Rebalancing in an index involves adjusting the weights of constituent stocks to maintain a desired allocation, reflecting changes in market capitalization or investment strategy. For example, the S&P 500 index regularly rebalances by adding or removing companies based on market capitalization and liquidity criteria, ensuring the index accurately represents the U.S. equity market. This process helps investors maintain exposure aligned with the index's investment objectives and manage risk effectively. Another example is the Nasdaq-100 index, which rebalances quarterly by recalculating stock weights to reflect current market values while removing companies that no longer meet eligibility criteria. Rebalancing keeps the index relevant amid changing market conditions, promoting accurate benchmarking for investors and fund managers. These systematic adjustments ensure that index funds tracking the Nasdaq-100 continue to mirror the overall technology-heavy market segment.

Table of Comparison

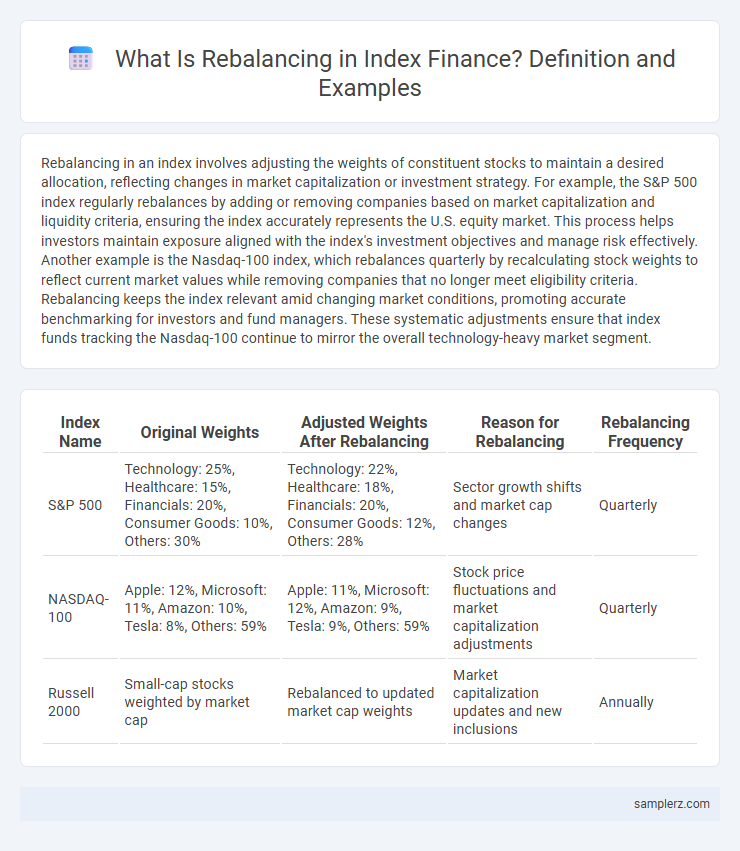

| Index Name | Original Weights | Adjusted Weights After Rebalancing | Reason for Rebalancing | Rebalancing Frequency |

|---|---|---|---|---|

| S&P 500 | Technology: 25%, Healthcare: 15%, Financials: 20%, Consumer Goods: 10%, Others: 30% | Technology: 22%, Healthcare: 18%, Financials: 20%, Consumer Goods: 12%, Others: 28% | Sector growth shifts and market cap changes | Quarterly |

| NASDAQ-100 | Apple: 12%, Microsoft: 11%, Amazon: 10%, Tesla: 8%, Others: 59% | Apple: 11%, Microsoft: 12%, Amazon: 9%, Tesla: 9%, Others: 59% | Stock price fluctuations and market capitalization adjustments | Quarterly |

| Russell 2000 | Small-cap stocks weighted by market cap | Rebalanced to updated market cap weights | Market capitalization updates and new inclusions | Annually |

Understanding Index Rebalancing: Key Concepts

Index rebalancing involves adjusting the weights of constituent stocks to maintain alignment with a benchmark strategy, such as restoring target allocation percentages after market fluctuations. For example, if a technology stock's weight in an index rises from 10% to 15% due to price appreciation, rebalancing would reduce its weight back to 10% by selling shares and reallocating to underrepresented sectors. This process ensures the index accurately reflects its intended market exposure and risk profile over time.

Real-World Example: S&P 500 Index Rebalancing

The S&P 500 Index undergoes quarterly rebalancing to reflect changes in market capitalization and maintain accurate representation of the U.S. equity market. During the rebalancing, companies may be added or removed based on factors like market cap, liquidity, and sector classification, impacting index weights and investment portfolios. For instance, in the 2024 first quarter rebalance, tech giants like Tesla were added due to substantial market growth, while underperforming firms faced removal, ensuring the index aligns with current market dynamics.

Case Study: Nasdaq-100 Adjustments Explained

The Nasdaq-100 rebalancing process involves quarterly adjustments to the index's components based on market capitalization and liquidity criteria, ensuring accurate representation of the largest non-financial companies listed on Nasdaq. For example, during the December 2023 rebalancing, tech giant Meta Platforms was added to replace underperforming constituents that no longer met the inclusion standards, reflecting shifts in market dynamics and company valuations. This systematic reallocation helps maintain the index's relevance for investors tracking the technology-heavy sector and supports passive funds aligned with the Nasdaq-100 benchmark.

Annual vs. Quarterly Index Rebalancing Schedules

Annual rebalancing of indexes involves adjusting portfolio components once a year, often resulting in lower transaction costs and reduced market impact due to less frequent trading. Quarterly index rebalancing schedules provide more timely alignment with market changes, enabling indexes to better capture shifts in sector performance and company fundamentals. Investors choosing between the two schedules weigh cost efficiency against responsiveness to market dynamics, impacting index tracking accuracy and risk management.

Criteria for Inclusion and Exclusion in Major Indexes

Major indexes like the S&P 500 use strict criteria for inclusion, such as a minimum market capitalization, liquidity thresholds, and sector representation to ensure an accurate market reflection. Exclusion occurs when a company fails to meet these benchmarks due to factors like mergers, significant declines in market cap, or sustained poor trading volume. Regular rebalancing adjusts index components to maintain alignment with these standards, preserving the index's integrity and investor confidence.

Impact of Rebalancing on Index Fund Performance

Rebalancing an index fund involves periodically adjusting the portfolio to match the target index composition, impacting performance by realigning asset weights and managing risk exposure. For example, during a market rally in technology stocks, an index fund may sell some overperforming tech shares and buy underperforming sectors like utilities to maintain balance. This systematic rebalancing can reduce tracking error, enhance diversification, and potentially improve long-term returns by preventing overweight in overheated assets.

Sector Weight Changes During Rebalancing

Sector weight changes during index rebalancing involve adjusting the proportions of sectors like technology, healthcare, and finance to reflect updated market capitalizations or economic shifts. For instance, an increase in technology sector performance might lead to a higher weight allocation, while underperforming sectors like energy could see reduced representation. This process ensures the index remains aligned with current market dynamics and investment strategies.

Index Rebalancing: Effects on Market Liquidity

Index rebalancing involves the periodic adjustment of index components to reflect changes in market capitalization or corporate actions, significantly impacting market liquidity. During rebalancing events, large buy or sell orders can create temporary spikes in trading volume and bid-ask spreads, affecting price efficiency. Studies show that liquidity often tightens post-rebalancing as markets absorb order imbalances and stabilize around the new index weights.

Challenges and Risks in Index Rebalancing

Index rebalancing involves adjusting portfolio weights to match target allocations, but challenges arise from market volatility causing sudden price swings that increase transaction costs and slippage. Liquidity risks may prevent efficient execution of trades, especially in less liquid small-cap stocks or emerging market indices. Additionally, timing risk can lead to unfavorable price movements between signal generation and trade execution, impacting overall index tracking fidelity.

Strategies for Investors During Index Rebalancing

Index rebalancing requires investors to adjust their portfolios to align with updated index compositions, often incorporating changes in sector weightings or newly added stocks. Strategies such as preemptive trades or utilizing exchange-traded funds (ETFs) that mimic index changes can help mitigate tracking errors and transaction costs. Employing algorithmic trading and leveraging historical rebalancing data enhances timing accuracy and optimizes returns during the rebalancing period.

example of rebalancing in index Infographic

samplerz.com

samplerz.com