinvestment in prevailing market conditions.

Common Mistakes to Avoid in Laddered Portfolios

Laddered bond portfolios often suffer from overconcentration in low-yield maturities, limiting income potential and inflation protection. Failure to regularly rebalance can cause the ladder to skew toward certain maturities, reducing diversification benefits and increasing interest rate risk. Ignoring credit quality shifts or market conditions may lead to holding bonds with deteriorated creditworthiness, affecting overall portfolio stability.

example of Ladder in bond portfolio Infographic

samplerz.com

samplerz.com