In the finance sector, contango refers to a market condition where the future price of a commodity exceeds its spot price. For example, in the oil market, if the spot price of crude oil is $70 per barrel but the futures contract for delivery in six months is priced at $75 per barrel, the market is in contango. This situation often occurs when storage costs, insurance, and other carrying charges push future prices above current spot prices. Traders and investors use contango as a signal to understand market expectations and storage demand. Oil producers might hedge their output by selling futures contracts at a premium, while investors might incur costs if they roll over near-month contracts continuously. Data analysis of futures curves from exchanges like NYMEX helps identify contango patterns and assess market sentiment regarding oil supply and demand dynamics.

Table of Comparison

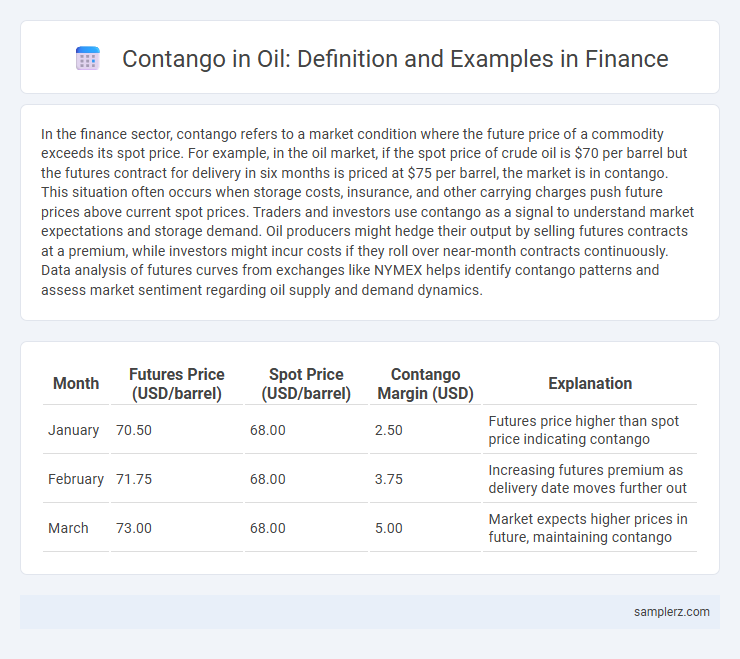

| Month | Futures Price (USD/barrel) | Spot Price (USD/barrel) | Contango Margin (USD) | Explanation |

|---|---|---|---|---|

| January | 70.50 | 68.00 | 2.50 | Futures price higher than spot price indicating contango |

| February | 71.75 | 68.00 | 3.75 | Increasing futures premium as delivery date moves further out |

| March | 73.00 | 68.00 | 5.00 | Market expects higher prices in future, maintaining contango |

Understanding Contango in Oil Markets

Contango in oil markets occurs when the futures price of crude oil is higher than the spot price, reflecting storage costs, carry charges, and market expectations of rising prices. This situation often arises during periods of oversupply, causing investors and producers to store oil while anticipating higher future prices. Understanding contango is essential for traders using futures contracts to hedge or speculate, as it influences the cost of holding positions and impacts profitability in oil trading strategies.

How Contango Affects Oil Prices

Contango occurs when future oil prices exceed current spot prices, signaling market expectations of rising crude supply or storage costs. This pricing structure incentivizes traders to purchase and store oil, leading to increased storage demand and potential upward pressure on spot prices. As a result, contango can inflate short-term oil prices and impact investment strategies tied to futures contracts.

Historical Examples of Oil Market Contango

Historical examples of oil market contango include the 2009 financial crisis when crude prices were low and futures contracts traded higher due to expected demand recovery. Another notable instance occurred in early 2020 during the COVID-19 pandemic, when oversupply and storage constraints pushed spot prices below futures prices. These periods highlight how market expectations and storage costs drive contango in oil futures.

The 2020 Oil Contango Phenomenon

In 2020, the oil market experienced a severe contango due to plummeting demand and oversupply amid the COVID-19 pandemic, with West Texas Intermediate (WTI) crude futures for later months priced significantly higher than near-term contracts. This price structure incentivized storage as traders profited by buying cheap near-term contracts and selling expensive futures further out, leading to a dramatic increase in oil inventories. The unprecedented contango forced storage facilities to reach capacity, with some participants even renting supertankers as floating storage to capitalize on the price differential.

Drivers Behind Contango in Crude Oil

Contango in crude oil futures occurs when the spot price is lower than futures prices, driven primarily by storage costs, interest rates, and expectations of future supply-demand imbalances. High storage expenses and abundant inventory incentivize holders to sell at current prices while locking in higher future prices through contracts. Market participants also factor in geopolitical risks and production forecasts, which influence the cost of carry and contribute to persistent contango structures in oil markets.

Implications of Contango for Oil Storage

Contango in oil markets occurs when the futures price exceeds the spot price, incentivizing traders to store crude oil to sell later at higher prices. This situation increases demand for storage facilities, leading to higher storage costs and capacity constraints. Elevated storage levels also impact market liquidity and can signal oversupply, influencing trading strategies and price forecasts.

Trading Strategies During Oil Contango

Oil contango occurs when future prices exceed spot prices, creating opportunities for trading strategies such as calendar spreads and storage plays. Traders exploit contango by buying physical oil at lower spot prices while simultaneously selling higher-priced futures contracts, profiting from the price differential as contracts converge at maturity. This strategy requires careful monitoring of storage costs, financing rates, and market liquidity to maximize gains during contango periods.

Risks Associated with Oil Contango

Oil contango occurs when future prices exceed current spot prices, creating risks such as increased storage costs and inventory holding expenses. Traders may face liquidity pressures due to the need to finance large physical inventories, while sudden market shifts can lead to significant losses if prices converge unexpectedly. The persistence of contango can also distort market signals, complicating hedging strategies and investment decisions in the oil sector.

Impact of Contango on Oil Producers and Consumers

Contango in the oil market causes futures prices to exceed spot prices, creating storage incentives for producers who can sell contracts at higher future prices, thereby increasing their cash flow. Consumers, especially refiners, face higher costs as they must purchase oil at elevated spot prices when contango results from large inventories and market oversupply. This price structure impacts investment decisions, inventory management, and ultimately the profitability of both producers and consumers in the oil industry.

Comparing Contango and Backwardation in Oil

Contango in oil markets occurs when futures prices are higher than the current spot price, often reflecting storage costs and expectations of rising demand. In contrast, backwardation happens when futures prices are lower than the spot price, signaling tight supply or high immediate demand. Traders use contango and backwardation to inform strategies on inventory management and speculative positioning in crude oil markets.

example of contango in oil Infographic

samplerz.com

samplerz.com