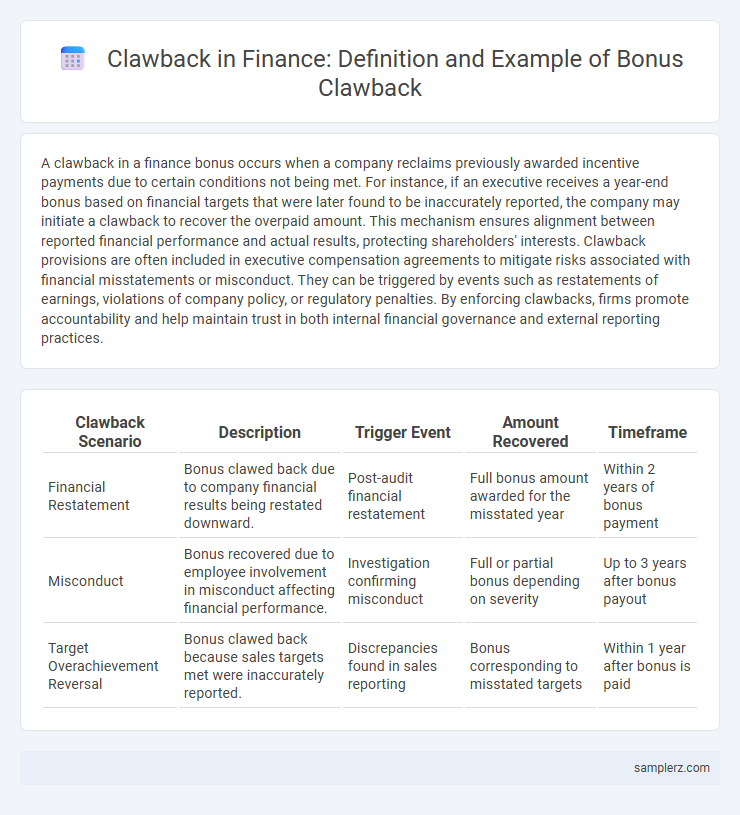

A clawback in a finance bonus occurs when a company reclaims previously awarded incentive payments due to certain conditions not being met. For instance, if an executive receives a year-end bonus based on financial targets that were later found to be inaccurately reported, the company may initiate a clawback to recover the overpaid amount. This mechanism ensures alignment between reported financial performance and actual results, protecting shareholders' interests. Clawback provisions are often included in executive compensation agreements to mitigate risks associated with financial misstatements or misconduct. They can be triggered by events such as restatements of earnings, violations of company policy, or regulatory penalties. By enforcing clawbacks, firms promote accountability and help maintain trust in both internal financial governance and external reporting practices.

Table of Comparison

| Clawback Scenario | Description | Trigger Event | Amount Recovered | Timeframe |

|---|---|---|---|---|

| Financial Restatement | Bonus clawed back due to company financial results being restated downward. | Post-audit financial restatement | Full bonus amount awarded for the misstated year | Within 2 years of bonus payment |

| Misconduct | Bonus recovered due to employee involvement in misconduct affecting financial performance. | Investigation confirming misconduct | Full or partial bonus depending on severity | Up to 3 years after bonus payout |

| Target Overachievement Reversal | Bonus clawed back because sales targets met were inaccurately reported. | Discrepancies found in sales reporting | Bonus corresponding to misstated targets | Within 1 year after bonus is paid |

Introduction to Bonus Clawbacks in Finance

Bonus clawbacks in finance refer to policies allowing firms to reclaim previously awarded bonuses if financial results are later found to be misstated or if employee misconduct emerges. These mechanisms protect companies from rewarding performance based on inaccurate data, enhancing accountability and risk management. Regulatory frameworks, such as the Dodd-Frank Act in the U.S., have increased the adoption of clawback provisions to promote financial transparency and integrity.

What Is a Bonus Clawback?

A bonus clawback is a contractual provision allowing employers to reclaim previously paid bonuses if certain conditions are not met, such as financial restatements, misconduct, or failure to meet performance targets. This mechanism is designed to align executive compensation with company performance and financial integrity, ensuring that bonuses awarded during periods of success are returned if underlying assumptions prove incorrect or unethical behavior is uncovered. Clawback policies are increasingly mandated by regulatory bodies like the SEC to enhance accountability and deter financial mismanagement.

Regulatory Framework Governing Bonus Clawbacks

The regulatory framework governing bonus clawbacks primarily hinges on financial legislation such as the Dodd-Frank Act and guidelines from the Securities and Exchange Commission (SEC), which mandate firms to reclaim bonuses awarded due to misconduct or financial restatements. Banks and financial institutions often enforce clawback policies in compliance with the Sarbanes-Oxley Act to recover incentive compensation linked to misstated earnings. These regulations ensure accountability and align executive remuneration with long-term company performance and shareholder interests.

High-Profile Cases of Bonus Clawbacks

High-profile cases of bonus clawbacks often emerge in the finance sector, exemplified by instances such as the Wells Fargo scandal where executives were required to return millions in bonuses due to fraudulent account openings. Similarly, Barclays faced significant clawbacks following the LIBOR manipulation scandal, resulting in senior bankers surrendering substantial bonus amounts. These cases underscore regulatory emphasis on accountability and the financial industry's commitment to recovering incentive pay linked to misconduct.

Common Triggers for Clawback Provisions

Clawback provisions in finance commonly trigger when financial statements require restatement due to errors or fraud, leading to the recovery of previously awarded bonuses. Executive misconduct such as violation of company policies or regulatory breaches also prompts clawbacks to ensure accountability. Performance targets not achieved or misstated incentives are additional frequent causes for bonus clawbacks.

Real-World Example: Clawback in Banking Sector

In 2010, JPMorgan Chase implemented a clawback policy targeting executives involved in the "London Whale" trading losses, reclaiming millions in bonuses linked to excessive risk-taking. This move aligned with the Dodd-Frank Act mandates designed to enhance accountability within the banking industry. Clawback provisions like these serve to deter unethical behavior and protect shareholder value by reversing compensation tied to financial mismanagement.

Clawback Clauses in Executive Compensation

Clawback clauses in executive compensation are contractual provisions that require executives to return previously awarded bonuses if financial results are later restated or found to be misstated due to fraud or error. These clauses help align executive incentives with long-term corporate performance and reduce risks associated with accounting irregularities. Prominent companies like Wells Fargo and General Electric have implemented clawback policies to ensure accountability and protect shareholder interests.

Impact of Clawbacks on Employee Behavior

Clawbacks on bonuses directly influence employee behavior by promoting accountability and discouraging excessive risk-taking in financial institutions. These provisions ensure that employees act in the long-term interest of the company and its shareholders, reducing instances of misconduct or financial misreporting. Research shows that firms with strict clawback policies experience improved ethical compliance and enhanced alignment between executive incentives and company performance.

Recent Trends in Clawback Policies

Recent trends in clawback policies highlight an increasing adoption by financial institutions to recover executive bonuses linked to misstated earnings or compliance violations. Regulators such as the SEC have intensified enforcement, prompting firms to implement more robust clawback clauses in employment contracts to mitigate risk and enhance accountability. Data from 2023 shows a 25% increase in companies enforcing clawbacks post-financial restatements, reflecting growing emphasis on corporate governance and shareholder protection.

Best Practices for Implementing Clawback Agreements

Implementing clawback agreements in bonus compensation requires clear, well-defined criteria tied to financial restatements or misconduct to ensure enforceability. Best practices include incorporating precise triggers, such as earnings restatements or violations of company policies, and establishing a transparent process for recovery to maintain fairness and compliance. Regular reviews and communication with stakeholders help align clawback provisions with corporate governance standards and regulatory requirements.

example of clawback in bonus Infographic

samplerz.com

samplerz.com