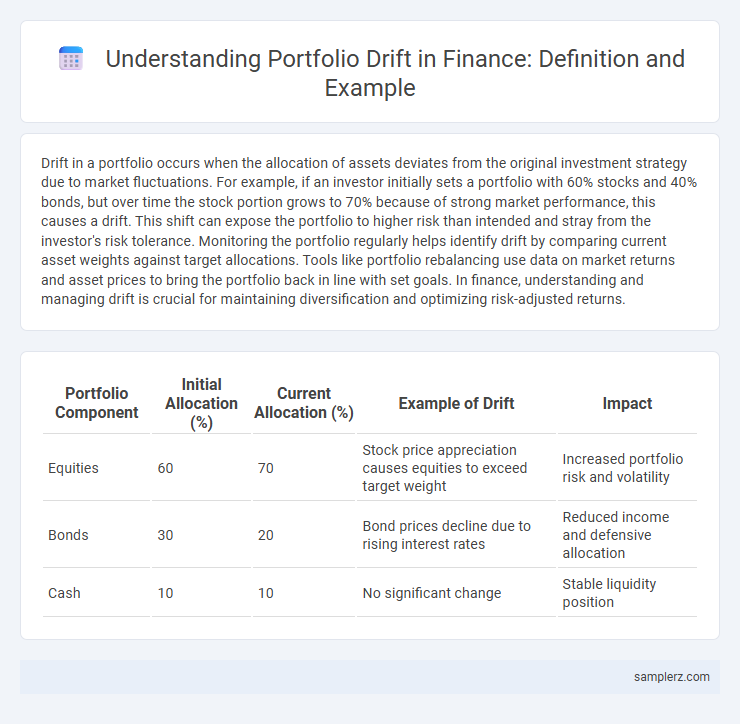

Drift in a portfolio occurs when the allocation of assets deviates from the original investment strategy due to market fluctuations. For example, if an investor initially sets a portfolio with 60% stocks and 40% bonds, but over time the stock portion grows to 70% because of strong market performance, this causes a drift. This shift can expose the portfolio to higher risk than intended and stray from the investor's risk tolerance. Monitoring the portfolio regularly helps identify drift by comparing current asset weights against target allocations. Tools like portfolio rebalancing use data on market returns and asset prices to bring the portfolio back in line with set goals. In finance, understanding and managing drift is crucial for maintaining diversification and optimizing risk-adjusted returns.

Table of Comparison

| Portfolio Component | Initial Allocation (%) | Current Allocation (%) | Example of Drift | Impact |

|---|---|---|---|---|

| Equities | 60 | 70 | Stock price appreciation causes equities to exceed target weight | Increased portfolio risk and volatility |

| Bonds | 30 | 20 | Bond prices decline due to rising interest rates | Reduced income and defensive allocation |

| Cash | 10 | 10 | No significant change | Stable liquidity position |

Understanding Portfolio Drift: Definition and Importance

Portfolio drift occurs when the asset allocation in an investment portfolio changes over time due to market fluctuations, causing deviations from the original target allocation. Understanding portfolio drift is crucial for maintaining risk tolerance and achieving long-term investment goals by regularly rebalancing to restore the intended asset mix. Failure to address portfolio drift can lead to unintended risk exposures and diminished returns, impacting overall portfolio performance.

Common Causes of Portfolio Drift in Finance

Portfolio drift commonly occurs due to unequal asset performance, market volatility, and rebalancing delays in finance. Changes in market conditions cause some investments to grow faster, shifting the original asset allocation and increasing risk exposure. Investor behavior, such as delayed portfolio review or emotional reactions to market movements, also contributes significantly to portfolio drift.

Example Scenario: Equity Allocation Drift Over Time

Equity allocation drift occurs when an initial 60% stock and 40% bond portfolio shifts to 70% stocks and 30% bonds due to differential returns, increasing exposure to equity risk. Over a five-year period, stocks may outperform bonds by an average of 8% annually versus 3%, causing the equity portion to overweight, which impacts the portfolio's risk profile and target asset allocation. Regular portfolio rebalancing restores the original allocation, maintaining risk tolerance and investment objectives.

How Market Movements Lead to Portfolio Drift

Market movements cause portfolio drift by altering the relative values of assets, shifting the allocation away from the original target percentages. For example, if equities outperform bonds, the equity portion grows larger than intended, increasing risk exposure beyond the investor's plan. Regular rebalancing helps restore the portfolio to its strategic asset allocation, maintaining risk and return objectives.

Case Study: Bond vs. Stock Portfolio Drift

A portfolio initially allocated with 60% stocks and 40% bonds can experience drift when market fluctuations cause the stock portion to rise to 70%, increasing risk beyond the investor's original tolerance. For example, during a bull market, equity returns may outperform bonds, pushing the portfolio towards a more aggressive stance without rebalancing. Regular monitoring and rebalancing back to the target allocation help maintain risk levels and investment objectives.

The Impact of Portfolio Drift on Risk and Returns

Portfolio drift occurs when the asset allocation deviates from its original targets due to differing returns among investments, leading to unintended risk exposure. This shift can increase portfolio volatility or reduce diversification, jeopardizing expected returns and risk management strategies. Regular rebalancing is essential to realign the portfolio with its intended risk-return profile and maintain investment discipline.

Identifying Drift: Portfolio Rebalancing Triggers

Portfolio drift occurs when asset allocation deviates from target weights due to market fluctuations, causing risk exposure to increase unintentionally. Identifying drift involves monitoring threshold limits, such as a 5% deviation from target allocation, which triggers rebalancing actions to restore desired portfolio balance. Regular rebalancing ensures alignment with investment objectives and risk tolerance, enhancing long-term portfolio stability.

Automated Rebalancing vs. Manual Adjustment

Portfolio drift occurs when asset allocations deviate from target weights due to market fluctuations, impacting risk and return profiles. Automated rebalancing uses algorithm-driven triggers to realign portfolios efficiently, minimizing emotional bias and transaction costs. Manual adjustment relies on investor discretion, often leading to delayed responses and suboptimal asset distribution.

Real-Life Example: Portfolio Drift in Retirement Accounts

Portfolio drift in retirement accounts frequently occurs when the allocation of assets shifts due to market fluctuations, causing the original balance between stocks, bonds, and cash to become misaligned with an investor's risk tolerance. For instance, a 60/40 stock-to-bond target allocation can unintentionally shift to 70/30 after a strong bull market in equities, increasing exposure to volatility risk. Regular rebalancing helps restore the desired asset mix, reducing potential downside and maintaining alignment with long-term retirement goals.

Strategies to Minimize and Manage Portfolio Drift

Regular portfolio rebalancing using algorithmic trading strategies can minimize drift by realigning asset allocation with target weights, mitigating risk exposure. Employing risk management tools such as stop-loss orders and volatility targeting helps contain unintended exposure caused by market fluctuations. Utilizing dynamic asset allocation models, including tactical adjustments based on market signals, enhances the management of portfolio drift while optimizing risk-adjusted returns.

example of drift in portfolio Infographic

samplerz.com

samplerz.com