A drawdown in a portfolio refers to the decline from a peak value to a trough before a new peak is reached. For example, if an investment portfolio reaches a value of $1,000,000 and then falls to $800,000, the drawdown is $200,000 or 20%. This metric helps investors assess the risk and volatility of their portfolio over a specific period. In practical terms, suppose a portfolio experiences a peak in January and drops by 15% over the next three months due to market fluctuations. The drawdown percentage quantifies this loss, reflecting the depth of the portfolio's decline. Monitoring drawdowns is essential for portfolio managers to manage risk and implement strategies to mitigate future losses.

Table of Comparison

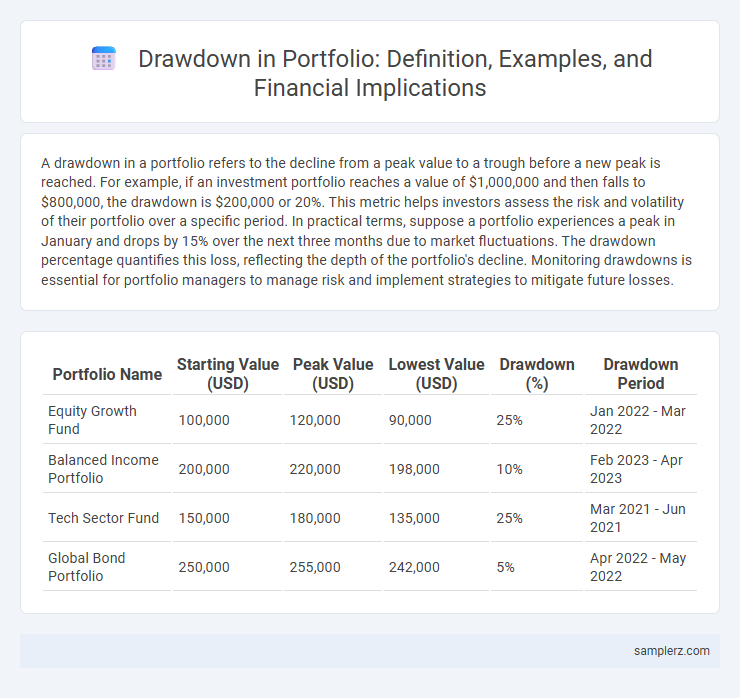

| Portfolio Name | Starting Value (USD) | Peak Value (USD) | Lowest Value (USD) | Drawdown (%) | Drawdown Period |

|---|---|---|---|---|---|

| Equity Growth Fund | 100,000 | 120,000 | 90,000 | 25% | Jan 2022 - Mar 2022 |

| Balanced Income Portfolio | 200,000 | 220,000 | 198,000 | 10% | Feb 2023 - Apr 2023 |

| Tech Sector Fund | 150,000 | 180,000 | 135,000 | 25% | Mar 2021 - Jun 2021 |

| Global Bond Portfolio | 250,000 | 255,000 | 242,000 | 5% | Apr 2022 - May 2022 |

Understanding Drawdown in Portfolio Management

Drawdown in portfolio management measures the peak-to-trough decline during a specific period, emphasizing risk exposure and capital preservation. For example, a portfolio dropping from $100,000 to $80,000 experiences a 20% drawdown, indicating potential vulnerability to market downturns. Understanding drawdown helps investors assess resilience, adjust asset allocation, and implement risk management strategies effectively.

Key Causes of Portfolio Drawdown

Portfolio drawdown primarily results from market volatility, where sudden price declines in equities, bonds, or commodities reduce overall asset values. Concentration risk exacerbates drawdown when investments lack diversification, causing disproportionate losses in correlated sectors or securities. Economic downturns, geopolitical events, and abrupt shifts in interest rates also trigger significant portfolio drawdowns by undermining investor confidence and asset performance.

Historical Examples of Major Portfolio Drawdowns

The 2008 financial crisis triggered one of the largest portfolio drawdowns in modern history, with the S&P 500 experiencing a peak-to-trough decline of approximately 57%. Another significant example is the Dot-com Bubble burst in 2000, where technology-heavy portfolios saw drawdowns exceeding 70%. These historical events highlight the importance of diversification and risk management in mitigating severe portfolio losses during market downturns.

Calculating Drawdown: Step-by-Step Example

Calculating drawdown in a portfolio involves identifying the peak value before a decline and the trough value at its lowest point, then computing the percentage decrease between these two values. For example, if a portfolio peaks at $100,000 and subsequently drops to $80,000, the drawdown is calculated as (100,000 - 80,000) / 100,000, resulting in a 20% drawdown. This step-by-step calculation helps investors quantify potential losses and assess the risk tolerance of their investment strategy.

Comparing Maximum Drawdown in Different Asset Classes

Maximum drawdown varies significantly across asset classes, with equities often experiencing deeper declines--sometimes exceeding 50%--during market crashes compared to bonds, which typically exhibit smaller drawdowns around 10-15%. Real estate investment trusts (REITs) generally show moderate drawdowns, frequently ranging from 20-30%, reflecting their hybrid nature between equities and fixed income. Understanding these disparities helps investors tailor portfolio risk management strategies by balancing volatile assets with more stable instruments.

Real-world Portfolio Drawdown Scenarios

Portfolio drawdown occurs when the value of an investment portfolio declines from its peak, reflecting real-world scenarios such as the 2008 financial crisis, where global equity markets saw drawdowns exceeding 50%. Another example includes the COVID-19 pandemic in early 2020, causing rapid drawdowns of up to 30% in diversified portfolios due to sudden market shocks. Understanding these drawdown events helps investors manage risk by setting stop-loss limits and diversifying assets across sectors and geographies.

The Impact of Market Crashes on Portfolio Drawdown

Market crashes often cause significant portfolio drawdowns, with declines commonly exceeding 20% during severe downturns such as the 2008 financial crisis or the COVID-19 pandemic in 2020. Institutional portfolios diversified across equities, bonds, and alternative assets may experience drawdowns ranging from 15% to 35%, reflecting heightened market volatility and rapid asset value depreciation. Effective risk management strategies, including asset allocation adjustments and stop-loss mechanisms, are essential to mitigate the financial impact of these market crashes on portfolio drawdown.

Strategies to Minimize Portfolio Drawdown

Employing diversification across asset classes and sectors can significantly reduce portfolio drawdown by limiting exposure to any single investment's downturn. Implementing stop-loss orders and dynamic asset allocation helps in systematically cutting losses and adjusting risk based on market conditions. Utilizing hedging techniques such as options and inverse ETFs further protects the portfolio against severe market declines by providing downside buffers.

Emotional and Psychological Effects of Drawdown

Drawdown in a portfolio can trigger significant emotional stress, leading investors to experience fear, anxiety, and panic that may result in impulsive decisions such as premature asset liquidation. The psychological impact often undermines long-term investment strategies, causing loss aversion and hesitation to re-enter the market even when conditions improve. Understanding the emotional response to portfolio drawdown is critical for implementing risk management techniques and maintaining discipline during periods of market volatility.

Lessons Learned from Significant Portfolio Drawdowns

Significant portfolio drawdowns, such as the 30% decline during the 2008 financial crisis, reveal the importance of diversification and risk management in investment strategies. Investors often learn that maintaining cash reserves and setting predefined stop-loss limits can mitigate the impact of severe market downturns. Understanding volatility patterns and stress-testing portfolios before major market events enhances resilience and preserves capital during drawdowns.

example of drawdown in portfolio Infographic

samplerz.com

samplerz.com